What do I get when I buy this product ?

A basic company director self assessment tax return (HMRC SA100). This product is designed to meet the HMRC requirements for self assessment for Company Directors. Prepared ACCA qualified chartered accountant.

Who should buy this product?

If you are a Company Director you can easily purchase and this product. Applies only to UK registered tax payers.

It’s easy: complete an online form and we will do the rest.

At your convenience

The most convenient way to prepare your tax return.

After you have purchased this product we will forward you a form to complete and request information and accounts from you.

Based upon those replies one of our tax specialists will prepare your tax return.

No need to attend accountant’s offices, this purchase is completed online from the convenience of your office or the comfort of your home.

Price promise

Fixed price. No more unexpected, unexplained accountant’s bills.

We will prepare your tax return ready for you to file yourself or we will file it for you. If you want us to file your tax return simply add FILING to your shopping trolley when requested.

Guaranteed - NO MORE MISSED DEADLINES

If you provide us with the information in the exact format which we request it and within our specifically stated timeframes we guarantee that we will prepare your return within HMRC’s filing deadlines.

What are a Company Director’s statutory obligations?

All company directors (even if they have other part-time or full-time employment) have a legal duty to:

1. Register with HMRC. They will be issued with a Unique Tax Reference (UTR), a 10 digit number which is specific to the individual.

2. Prepare and file an individual self assessment tax return (SA100).

The following are additional products and not included in the purchase above. Please check the list below and if any of the sections applies then add it to your purchase. Our after sales team will in any event contact you by email in order to establish that you have purchased the correct product.

If you are unsure as to which additional sections apply to you then purchase the basic Tax return for a sole trader and we will contact you with a questionnaire to help qualify this for you.

SEE SEPARATE SUPPLEMENTARY SECTION

What this product includes:

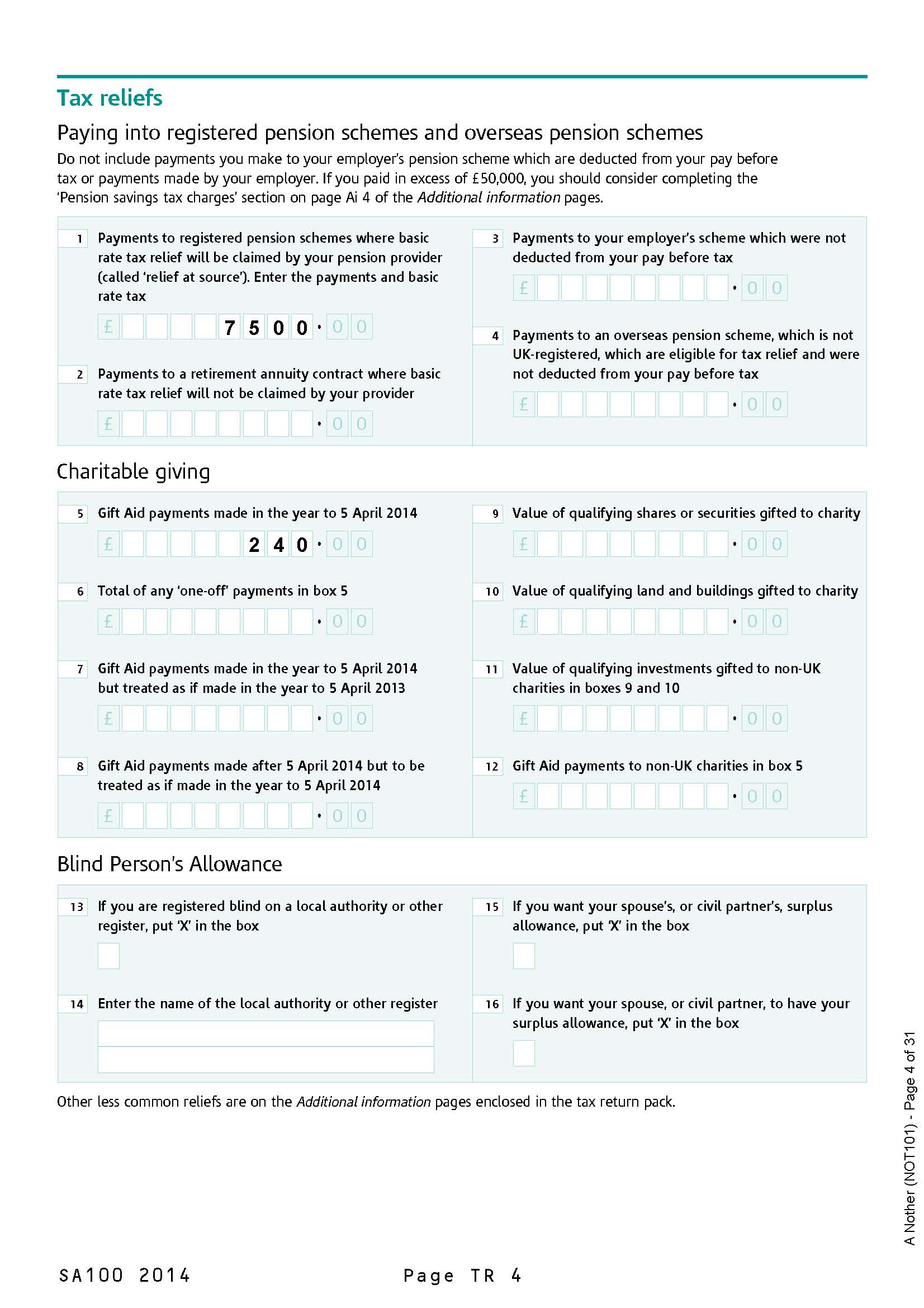

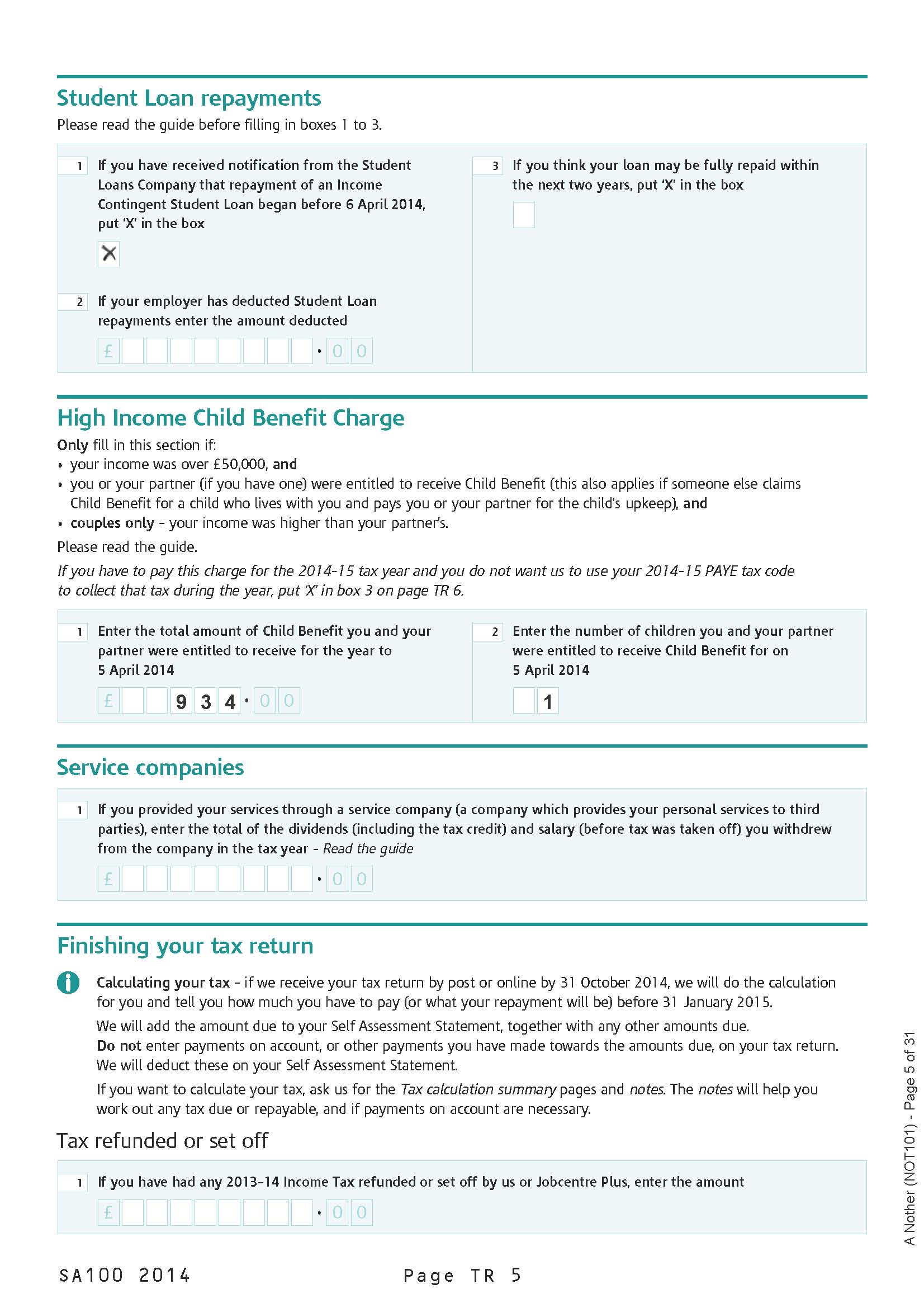

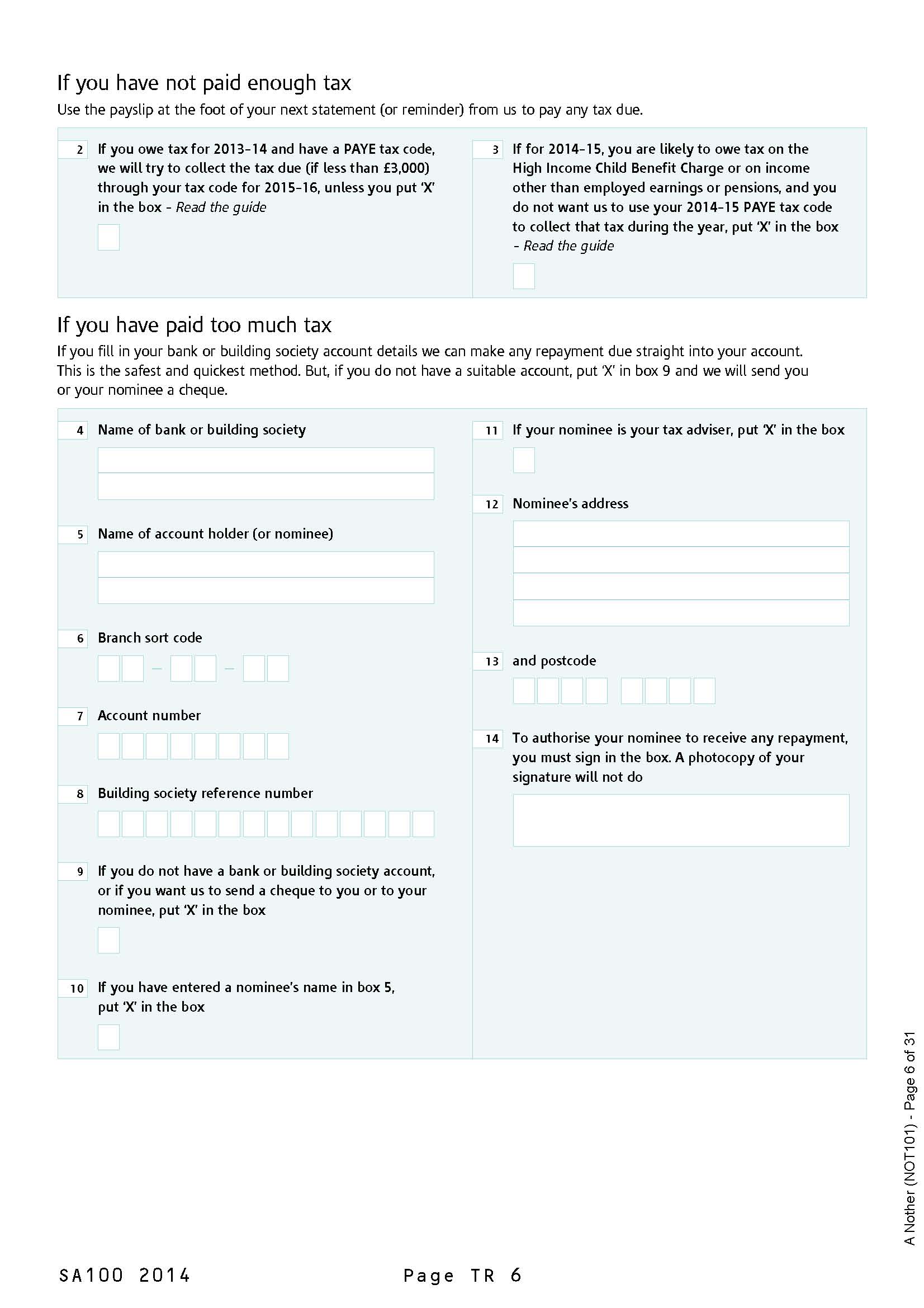

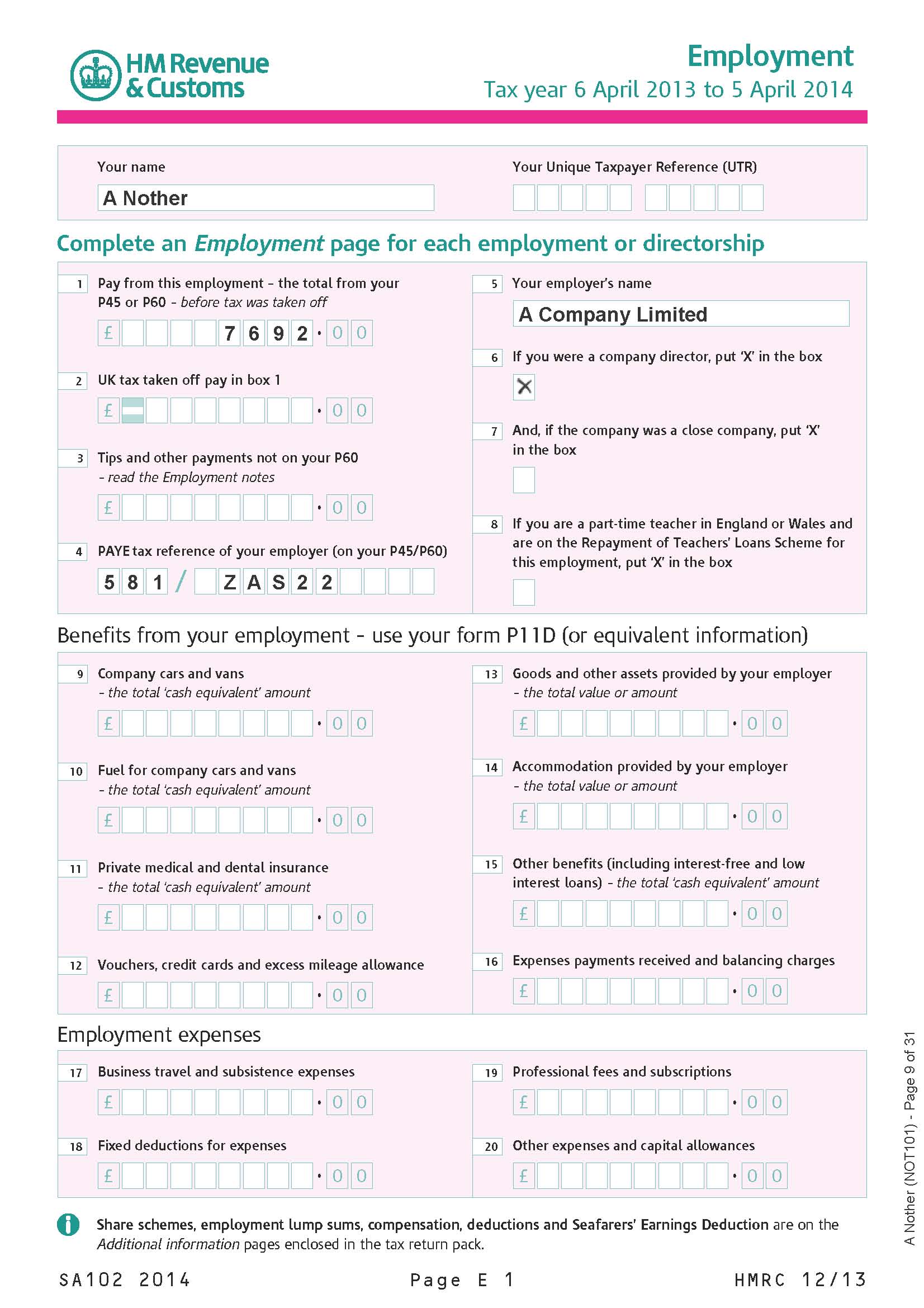

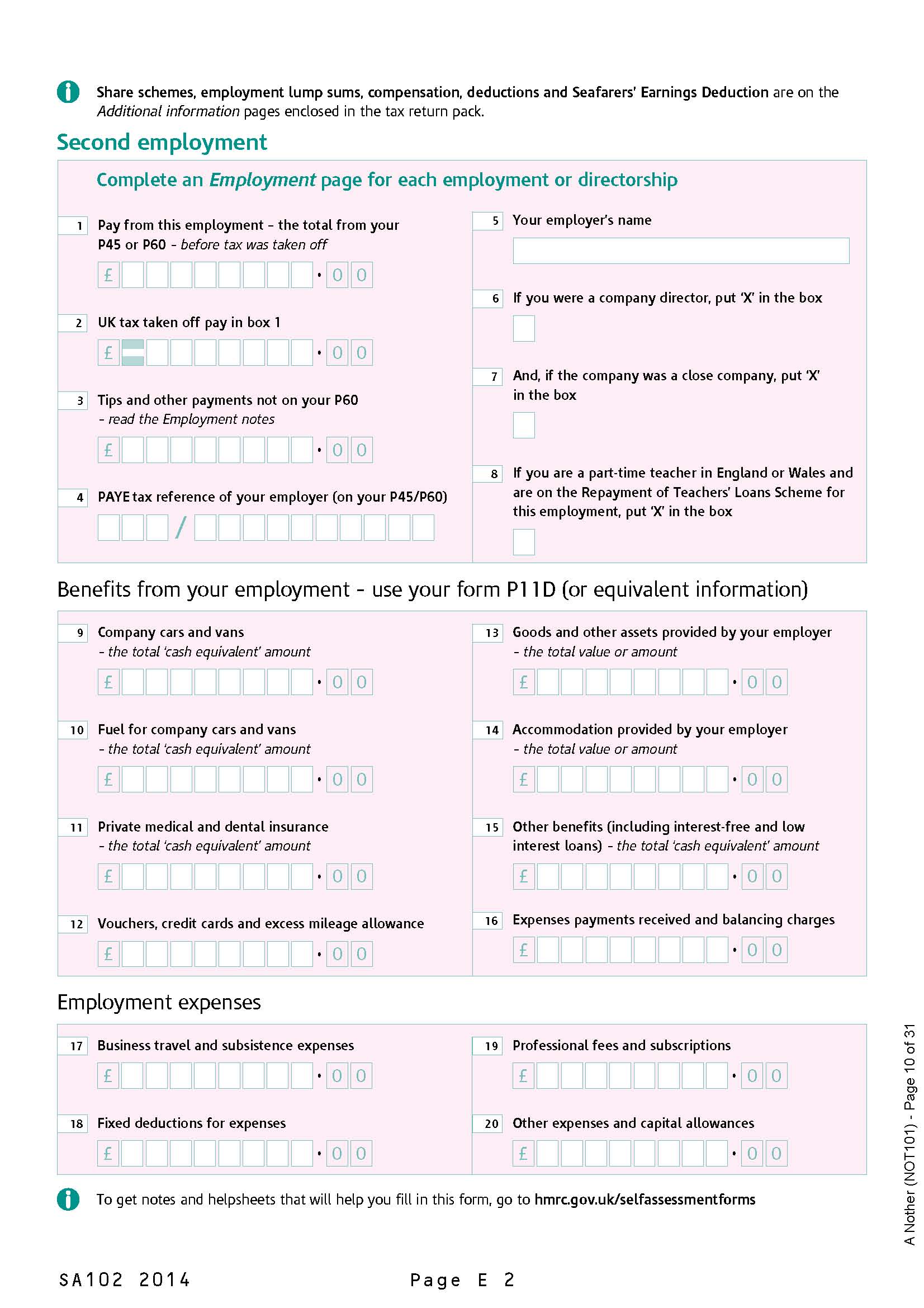

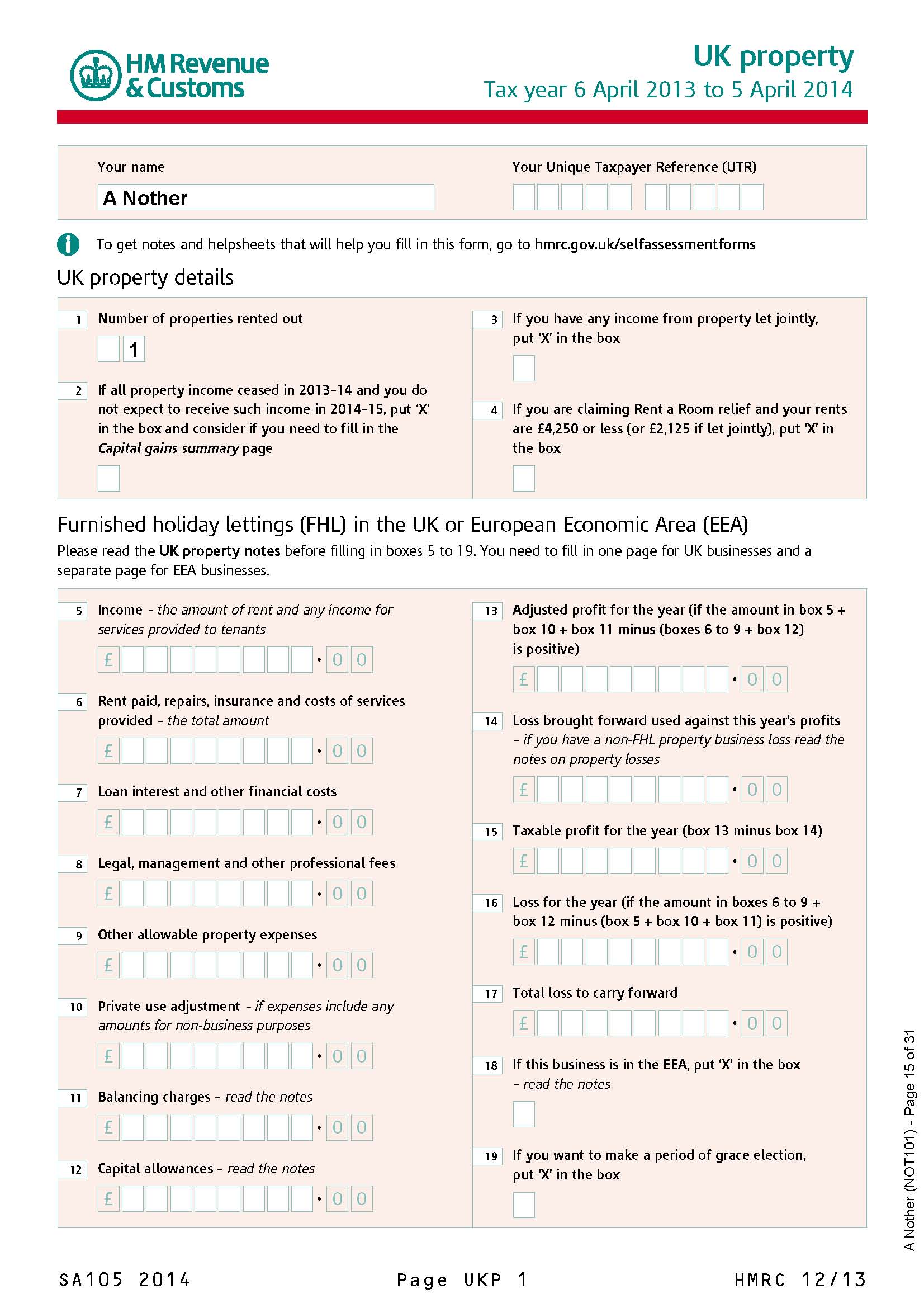

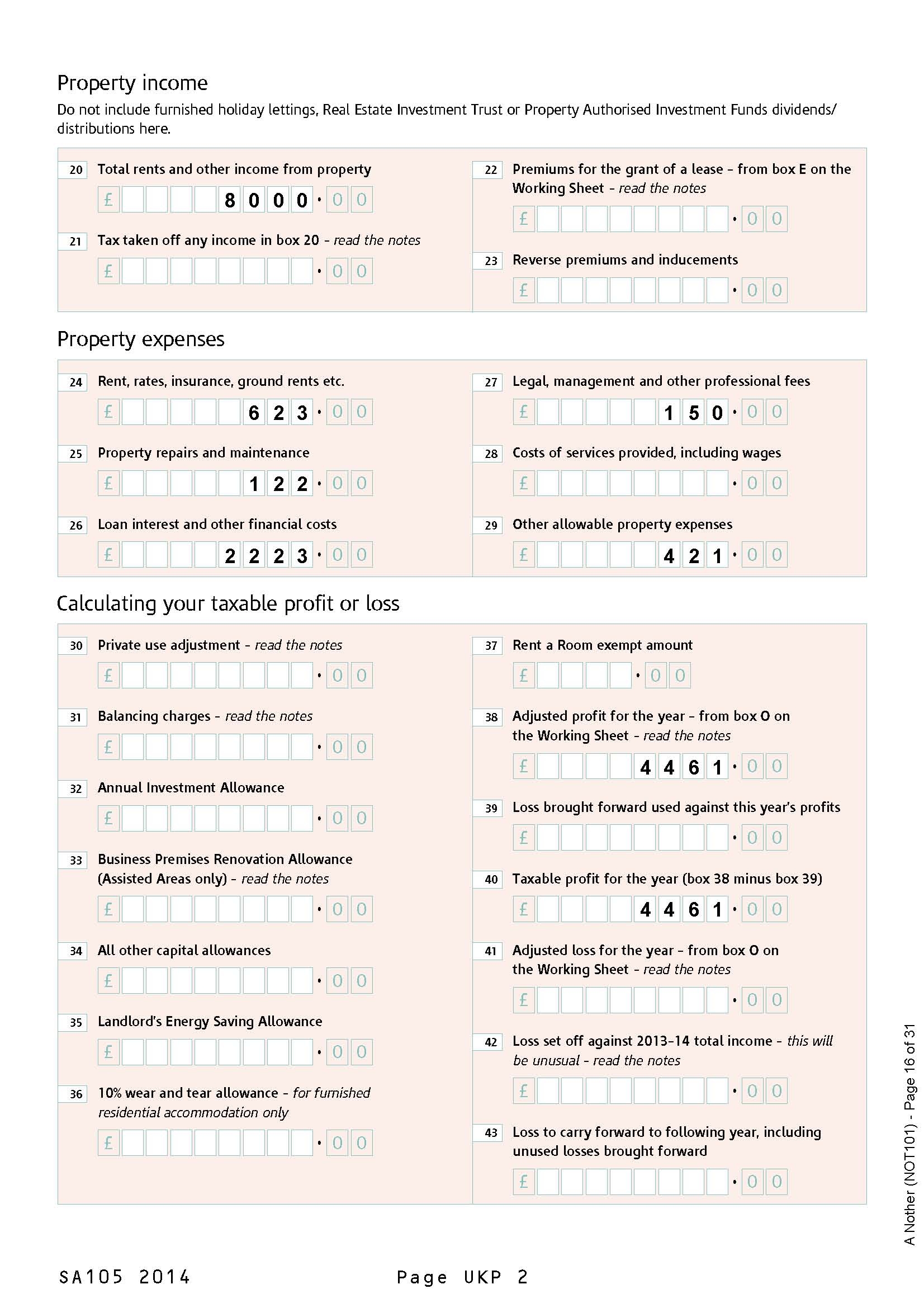

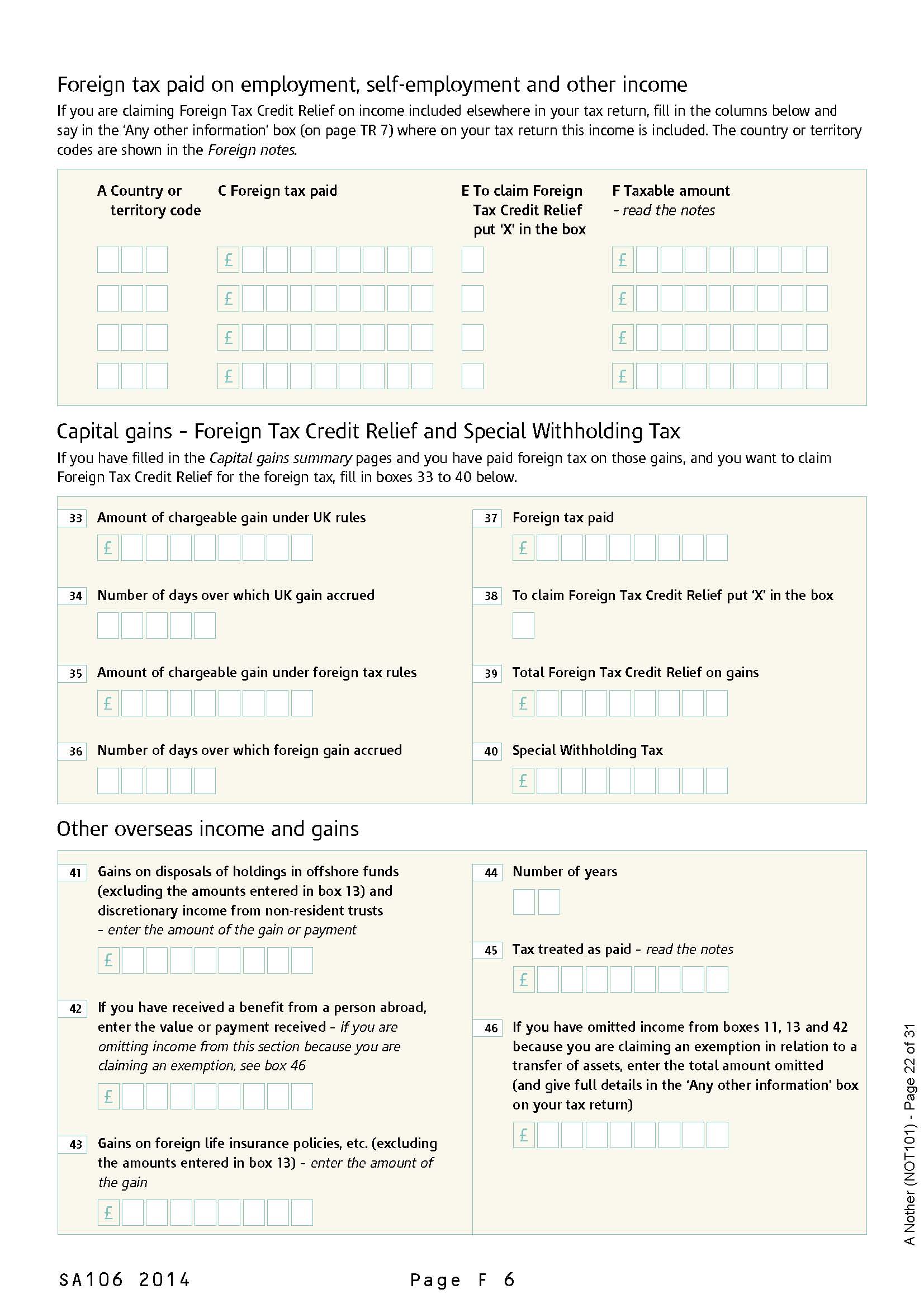

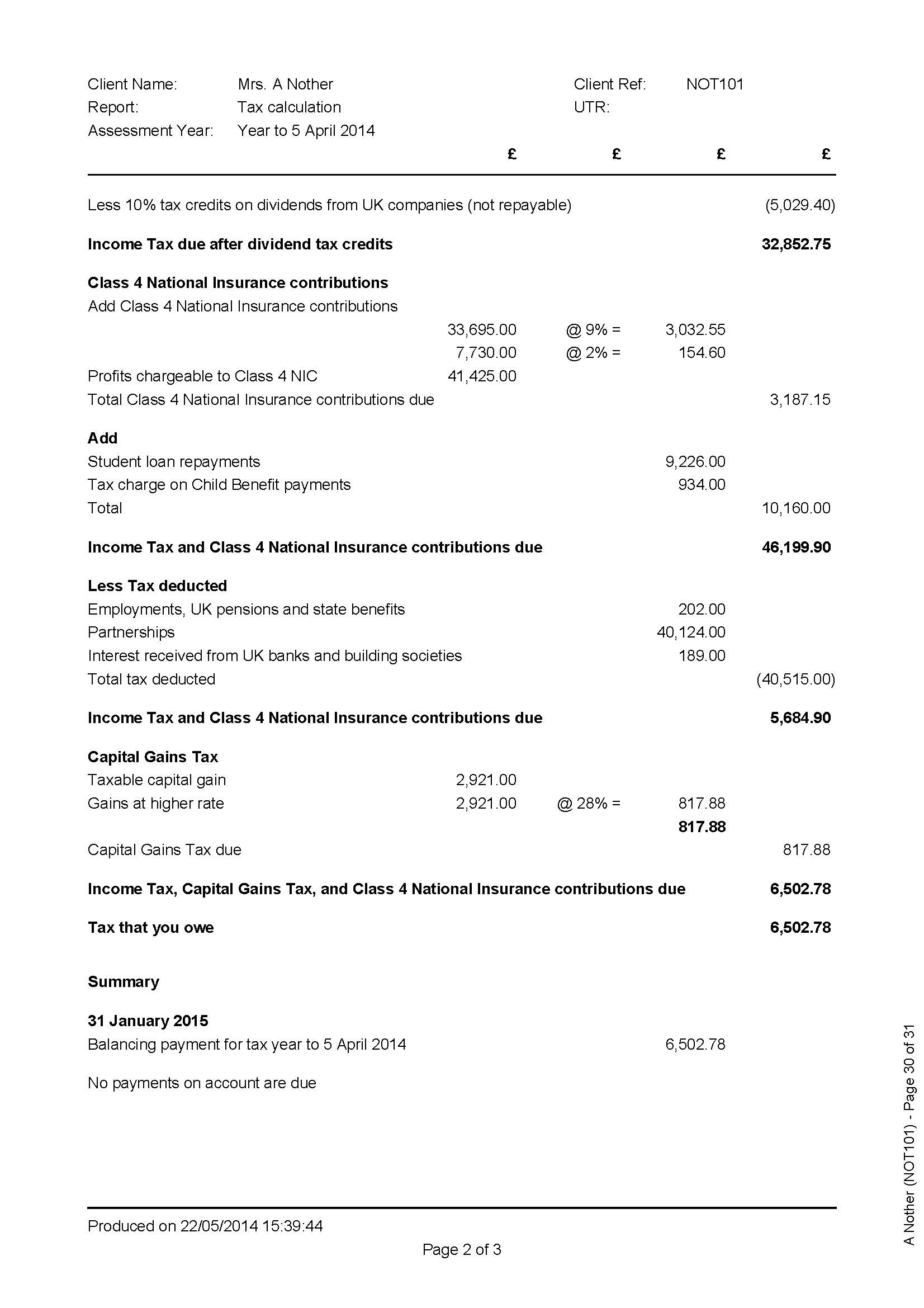

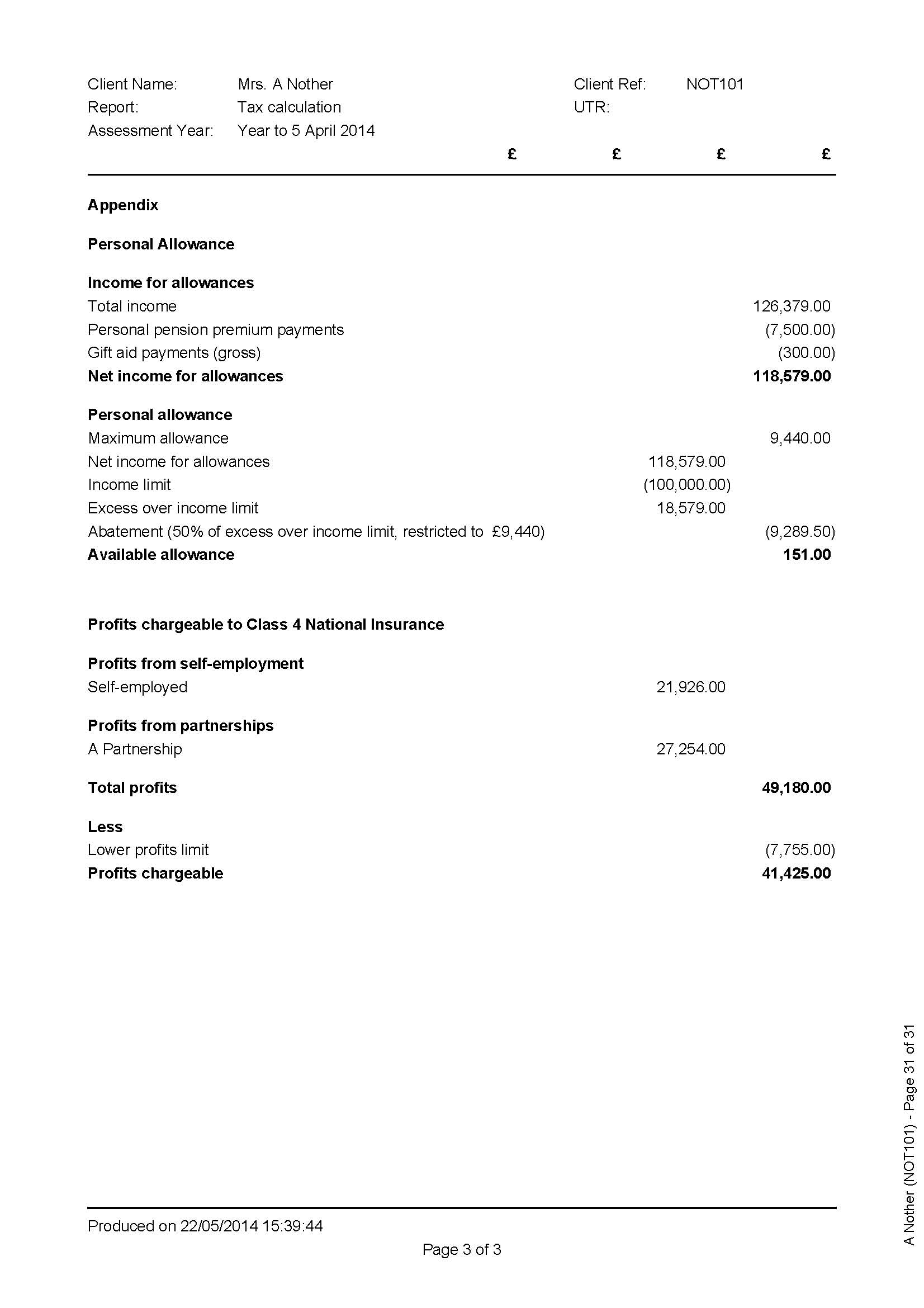

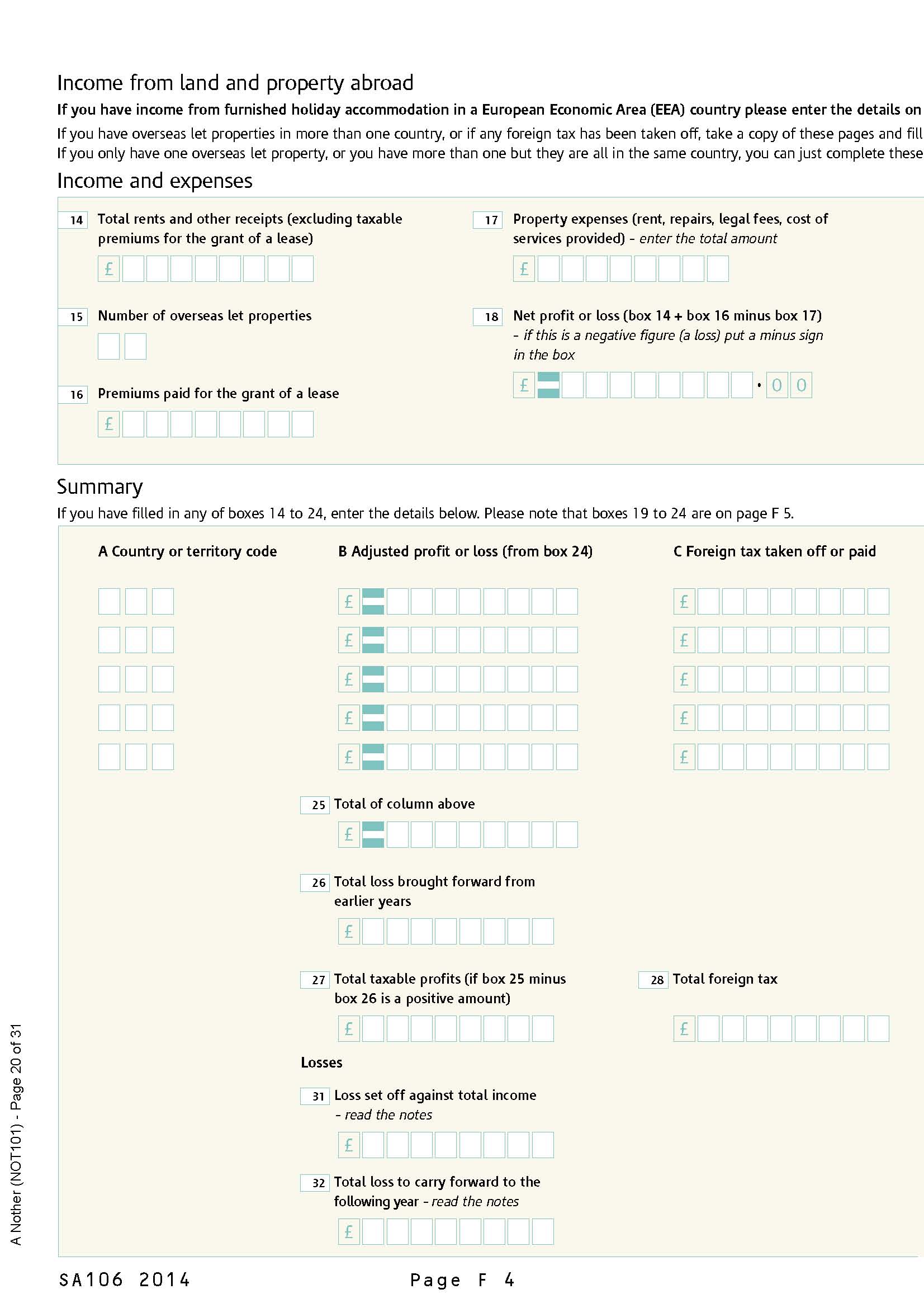

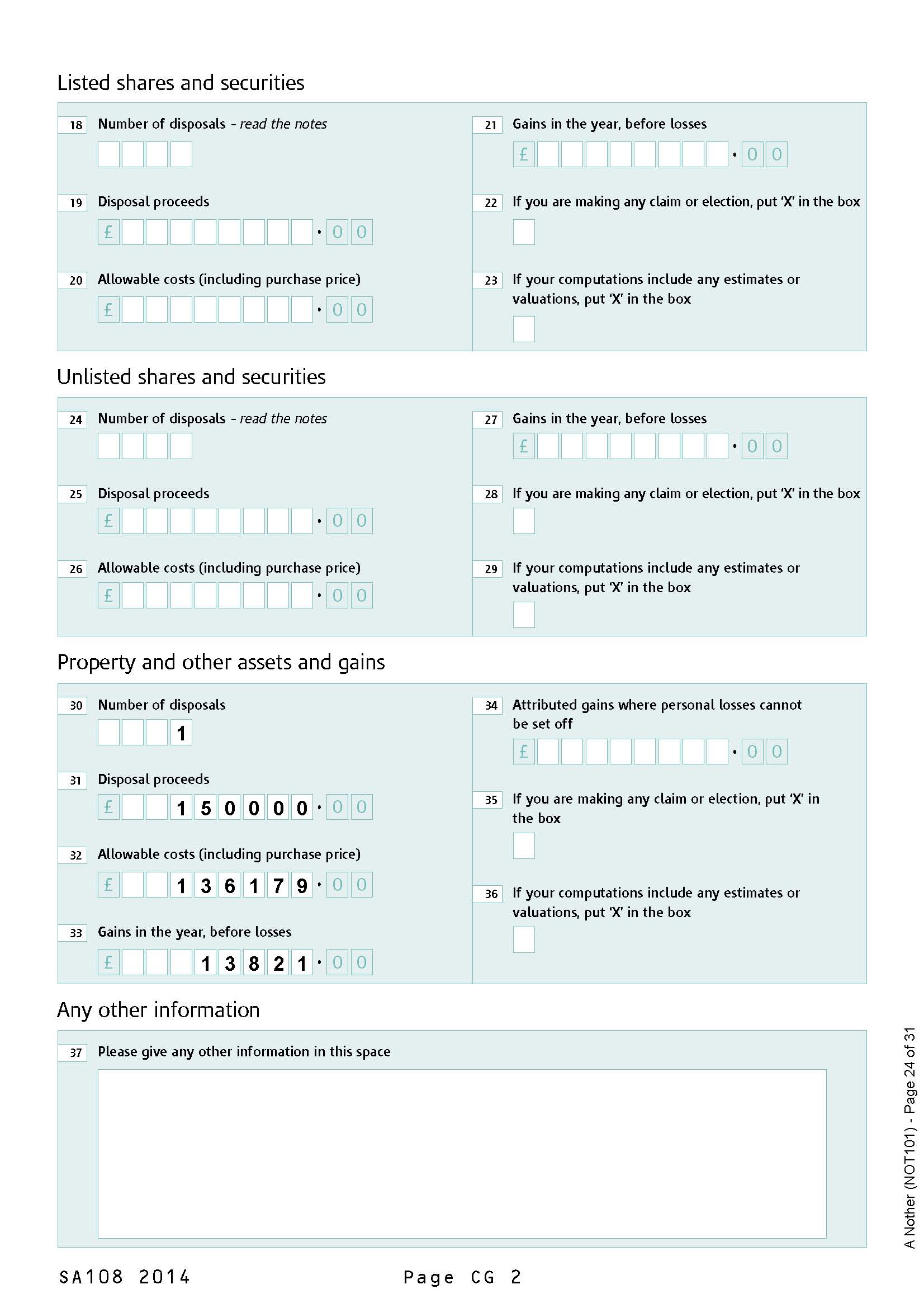

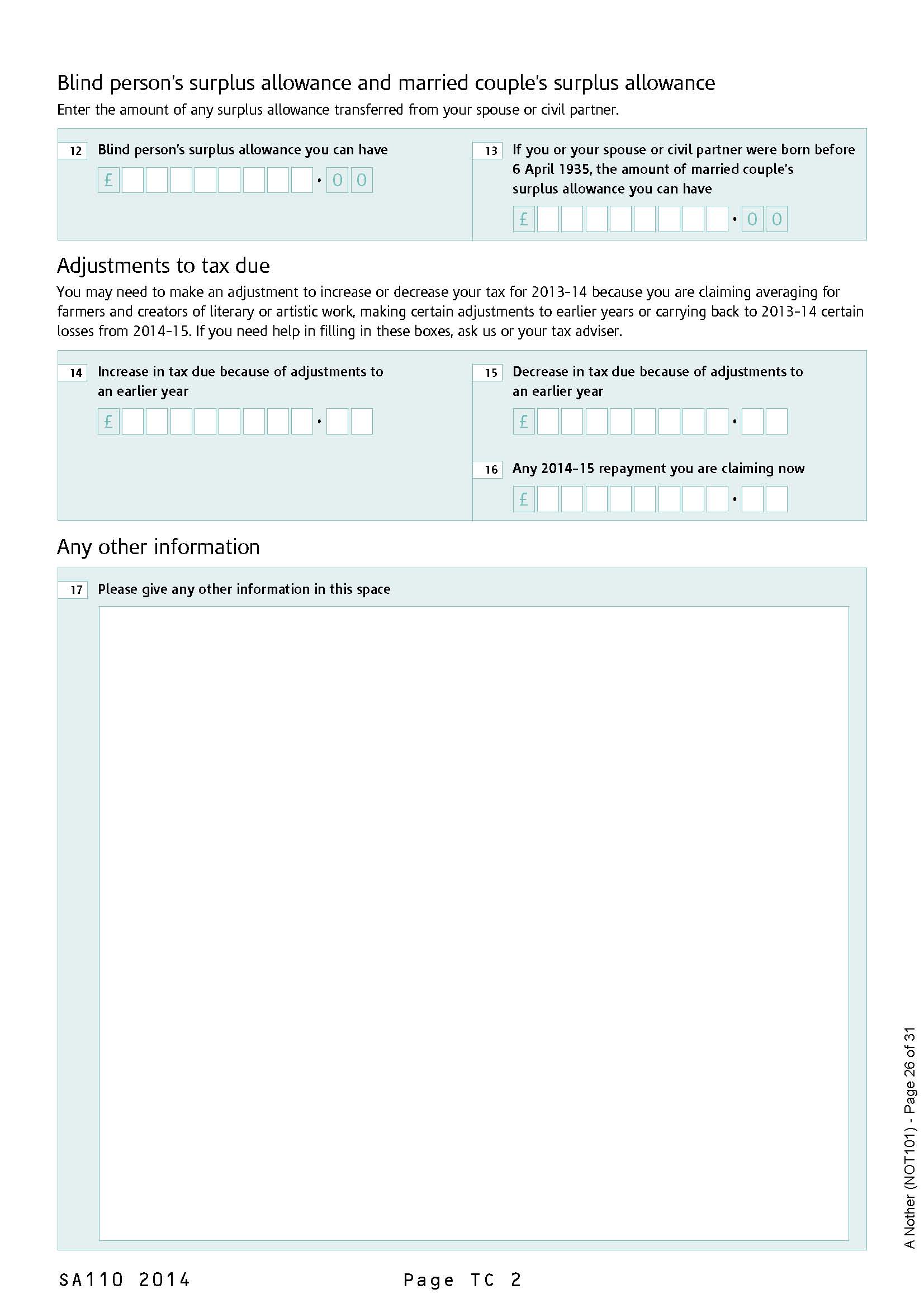

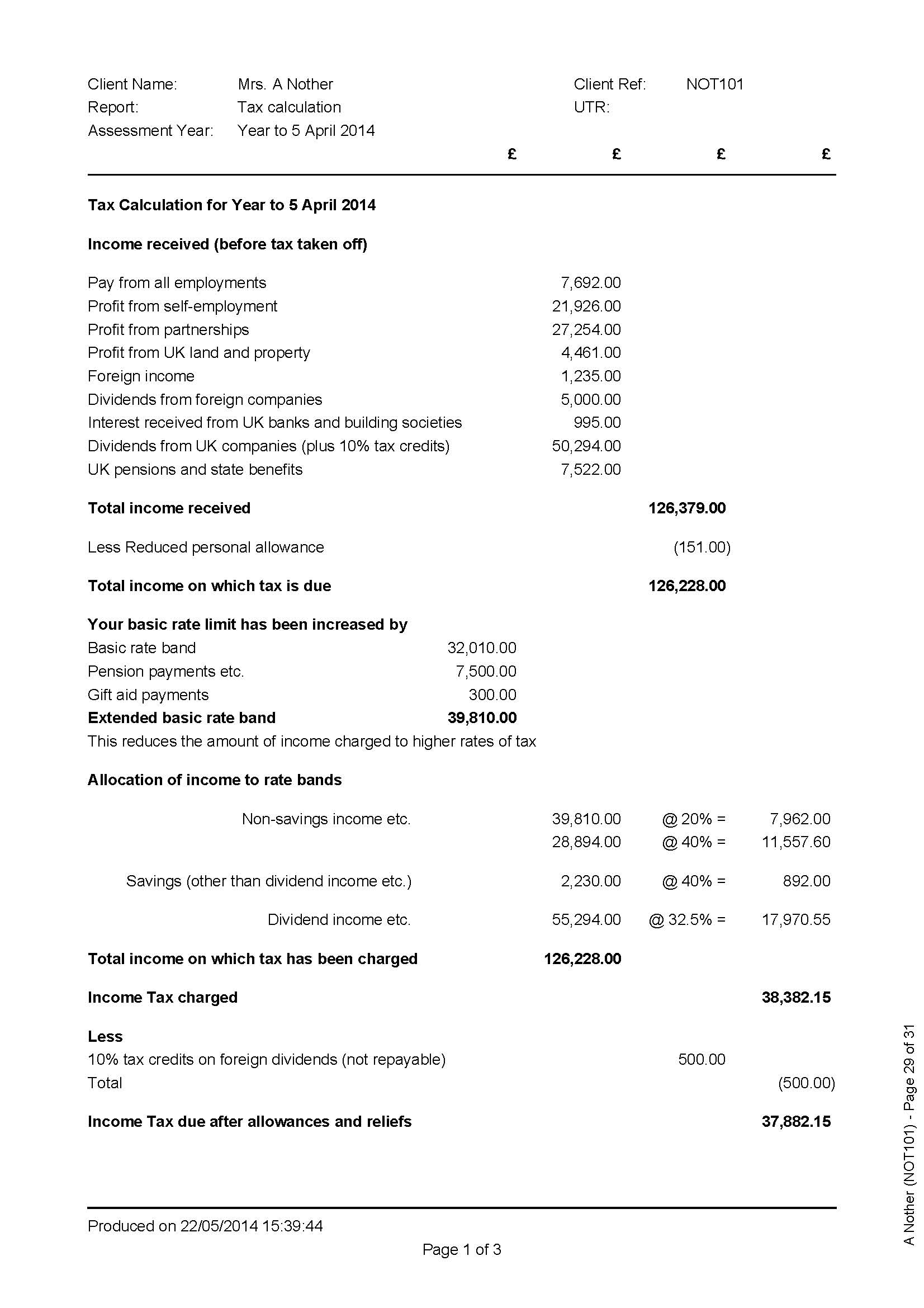

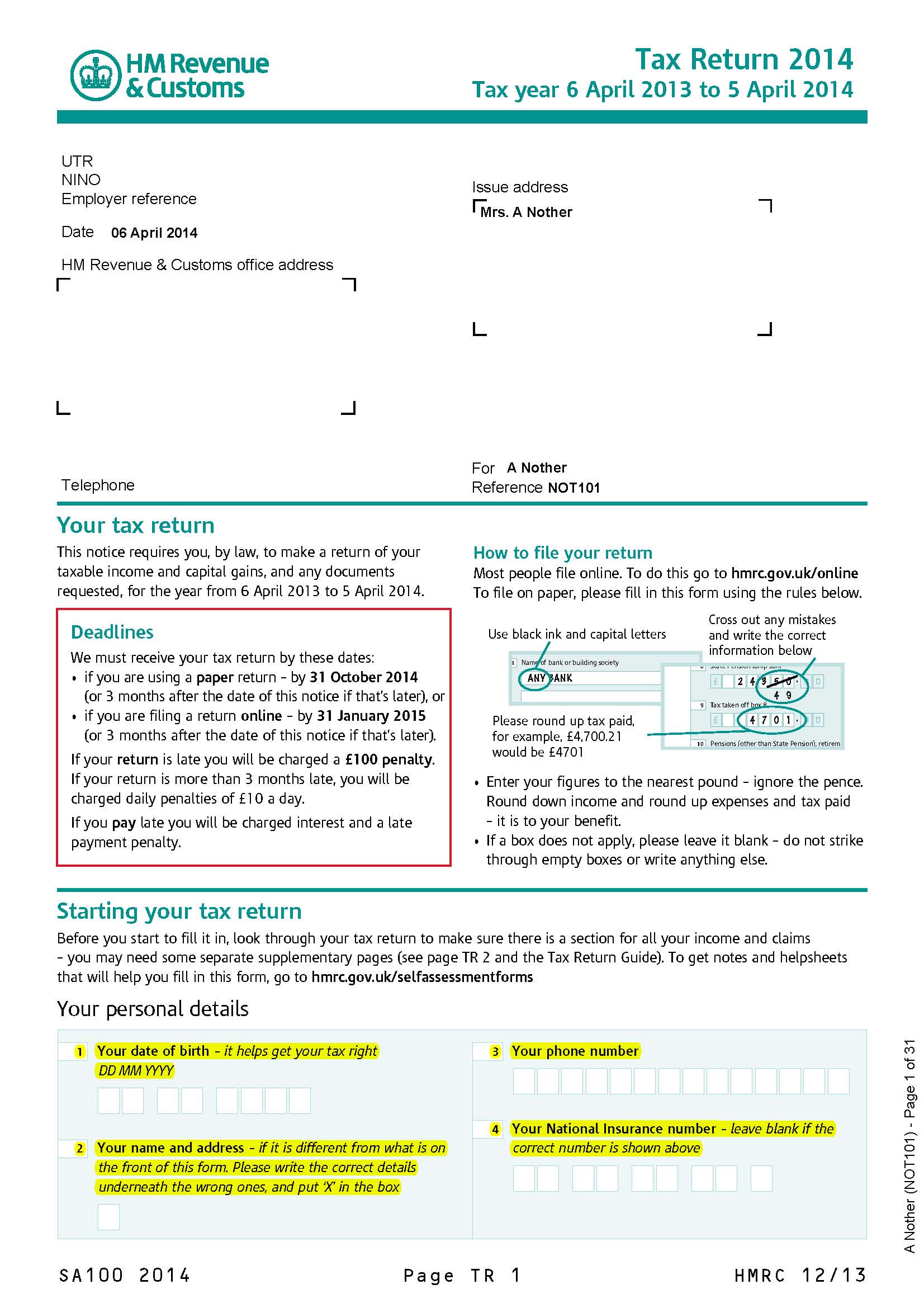

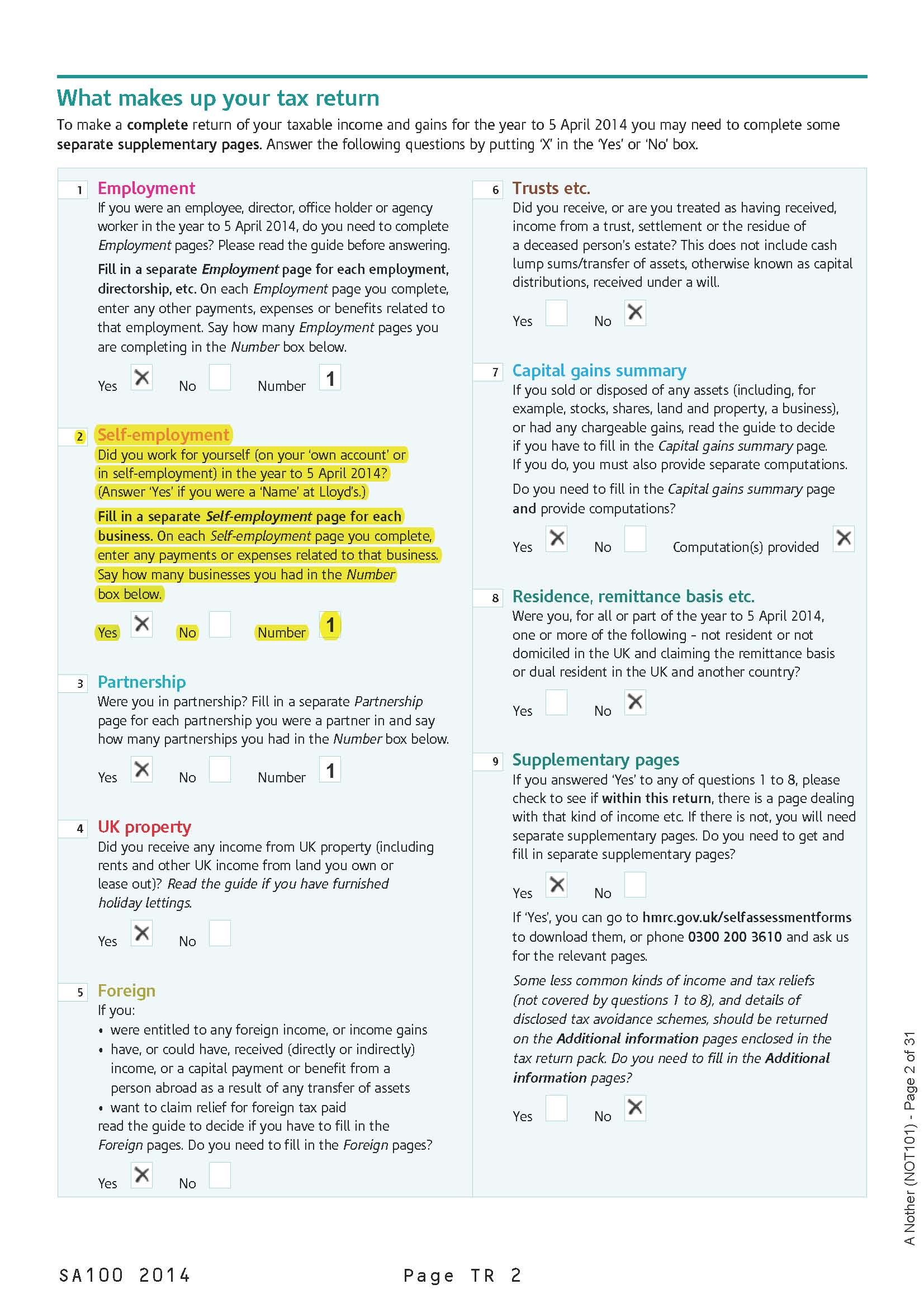

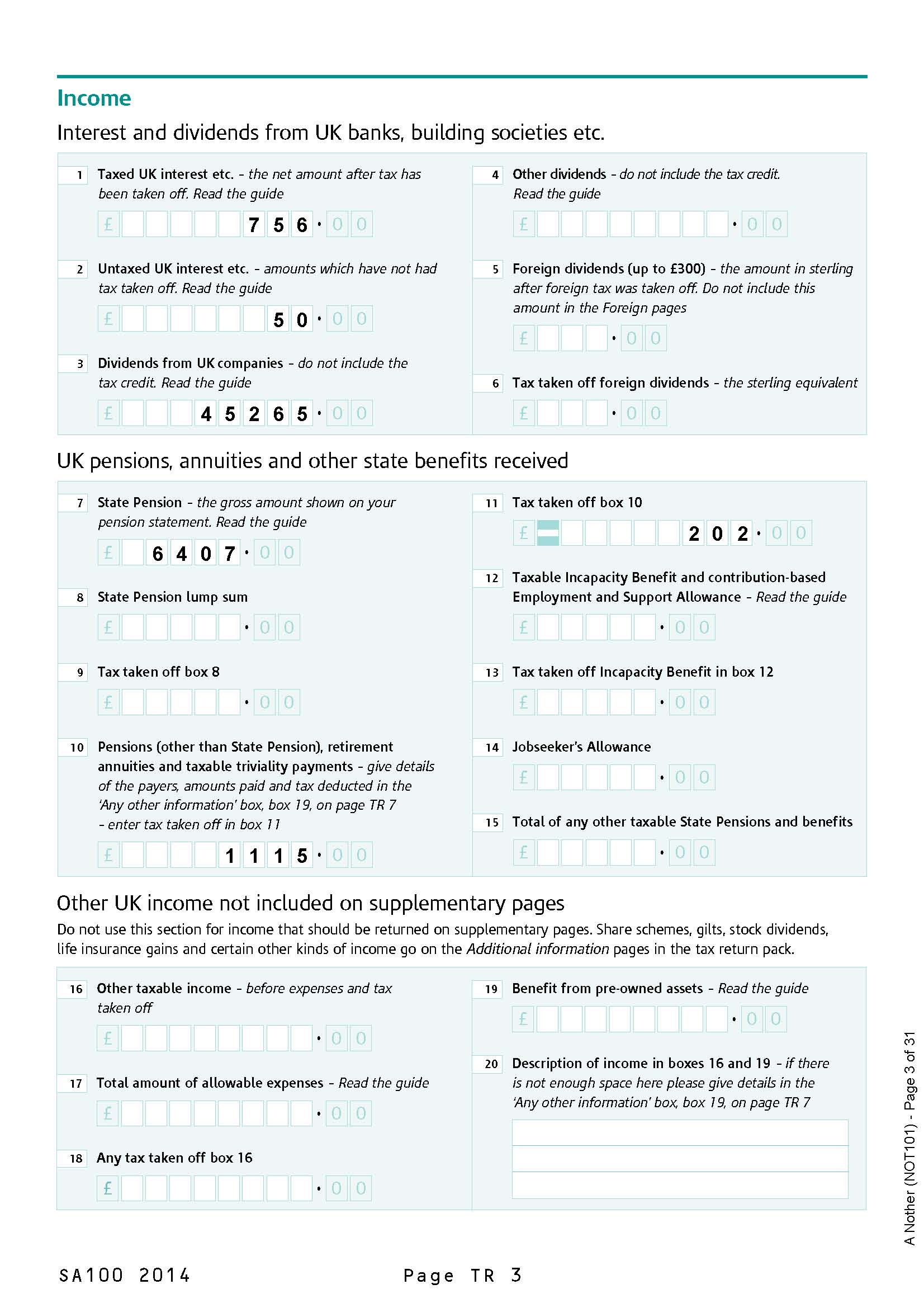

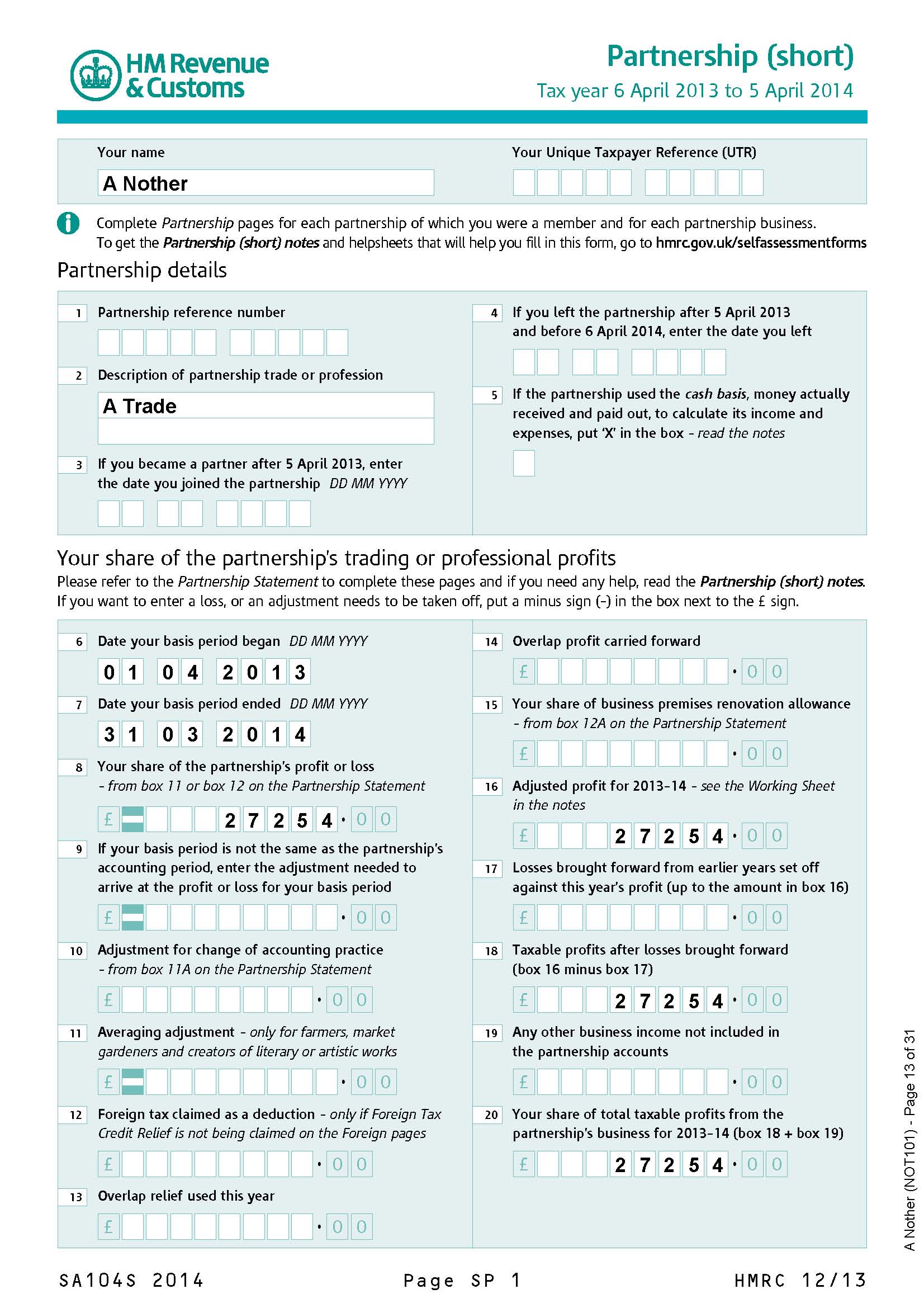

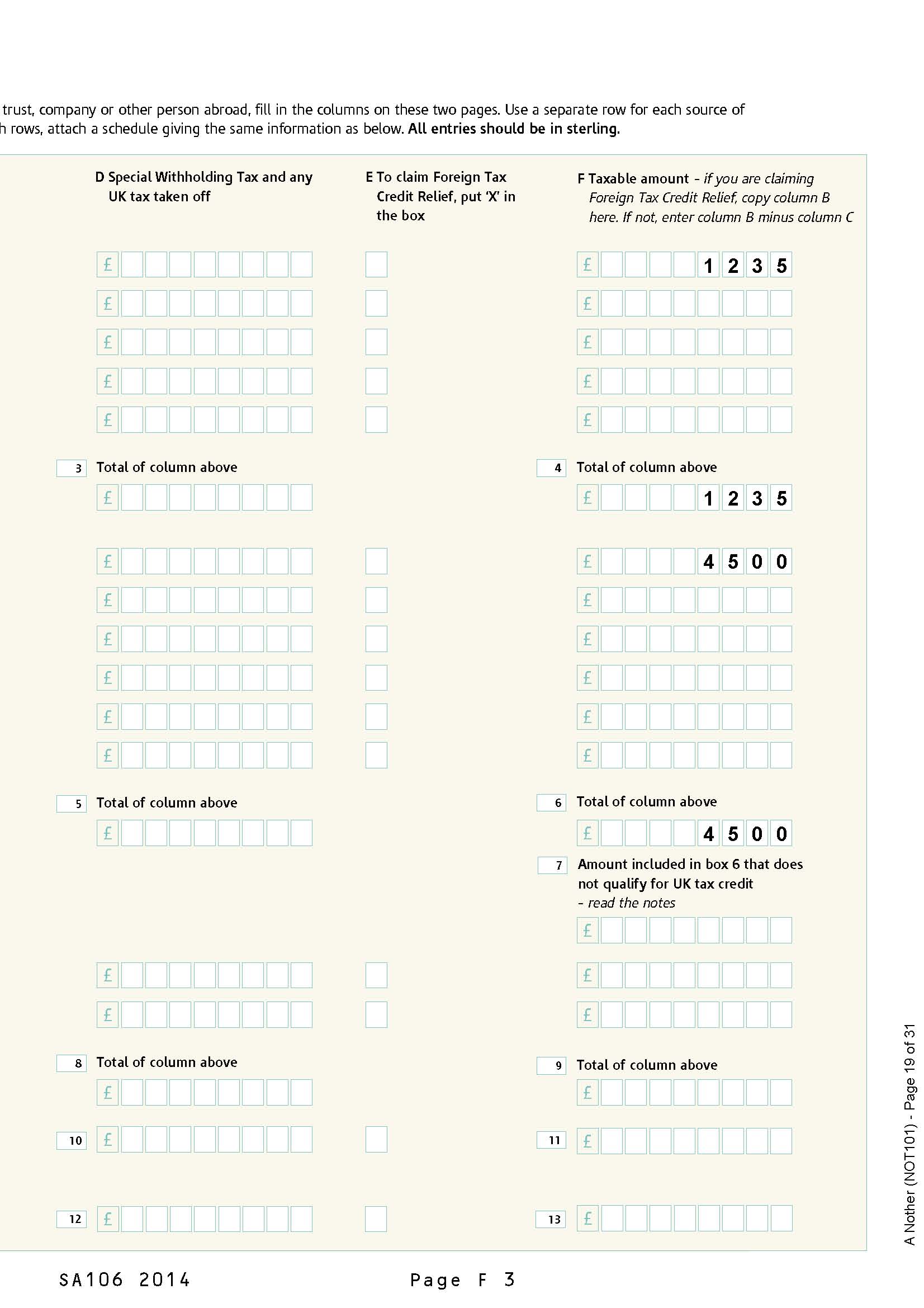

The product images show exactly which sections of a tax return are included with this product.

Every Company director gets the basic tax return issued to them by HMRC. There are other, ‘supplementary’, pages covering the less common types of income, and disposals of chargeable assets.

If you need or think you may need any other sections, or other supplementary sections, please see ‘other sections of the tax return which may apply’ and add those to your basket. However we will contact you with a detailed questionnaire after you purchase the product to check if you have included everything you will need.

The basic Tax return (SA100) for Company directors includes the following*;

6) An evaluation which identifies any issues in your records which may affect your tax return and advice how to correct this.

7) Preparation of a basic SA100 Company Director’s tax return to draft copy including;

e) SA100 TR1 questions 1 – 4 Your personal details

f) SA102 TR2 section 2* Employment income pages

g) SA100 TR7 questions 15 – 18 your tax advisor

h) SA100 TR8 questions 20 – 21 declaration

8) Your questions answered.

9) Amendments to your tax return

10) Final SA100 Self Assessment tax return ready for filing.

If you have more complicated tax affairs for example, if you have another employment, dividends, or stocks and shares income, or are a landlord then you should bolt on to this purchase one of our additional products which will ensure that your tax affairs are properly stated. Any questions where to?

*If you have more than one directorship you will need to select the SA102 employment bolt on product.

Simply provide us with the information we request and we will produce your SA100 tax return for you ready to file. You will be able to ask your Helpbox chartered accountant questions.

What this product includes:

The product images show exactly which sections of a tax return are included with this product.

Every Company director gets the basic tax return issued to them by HMRC. There are other, ‘supplementary’, pages covering the less common types of income, and disposals of chargeable assets.

If you need or think you may need any other sections, or other supplementary sections, please see ‘other sections of the tax return which may apply’ and add those to your basket. However we will contact you with a detailed questionnaire after you purchase the product to check if you have included everything you will need.

The basic Tax return (SA100) for Company directors includes the following*;

1) An evaluation which identifies any issues in your records which may affect your tax return and advice how to correct this.

2) Preparation of a basic SA100 Company Director’s tax return to draft copy including;

a) SA100 TR1 questions 1 – 4 Your personal details

b) SA102 TR2 section 2* Employment income pages

c) SA100 TR7 questions 15 – 18 your tax advisor

d) SA100 TR8 questions 20 – 21 declaration

3) Your questions answered.

4) Amendments to your tax return

5) Final SA100 Self Assessment tax return ready for filing.

If you have more complicated tax affairs for example, if you have another employment, dividends, or stocks and shares income, or are a landlord then you should bolt on to this purchase one of our additional products which will ensure that your tax affairs are properly stated.

*If you have more than one directorship you will need to select the SA102 employment bolt on product.

Simply provide us with the information we request and we will produce your SA100 tax return for you ready to file. You will be able to ask your Helpbox chartered accountant questions.

What is a Limited company?

A limited company has to be

brought into creation (formation) and its name approved and registered

by Companies House, in accordance with the primary piece of UK company

law known as the Companies Act 2006.

A Limited company is

actually a separate legal entity in its own right. This means it has its

own Unique Tax Reference (UTR – ten digit number), can own assets, and

must complete its own tax return.

The main reason for setting up as a

limited company instead of as a sole trader or partnership tends to be

liability. In a limited company your liability is generally limited to

the amount you have invested in it, usually the face value of the

shares. This limits the risk to yourself of losing your assets such as

your family home etc. This can be very useful if you are in a trade with

a high risk factor. Obviously you want your business to do well and

will do everything you can to make sure it succeeds but it’s good to

have peace of mind.

There are different types of limited company but a

private limited company is the most common and the one you are most

likely to set up. This means the company cannot offer its shares for

sale to the public unlike a public limited company (plc).

What are Limited Company annual accounts (Financial Statements)

The financial statements are the formal record of the financial activities of a business. The relevant information is presented in a standardized format to make them easy to understand regardless of the industry or trade type of the business itself. Their purpose is to provide the reader with information about the financial position and trading activities of the business across the financial year and enables more informed business decisions to be made based on this information. They have four main purposes and users;

• Employees – to decide on taking up employment, in negotiating pay etc

• Investors – both current and potential in deciding how viable the business is for making an investment in

• Financial Institutions – to make decisions on whether to give credit, loans and mortgages etc

Filing Obligations of a Limited Company

Limited companies have a statutory obligation to file accounts with Companies House within 9 months of each financial year-end. Additionally, each Limited company must file an annual tax return called a corporation tax return (CT600) with HMRC within 12 months of the financial year end including a full set of accounts. This gives anyone who sees these accounts a picture of the trading activities of the company over that period

In addition to these the company must file an annual return every 12 months at companies which is a snapshot of the structure of the company including details of directors, shareholders etc. Small companies have a number of exemptions which allows them to file abbreviated accounts at Companies House.

What is a Limited company?

A limited company has to be brought into creation (formation) and its name approved and registered by Companies House, in accordance with the primary piece of UK company law known as the Companies Act 2006.

A Limited company is actually a separate legal entity in its own right. This means it has its own Unique Tax Reference (UTR – ten digit number), can own assets, and must complete its own tax return.

The main reason for setting up as a limited company instead of as a sole trader or partnership tends to be liability. In a limited company your liability is generally limited to the amount you have invested in it, usually the face value of the shares. This limits the risk to yourself of losing your assets such as your family home etc. This can be very useful if you are in a trade with a high risk factor. Obviously you want your business to do well and will do everything you can to make sure it succeeds but it’s good to have peace of mind.

There are different types of limited company but a private limited company is the most common and the one you are most likely to set up. This means the company cannot offer its shares for sale to the public unlike a public limited company (plc).

If your business is dormant

Companies and associations don’t always have to pay Corporation Tax or file Company Tax Returns if they aren’t active (sometimes called ‘dormant’ or ‘non-trading’).

HMRC may decide that your company or association is dormant if it:

• isn’t doing business or receiving income

• is an unincorporated association that owes less than £100 Corporation Tax

• is a flat management company that qualifies as dormant

There are additional requirements for dormant unincorporated associations. You’ll get a letter from HMRC telling you if you don’t have to pay Corporation Tax or file Company Tax Returns. You must still file a Company Tax Return if HMRC tells you to by letter. Check if your company is also dormant for Companies House annual accounts.

If your dormant business becomes active again

You must tell HMRC if your company becomes active again. You’ll get a letter from HMRC telling you if it must pay Corporation Tax and file Company Tax Returns.

What is a small company?

According to Companies House to be a small company it must have, at least two of the following conditions

must be met:

• Annual turnover must be £6.5 million or less

• The balance sheet total must be £3.26 million or less

• The average number of employees must be 50 or fewer

HMRC consider a small company to be a limited company that employs less than 50 employees and has an annual turnover of less than £5.6 million.

What are limited company shareholders?

Limited companies are owned by its shareholders. Shareholders liability is limited to the amount of money they have paid for the shares.

What are limited company directors?

The people who run the business are referred to as the company officers, and are known as directors. The shareholders appoint the directors. The directors make the day to day decisions about the business

Companies House

All Limited Liability companies whose registered office is located in England and Wales must be incorporated and registered at Companies House, which is the registry of companies for the UK. The law governing a limited company is the Companies Act 2006. That act sets out how a company must operate. Part of the Companies Act 2006 requires Ltd co officers (directors) to file certain information with Companies House. For example any changes to the company’s directorships, appointments and resignations must be reported to Companies House. Each year a company has to file an annual return and a set of trading accounts, usually abbreviated accounts.

What is a Corporation tax return CT600?

The HMRC Tax return is different to the companies’ legal obligation and submission of accounts and annual return with Companies House.

A HMRC corporation tax return is often referred to as a Limited company tax return, Company tax return, Corporation tax, and sometimes a CT600. They are all referring to the same thing. It is a summary of the financial activities of the company over the accounting period and details the corporation tax to be paid to HMRC. This CT600 should be filed with HMRC within 12 months of the accounting period end, however the corporation tax itself must be paid within 9 months and 1 day of the accounting period end

Who are HMRC?

Her Majesties Revenue and Customs (HMRC) are responsible for collection of all taxes in the UK, commonly known as the ‘Taxman’.

Do company directors also complete a CT600?

No. Only information relating to the limited company is submitted on the HMRC corporation Tax return CT600. It is the duty of every company director to both registered with HMRC when they are appointed as a director of a limited company. HMRC will then issue the appropriate Tax form: A self assessment tax return SA100.

What happens if I don’t file a Tax return?

HMRC have very powerful and wide ranging powers including the power of arrest. If you fail to either register and or file a tax return, then HMRC powers allow then to impose financial penalties and charge interest on any due tax.

Who are HMRC?

Her Majesties Revenue and Customs (HMRC) are responsible for

collection of all taxes in the UK, commonly known as the ‘Taxman’.

How to Register

as an employer with HMRC

An employer has a need to register the business with Her

Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’.

Dealing with HMRC and

paying tax

External functions include providing information

to Government agencies most commonly Her Majesties Revenue and Customs

Quickbooks

accountancy software

Provide us a back up of your Quickbooks software using the

Helpbox upload bay. We will then prepare your annual accounts from your

Quickbooks. Preparing annual accounts from Quickbooks via Helpbox is probably

the most affordable way to prepare your annual accounts.

Partnership Tax

return (SA800)

Who has to submit a

self assessment tax return?

Each partnership should nominate a managing partner. That is

the partner who will take responsibility to manage the financial affairs of the

business. In law a partners in a partnership are subject to joint and several

liability. That means each and every partner is potentially personally liable

for all of the partnerships debts not just their own share. Often the managing

partner is the one who co-ordinates with us to provide the information need to

complete the year-end partnership (SA800) tax return form.

When does the tax

return have to be filed?

Each year the partnership must file with HMRC a partnership

tax return for all accounting transaction in the period 6th April to

5th April the following year. The SA800 partnership tax return must be

filed with HMRC no later than 31st January the following year.

declared on the self assessment tax return. Which must be paid in full. Any

late payments will be subject to surcharge penalty by HMRC. Likewise severe

penalties apply to late or non-submissions. These fines escalate very quickly

and within a few short weeks can exceed £1000.

Partners additional

tax returns

Anyone who is part of a business partnership, as the same

duty as a sole trader and must register their self employment with HMRC within

90 days of starting trading. Failure to

do so can result in HMRC fines and penalties. The partnership has to file a tax

return and additionally each partner must submit their own (SA100) self assessment

tax return.

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

Partners in a business Partnership are self employed and

must register with HMRC and file a SA100 self assessment tax return each year.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.

Every company has each year to comply with the Companies Act

2006 and file an annual return at companies house. Not to do so is a criminal

offence and convicted directors are liable to pay a fine and have a criminal

record registered against their individual names.

Also every newly

incorporated company must register the new limited liability company with HMRC

for purposes of being assessed for payment of corporation tax.

Thereafter each year the Ltd Co., must file with Her

Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, a

corporation tax return. This HMRC form has a form name CT600.

It is very important to understand the UK HMRC

tax rules because every limited liability company must register and file an

HMRC CT600. If you do not file a tax return then you are liable to sever, fines

and penalties, which will be imposed on you by HMRC. In more serious cases where

the company is considered to have ignored their duty to register with HMRC for

the purposes of declaring income. The directors can face criminal charges which

carry penalties of fines and imprisonment.

Company directors should be aware of their obligation to

register their directorship with HMRC so that they can have their income

assessed for possible taxation.

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.

Every company has each year to comply with the Companies Act

2006 and file an annual return at companies house. Not to do so is a criminal

offence and convicted directors are liable to pay a fine and have a criminal

record registered against their individual names.

Also every newly

incorporated company must register the new limited liability company with HMRC

for purposes of being assessed for payment of corporation tax.

Thereafter each year the Ltd Co., must file with

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, a

corporation tax return.

This HMRC form has a form name CT600.

It is very important to understand the UK HMRC

tax rules because every limited liability company must register and file an

HMRC CT600. If you do not file a tax return then you are liable to sever, fines

and penalties, which will be imposed on you by HMRC. In more serious cases

where the company is considered to have ignored their duty to register with

HMRC for the purposes of declaring income. The directors can face criminal

charges which carry penalties of fines and imprisonment.

What happens if I

don’t file a Tax return?

HMRC have very powerful and wide ranging powers including

the power of arrest. If you fail to either register and or file a tax return,

then HMRC powers allow then to impose financial penalties and charge interest

on any due tax.

What

is a self employed person?

The UK Government is keen for more people to set up in business a

self-employed. One of the key attractions for becoming self employed is that

you no longer have to work for someone else. You are your own boss. Being your

own boss requires new start up business owner to be responsible for their own

sick pay, and paying your own taxes and pension provision.

What

is a self employed business entity?

Once you have decided to take the plunge and you start up your own new

business then you need to consider what kind of entity will operate your

business. Sole trader, partnership, or a limited liability company.

Registering as self employed with HMRC

start-up businesses choose simple self employment and trade their new business

as a sole trader. Whatever entity you choose you must register that you are

self employed with Her majesties Revenue & Customs HMRC. As well as

registering online with HMRC for self assessment tax returns. You should also

consider how you will pay your National Insurance contributions NIC’s

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

Partners in a business Partnership are self employed and

must register with HMRC and file a SA100 self assessment tax return each year.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.

Company directors should be aware of their obligation to

register their directorship with HMRC so that they can have their income

assessed for possible taxation.

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.