A set of Partnership annual accounts prepared from your Excel bookkeeping records by an ACCA qualified chartered accountant.

An off the shelf boxed product. No more unexpected unexplained accountant’s bills. Fixed (fee) price RRP.

What it includes:

1. An Annual Accounts evaluation report. Which helps identify any missing information?

2. A tax specialist report to help identifies ways to reduce your tax payable.

3. A Draft set of accounts.

4. A detailed explanation of the accounts.

5. Your questions answered.

6. Amendments to your draft annual accounts.

7. A final set of Annual Accounts.

Simply provide us with your completed Excel bookkeeping records and we will produce a set of annual accounts. You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation explanation of the accounts.

What do I get when I buy this product?

A set of Partnership annual accounts prepared from your Excel bookkeeping records. Prepared by an ACCA registered chartered accountant.

Who should buy this product?

If you are a business partnership who keeps their bookkeeping data on Excel accounting software you can easily purchase this product. Applies only to UK registered tax payers.

It’s easy: complete an online form and we will do the rest.

At your convenience

The most convenient way to prepare your Annual Accounts.

After you have purchased this product simply provide us with your completed Excel bookkeeping records or online log in details and your closing bank statement (which covers the last days either side of your financial year end). We will also forward you a form to complete.

Based upon those replies one of our ACCA registered chartered accountants will produce a set of annual accounts.

No need to attend offices, this purchase is completed online from the convenience of your office or the comfort of your home. You will be able to ask your Helpbox chartered accountant questions and you will receive a full explanation of the accounts.

Price promise

Fixed (fee) price. No more unexpected, unexplained accountant’s bills.

We will prepare your annual accounts ready for you to complete your tax return yourself or we will complete it for you. If you want us to complete your tax return simply add SA800 tax return for the partnership and SA100 tax return for each partner to your shopping trolley when requested.

Guaranteed - NO MORE MISSED DEADLINES

If you provide us with the information in the exact format which we request it and within our specifically stated timeframes we guarantee that we will prepare your return within HMRC’s filing deadlines.

What are a Partnership’s statutory obligations?

All Partnerships have a legal duty to:

1. Register with HMRC within 3 months of beginning to trade.

2. Each tax year prepare and complete a set of accounts the figures from which are used to;

3. Prepare and file a partnership self assessment tax return (SA800) and individual partners self assessment tax returns (SA100).

1. An evaluation and deficiency report which identifies any issues in your records which may affect your accounts from items incorrectly entered to unclaimed expenses, and advice how to correct this.

2. Draft set of accounts.

3. A detailed explanation of the accounts.

4. Your questions answered.

5. Amendments to your draft annual accounts

6. A Final set of Annual Accounts.

Simply provide us with your completed Excel bookkeeping records and we will produce a set of Annual Accounts. You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation explanation of the accounts.

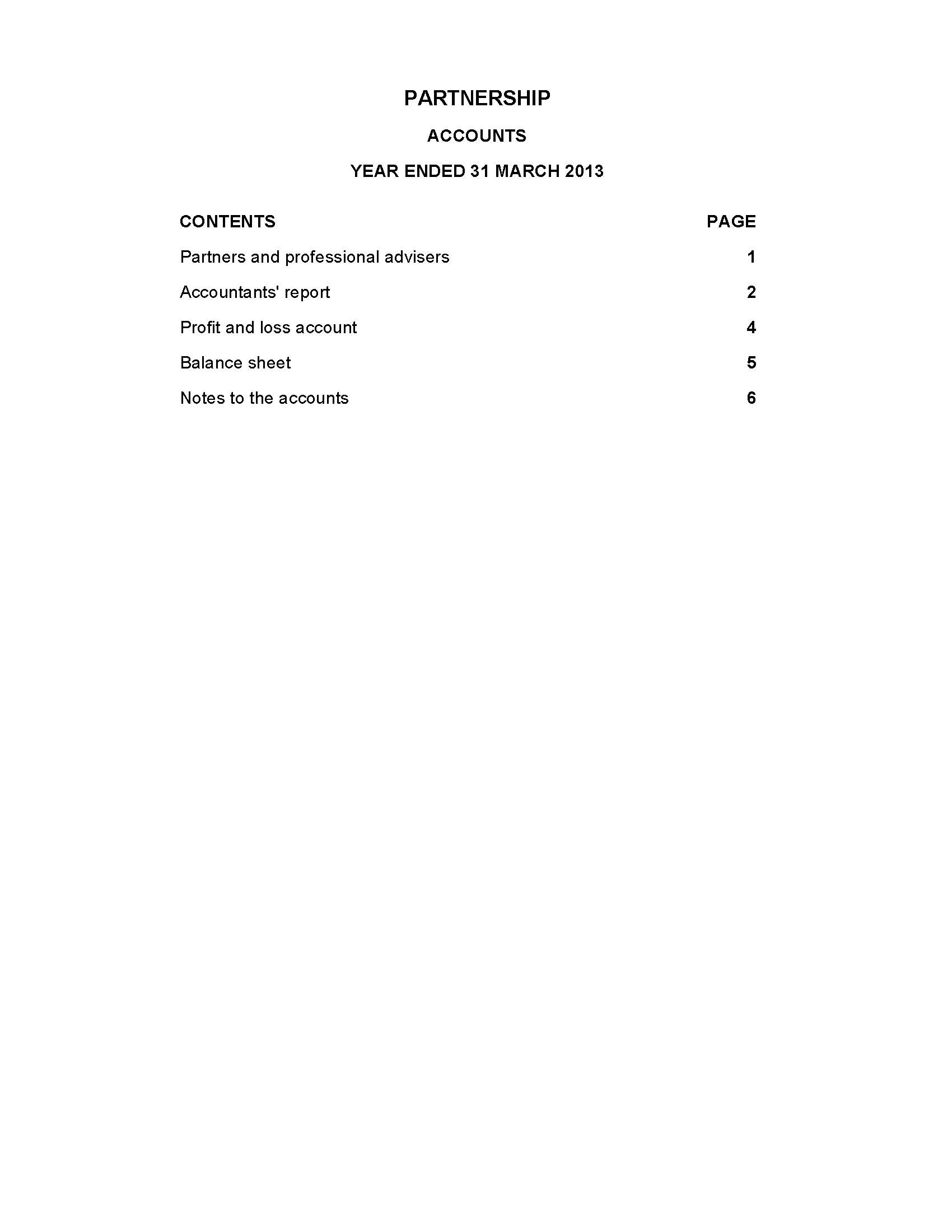

Annual Accounts

We have transformed traditional accountancy services by developing a range of transparently priced accountancy products; whilst maintaining the integrity of

the professional relationship with a clearly defined description of what you

get for your money at a fixed retail price.

Now for the first time you are able to compare accountancy

services on both a clear value benchmark, which evaluates quantity and quality

of work done along with price.

Our Chartered Accountants are able to prepare annual

accounts for the following business types:

- Sole trader

- Partnerships

- Limited Companies

What are

year-end annual accounts?

Annual accounts are sometimes referred to as an annual

report, trading accounts or financial statements. The annual or year-end accounts are a summary

of all the entities transactions in a 12 month period which is usually referred

to as the financial trading period.

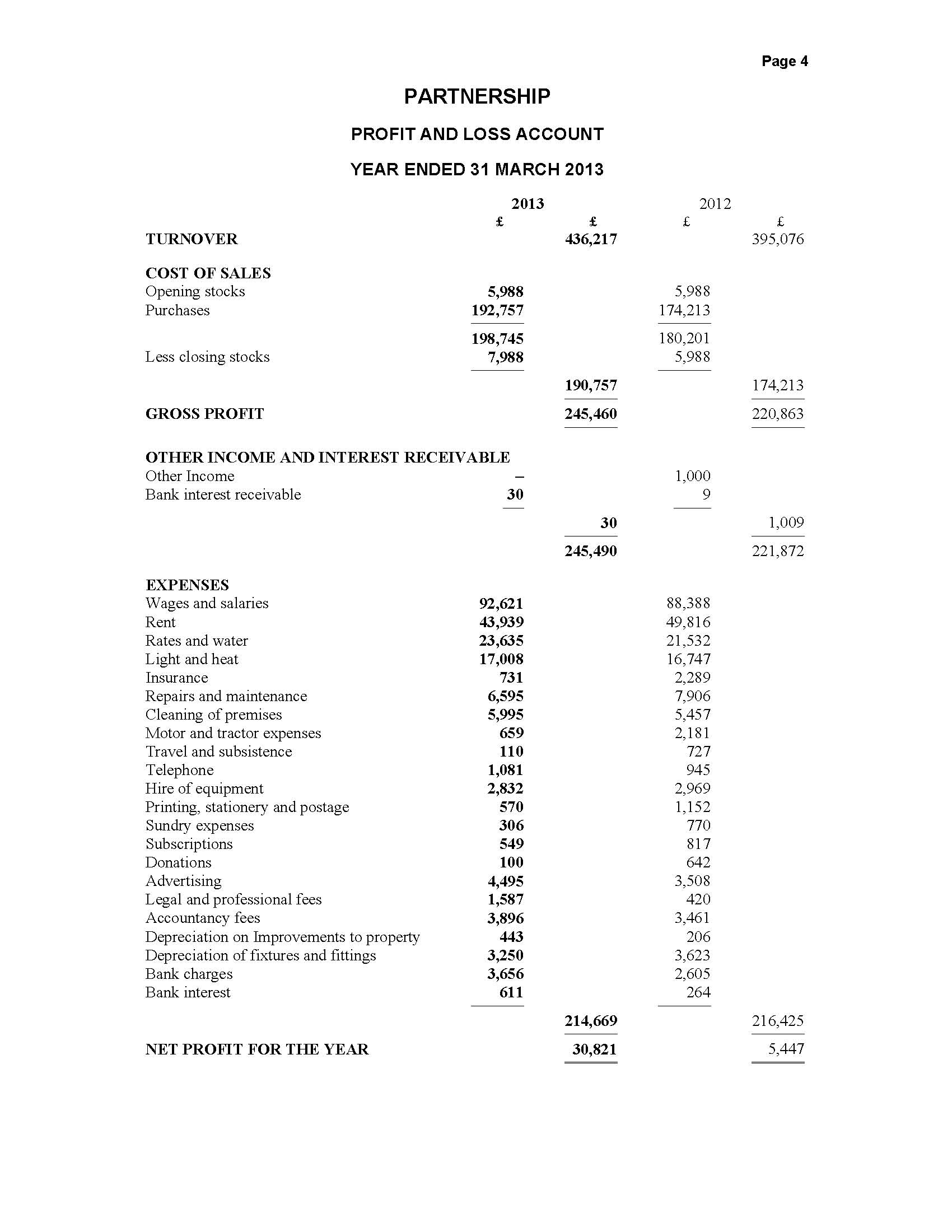

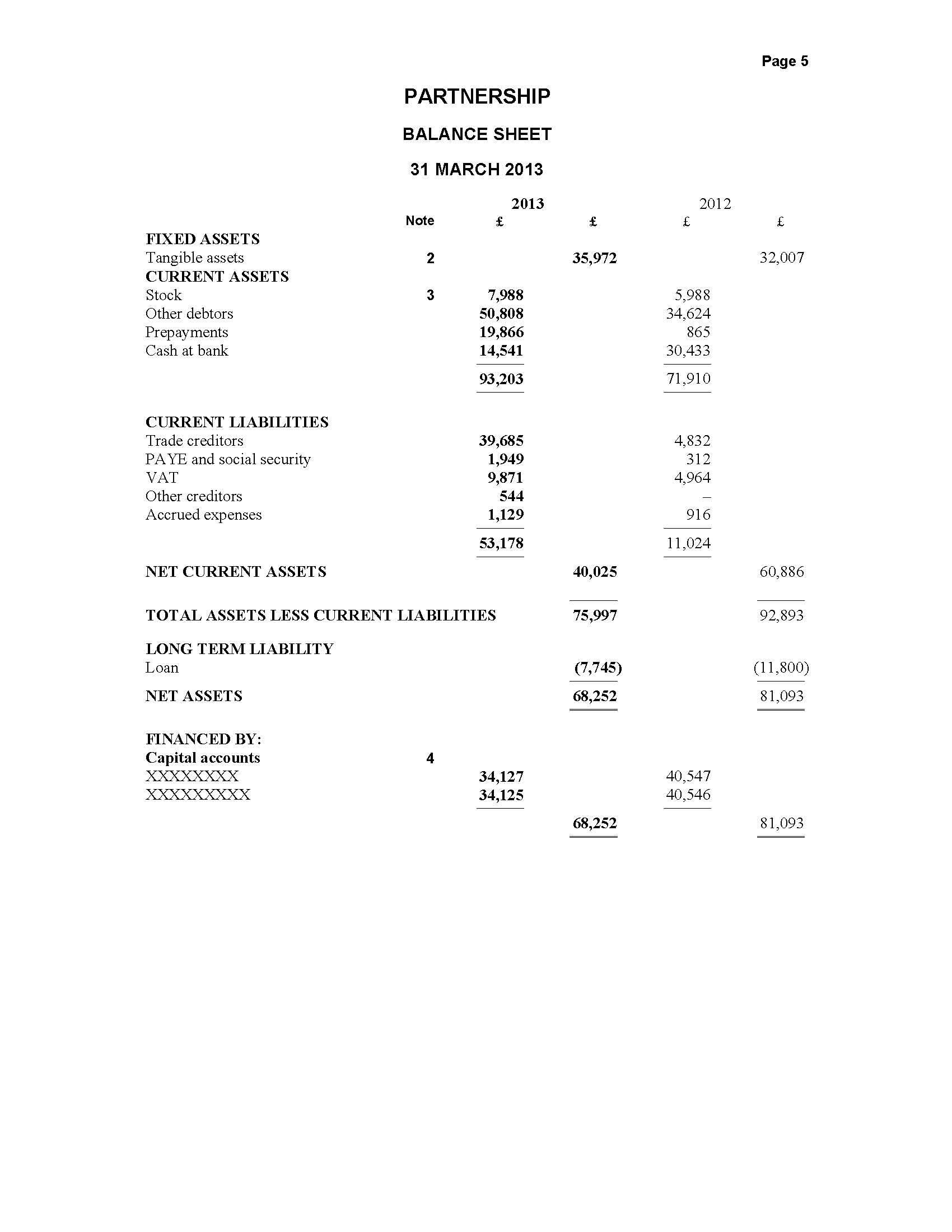

They give a clear picture of both the trading

activity of the business over a 12 month

period through the profit and loss account, whilst the balance sheet gives a

clear snapshot of the business finances on the last day of that period.

Annual accounts are

probably the most common accountancy service which a business asks an

accountant to perform

Annual accounts are probably the most common accountancy service which

a business asks an accountant to perform.

Who has to

prepare annual accounts?

Be it a sole trader, partnership or limited company, the need for

year-end annual accounts is common to all 3 different entities. Annual accounts

are the product of the businesses bookkeeping records.

What is a trial

balance?

The bookkeeper brings together all the entries

in the different ledgers which make up the books whether this is kept on paper

books, spreadsheets or accounting software. It includes sales invoices, purchase

receipts, bank payment and cash payments, into an accounting document called a

trial balance. The trial balance is passed from the bookkeeper to the

accountant and this forms the basis for the yearend annual accounts. It is basically a summary of all the totals

in the accounting records and should balance with how the business was funded

whether through sales income or capital invested.

Are year end and

annual accounts different?

Both Annual accounts and year-end accounts are the same

thing, as are annual reports, trading accounts and financial statements.

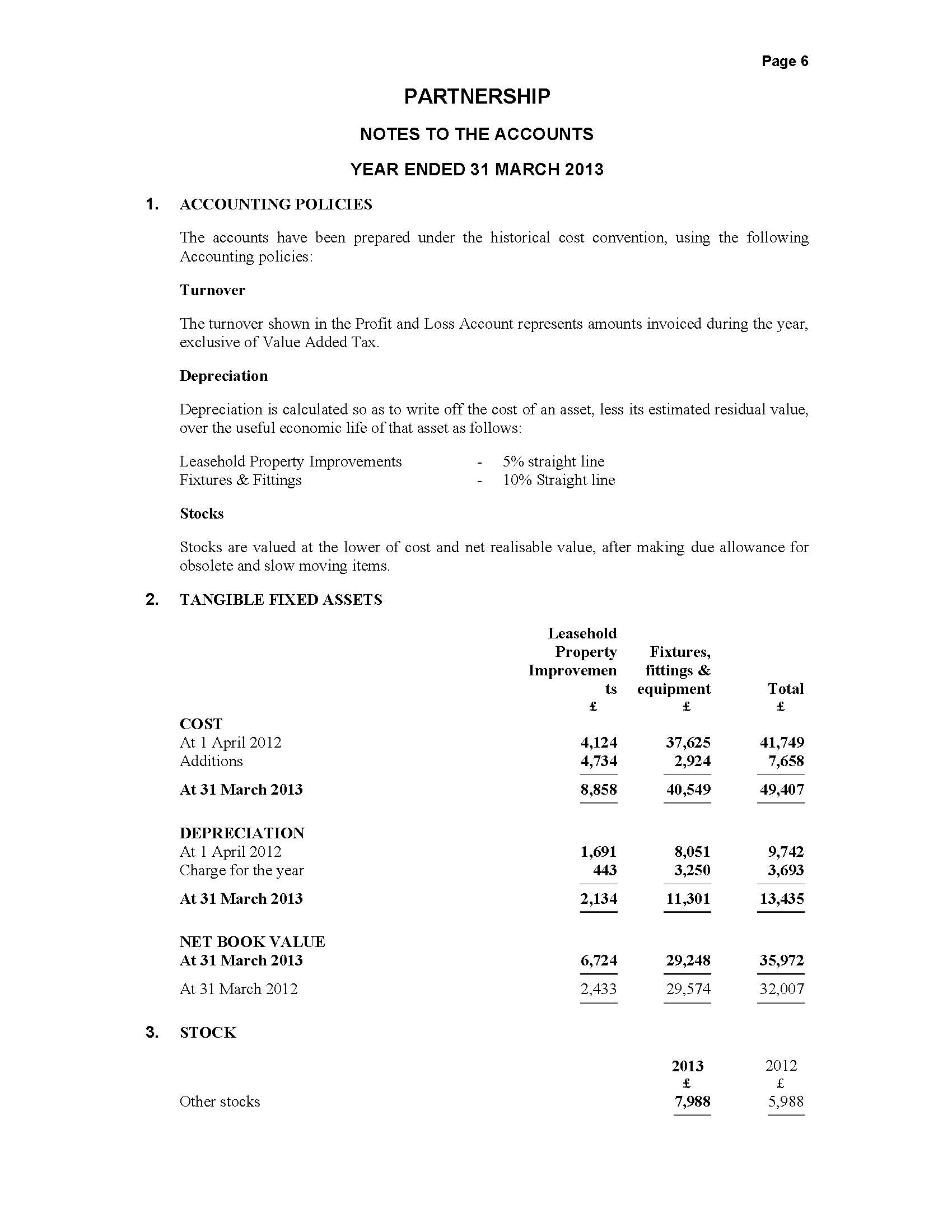

What information should be in the annual accounts?

Generally speaking but not always, annual

accounts should include;

-

Profit and loss account or

income expenditure statement

- Balance sheet

- Fixed asset and depreciation schedule

-

Accountants report

-

Signature of proprietor/partner/director

- Directors report

- Notes to the accounts

- Officials

and directors information

What is the purpose

of preparing annual accounts?

Annual accounts provide an annual (year-end) summary of the businesses

financial performance. This can provide

essential information on how well or how badly the business is performing.

Additionally, every business has a legal requirement to

report their key financial data to HMRC and for limited companies the additional

requirement to file accounts with the Register of companies at companies house.

Affordable

accountancy solutions for sole traders. This product is ideal for self employed

sole traders who want to enter their own bookkeeping records. Where you have

entered details of your business transactions, purchase receipts, sales

invoices and bank statements into an excel xl spreadsheet. If you are a self

employed sole trader and do not want the complexity of operating a full

accountancy software programme. We will

prepare a set of year end accounts, including profit and loss schedule and

balance sheet. Whether you are VAT registered or not, a new start-up or

existing business, we will provide a seamless service which includes

preparing HMRC ready annual accounts. Which means we can also provide a very

affordable tax filing service from those year end annual accounts. Excellent

product for the self employed sole trader business.

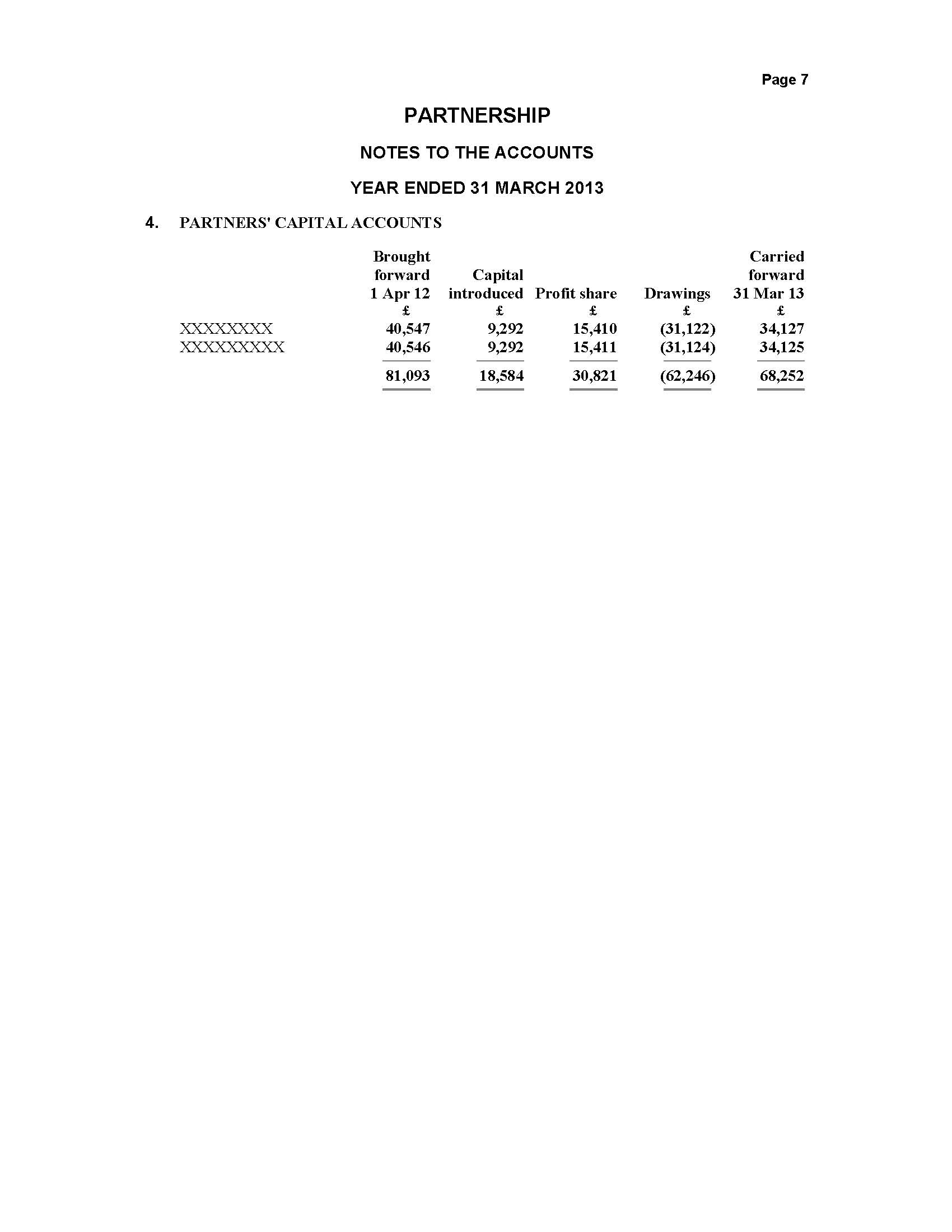

Partnership Annual Accounts

Partnerships and partners have no legal requirement to file accounts with the SA800 partnership tax return, however, HMRC say:

If you have to send HMRC a tax return, the law says that you must keep all the records and documents you need to complete the return. If you don't have adequate records or if you don't keep them for long enough, you may have to pay penalties.

Therefore, if an HMRC investigation is to be avoided proper financial records have to be kept. These include annual accounts.Annual accounts are particularly helpful when completing the partnership tax return SA800 which each partnership has a statutory duty to file each year. They provide information on the distribution of partnership profits, which is essential information each partner will have to provide to HMRC on their own self assessment tax return (SA100). Our products are designed to enable partnerships to prepare their year-end accounts conveniently and efficiently at an affordable cost

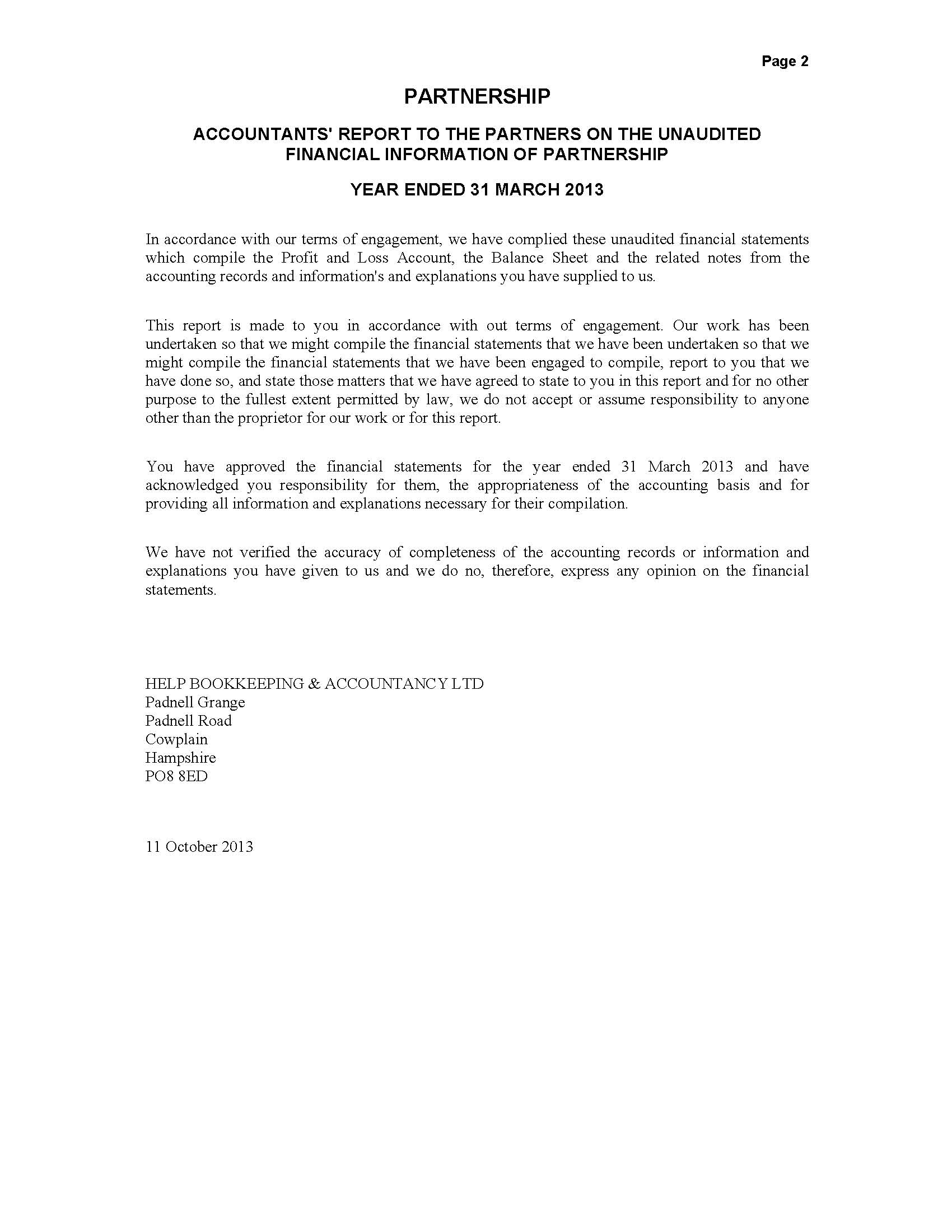

Chartered Accountant prepared annual accounts for Partnerships:

Real price low cost accountancy has transformed traditional accountancy services in to a range of transparently priced accountancy products. We are maintaining the integrity of the professional relationship with a clearly defined description of what you get for your money at a fixed retail price.

Now for the first time you are able to compare accountancy services through a clear value benchmark, which evaluates quantity and quality of work done along with price.

In order for us to prepare your annual accounts we will need a copy of either your paper records or your accountancy software.

When does the tax return have to be filed?

Each year the partnership must file with HMRC a partnership tax return with HMRC for all accounting transactions in the period 6th April to 5th April the following year.

The tax year runs from 6th April to the following 5th April and should be filed by the 31st January following the end of this period.

e.g. 06-04-12 – 05-04-13 should be filed by 31-01-14

However your accounting period does not have to be April to April; you must include on the partnership tax return the accounting year which ends in that period

e.g. If your accounts year end is June 30th then for the tax return above you would include accounts ending 30-06-12

The deadline also applies to the payment of tax declared on the self assessment tax return, which must be paid in full. Any late payments will be subject to a surcharge penalty by HMRC. Likewise penalties apply to late or non-submissions. These fines escalate very quickly and within a few short weeks can exceed £1000.

Nominated Partner

Each partnership should nominate a managing partner. That is the partner who will take responsibility to manage the financial affairs of the business. In law the partners in a partnership are subject to joint and several liability. That means each and every partner is potentially personally liable for all of the partnerships debts not just their own share. Usually the managing partner is the one who co-ordinates with us to provide the information need to complete the year-end partnership (SA800) tax return form.

Partner’s tax returns

Anyone who is a partner in a business partnership has the same duty as a sole trader to register their self employment with HMRC within 90 days of starting trading. Failure to do so can result in HMRC fines and penalties.

Its not just self employed people who have to file a HMRC SA100 Tax return; it includes other employed people such as directors of limited liability companies, and higher rate tax payers, if you have a separate part-time income from self employment, such as income from renting property, some kinds of pensions and stocks and shares you may need to file a SA100

The Role of the Accountant

It is important to employ an accountant to prepare a set of year end annual accounts including profit and loss schedule for the relevant tax period. A self employed person such as a sole trader or a partner in a business partnership is allowed to offset their business expenses against their income, . I including purchase receipts helps reduce the profit and as a consequence reduce the amount of tax payable to HMRC. An accountant can help you identify areas where you may not be claiming allowable expenses and deductions which can save you more than just their fees in tax each year.