What do I get when I buy this product?

A basic partner self assessment tax return made easy.

This product is designed to meet the HMRC requirements for self assessment for self employed partners who trade as part of a partnership. Prepared by an ACCA registered chartered accountant.

Note: This is not a partnership tax return SA800 which is completed for the partnership from partnership accounts. That is a separate product which can be found on this website also. See ref???

Who should buy this product?

If you are a partner in a business partnership you can easily purchase and this product.

Applies only to UK registered tax payers.

It’s easy: complete an online form and we will do the rest.

At your convenience

The most convenient way to prepare your tax return.

After you have purchased this product we will forward you a form to complete and request information and accounts from you.

Based upon those replies one of our tax specialists will prepare your tax return.

No need to attend accountant’s offices, this purchase is completed online from the convenience of your office or the comfort of your home. You will be able to ask your Helpbox chartered accountant questions.

Price promise

Fixed price. No more unexpected, unexplained accountant’s bills.

We will prepare your tax return ready for you to file yourself or we will file it for you. If you want us to file your tax return simply add FILING to your shopping trolley when requested.

Guaranteed - NO MORE MISSED DEADLINES

If you provide us with the information in the exact format which we request it and within our specifically stated timeframes we guarantee that we will prepare your return within HMRC’s filing deadlines.

What are a Partner’s statutory obligations?

All self employed people including partners in a partnership business(even if they have other part-time or full-time employment) have legal duty to:

1. Register with HMRC within 3 months of beginning to trade.

2. Each tax year prepare and complete a set of accounts the figures from which are used to:

Prepare and file an individual self assessment tax return (SA100).

What this product includes:

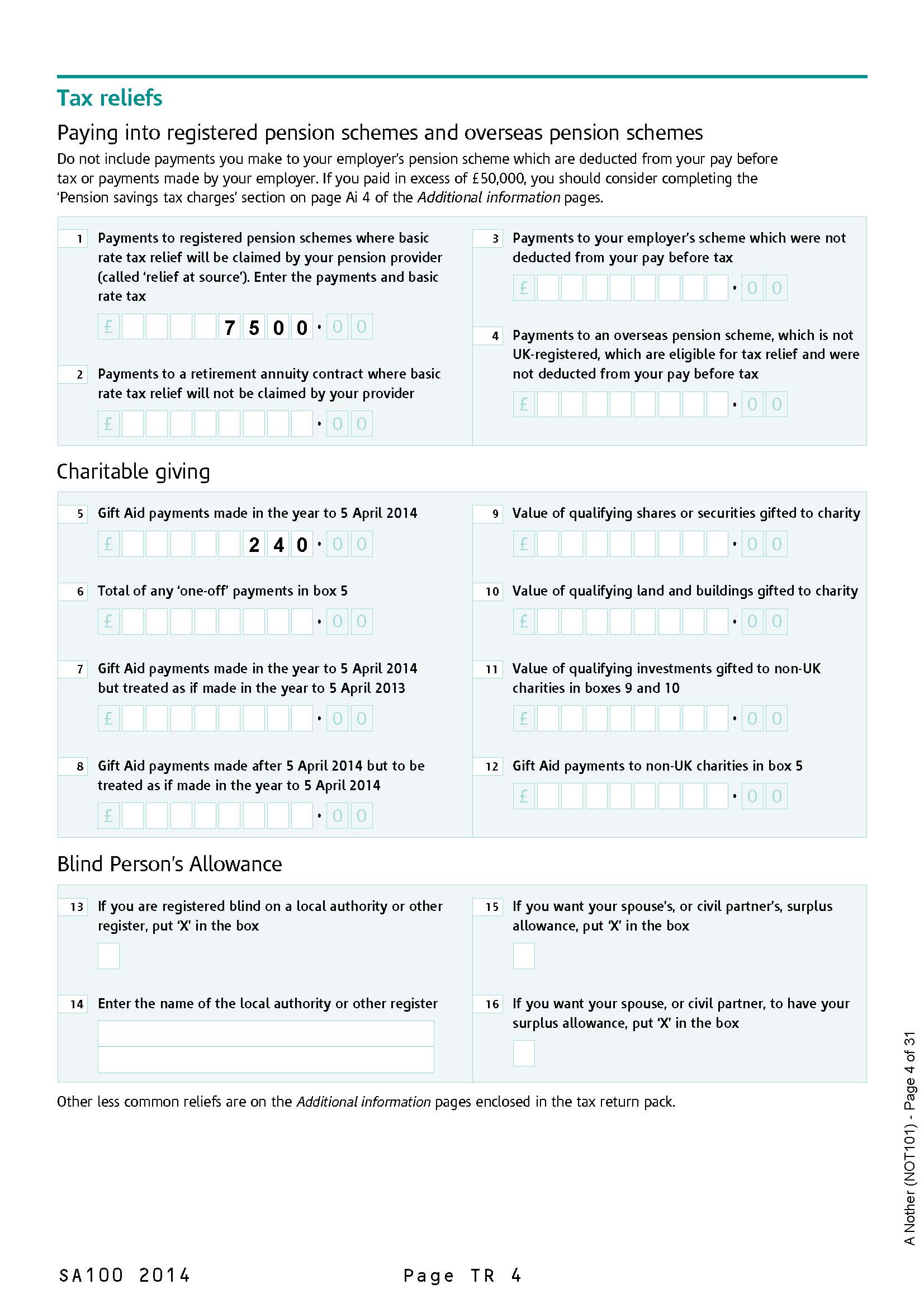

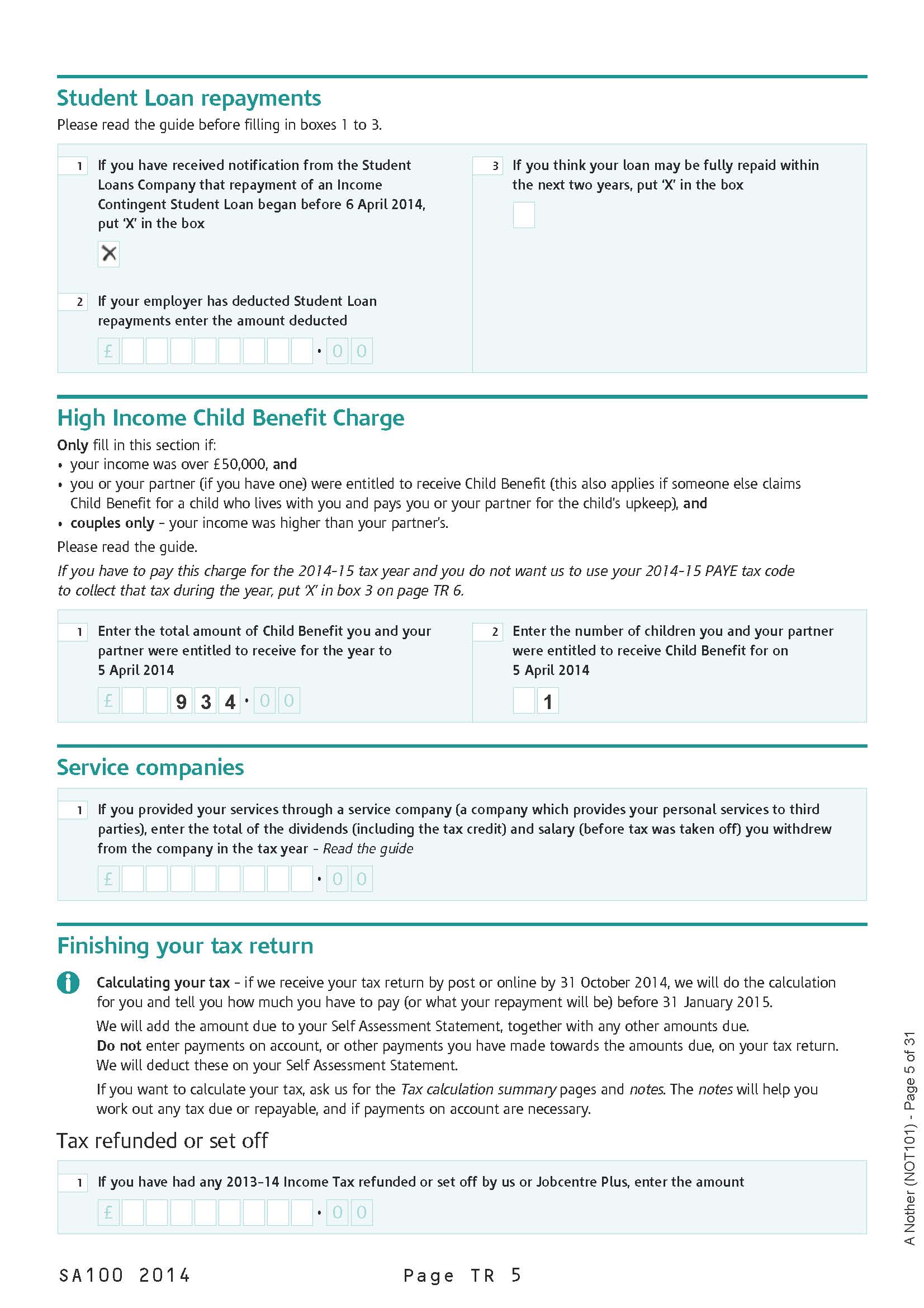

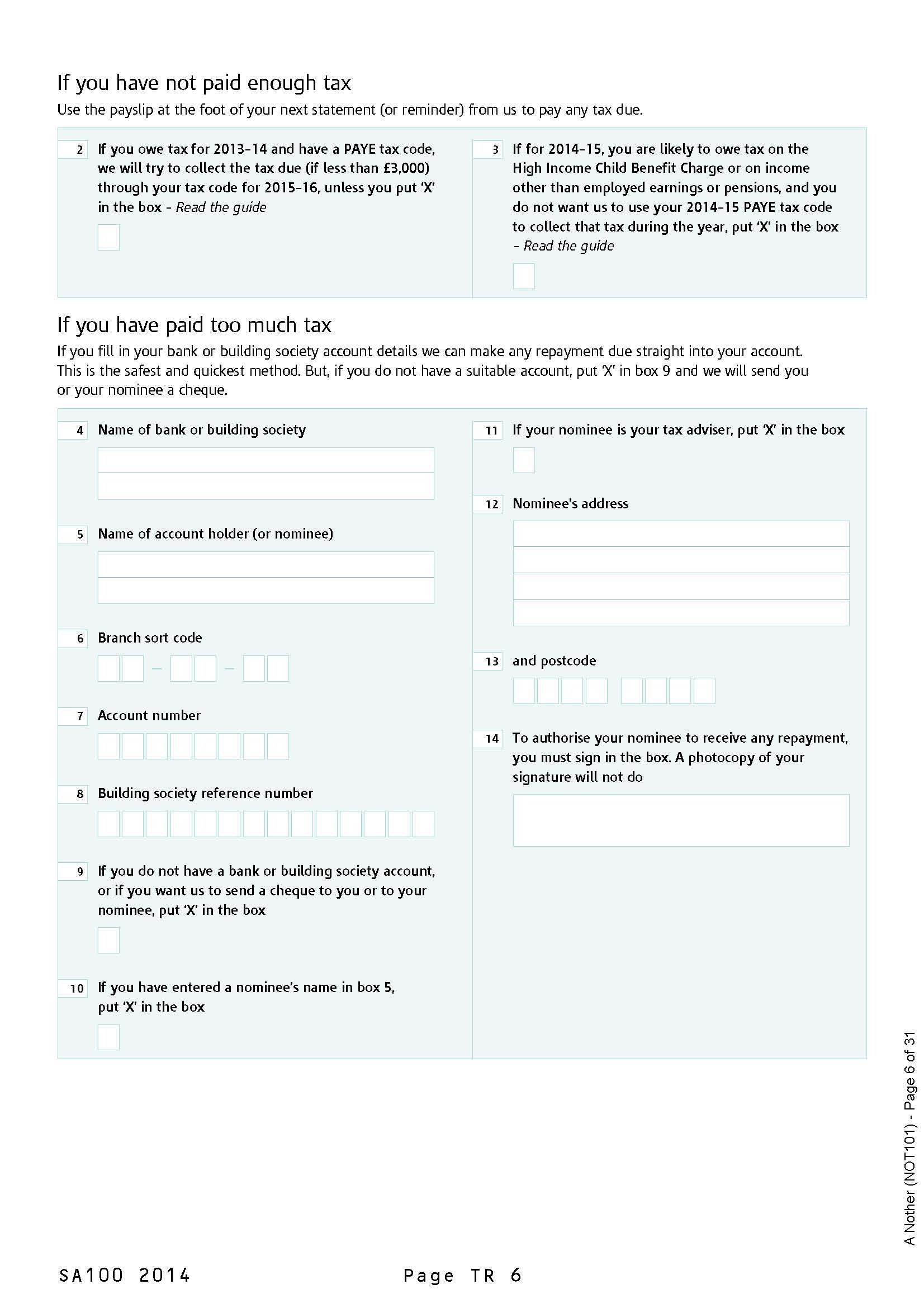

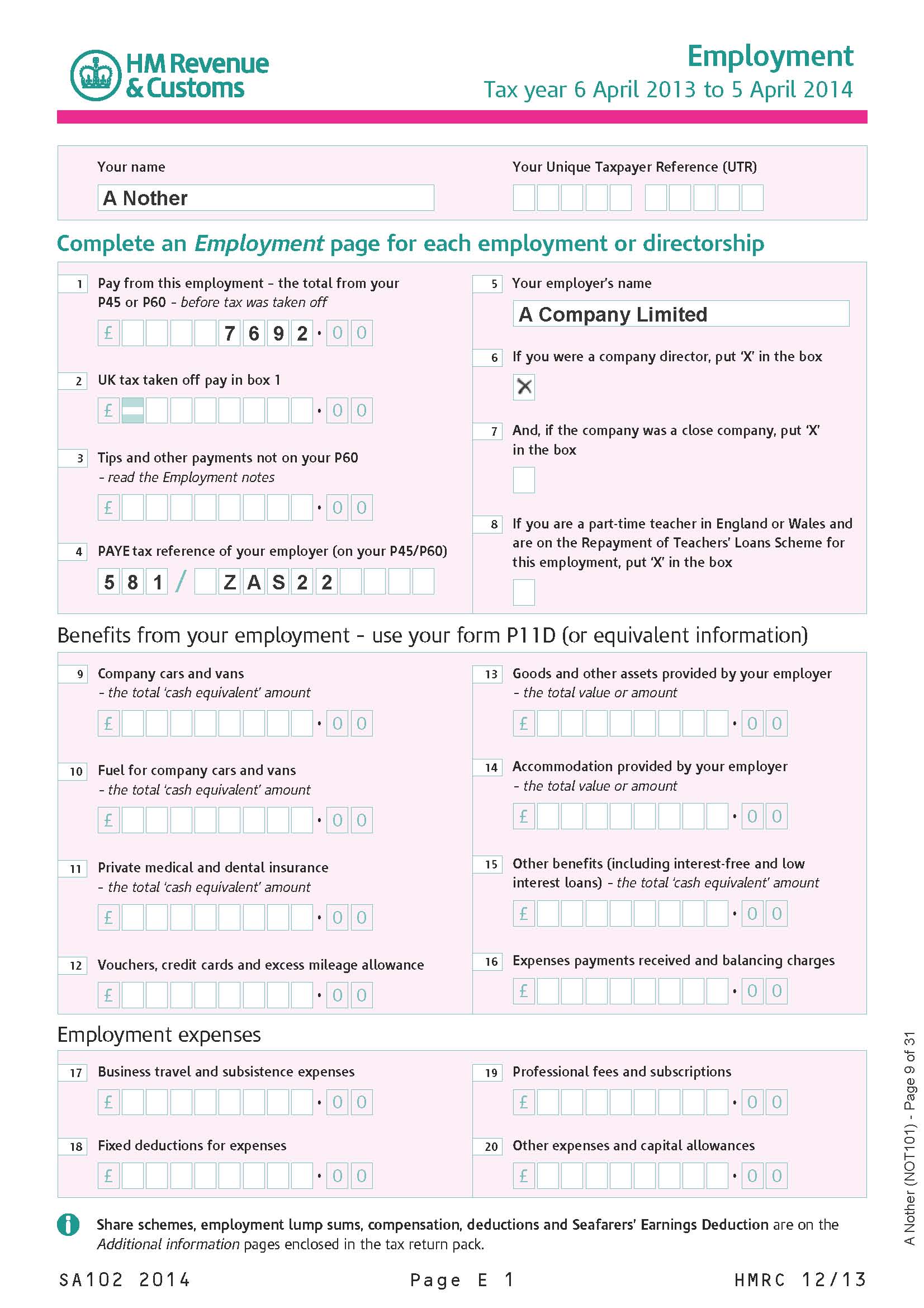

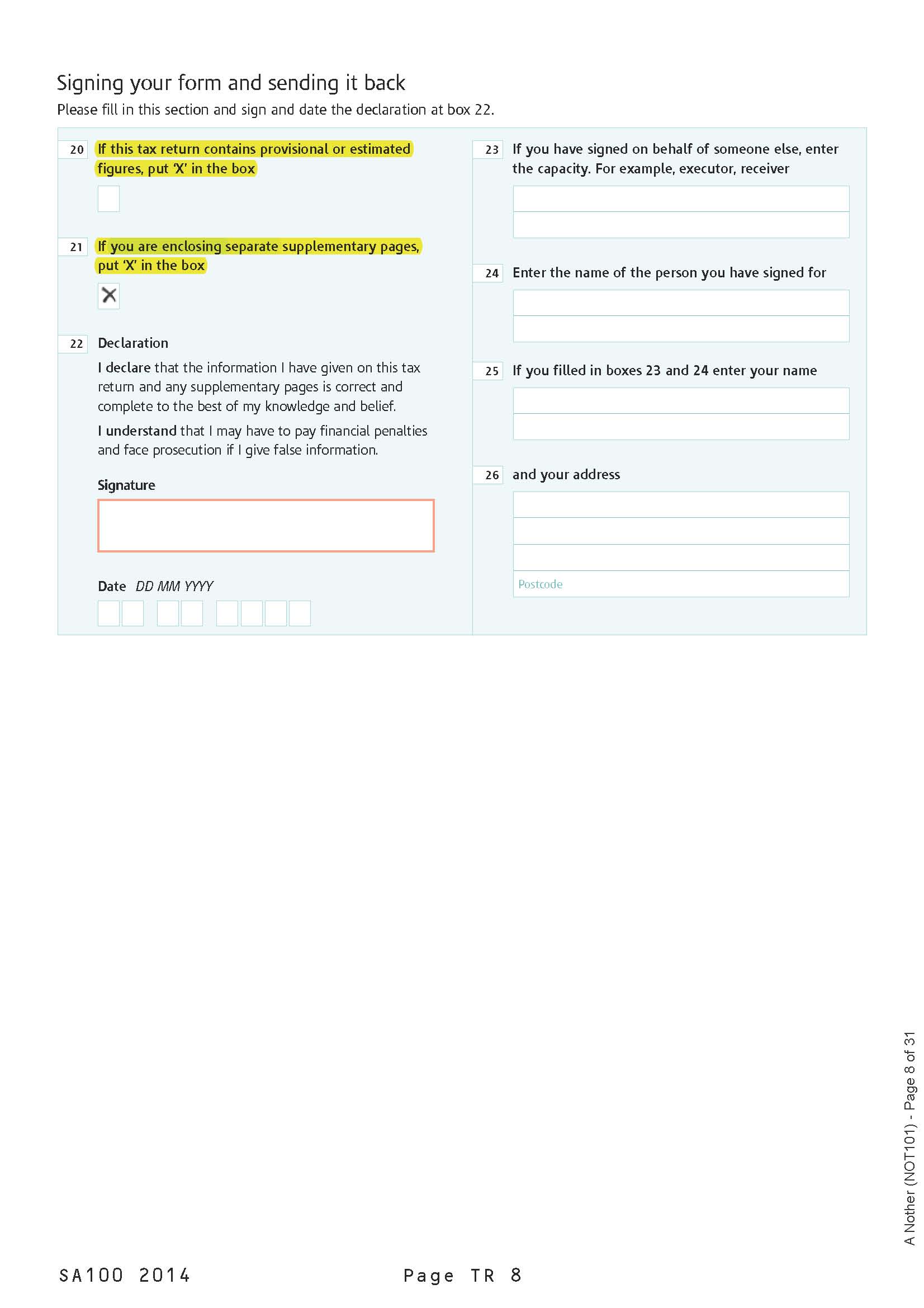

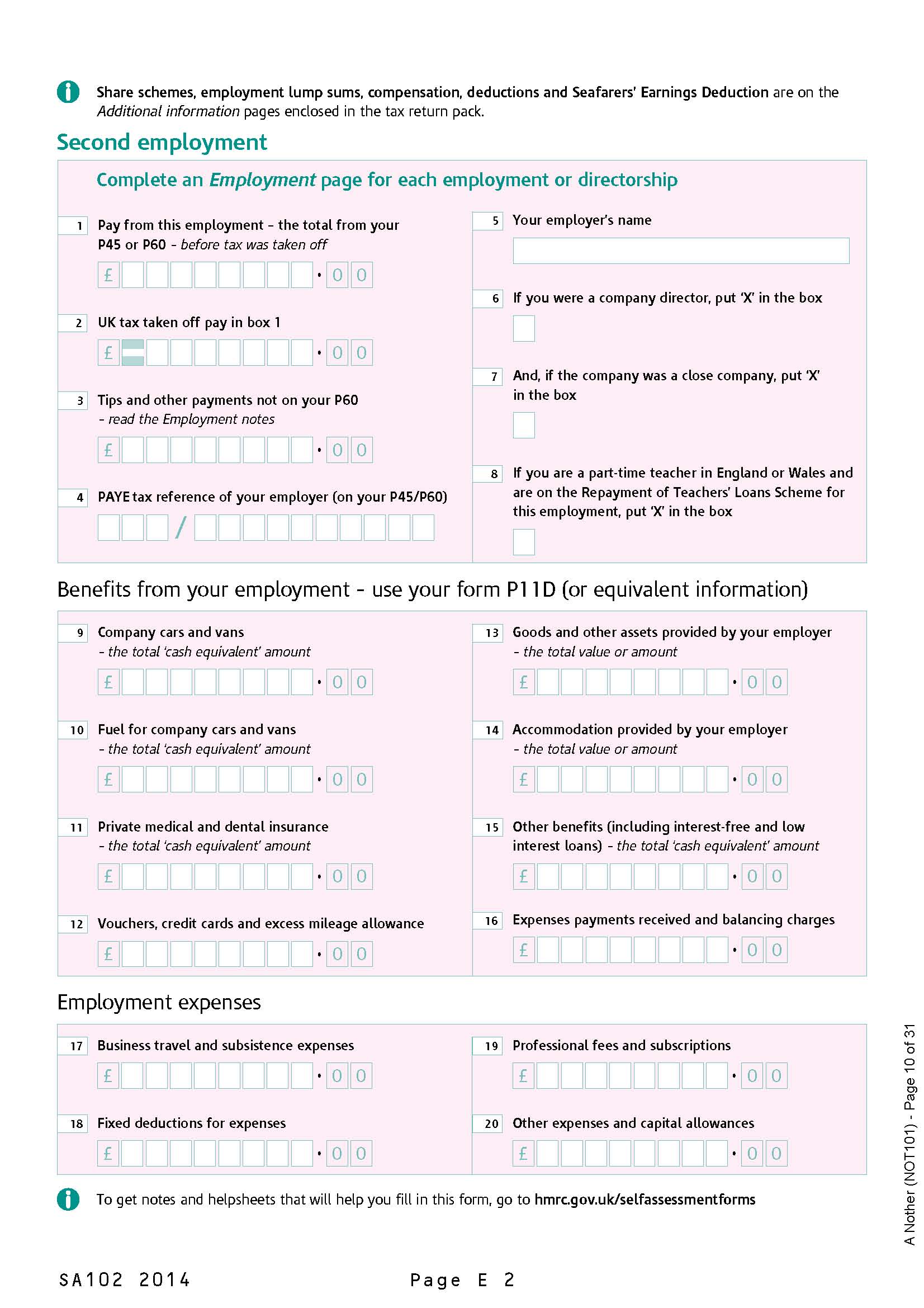

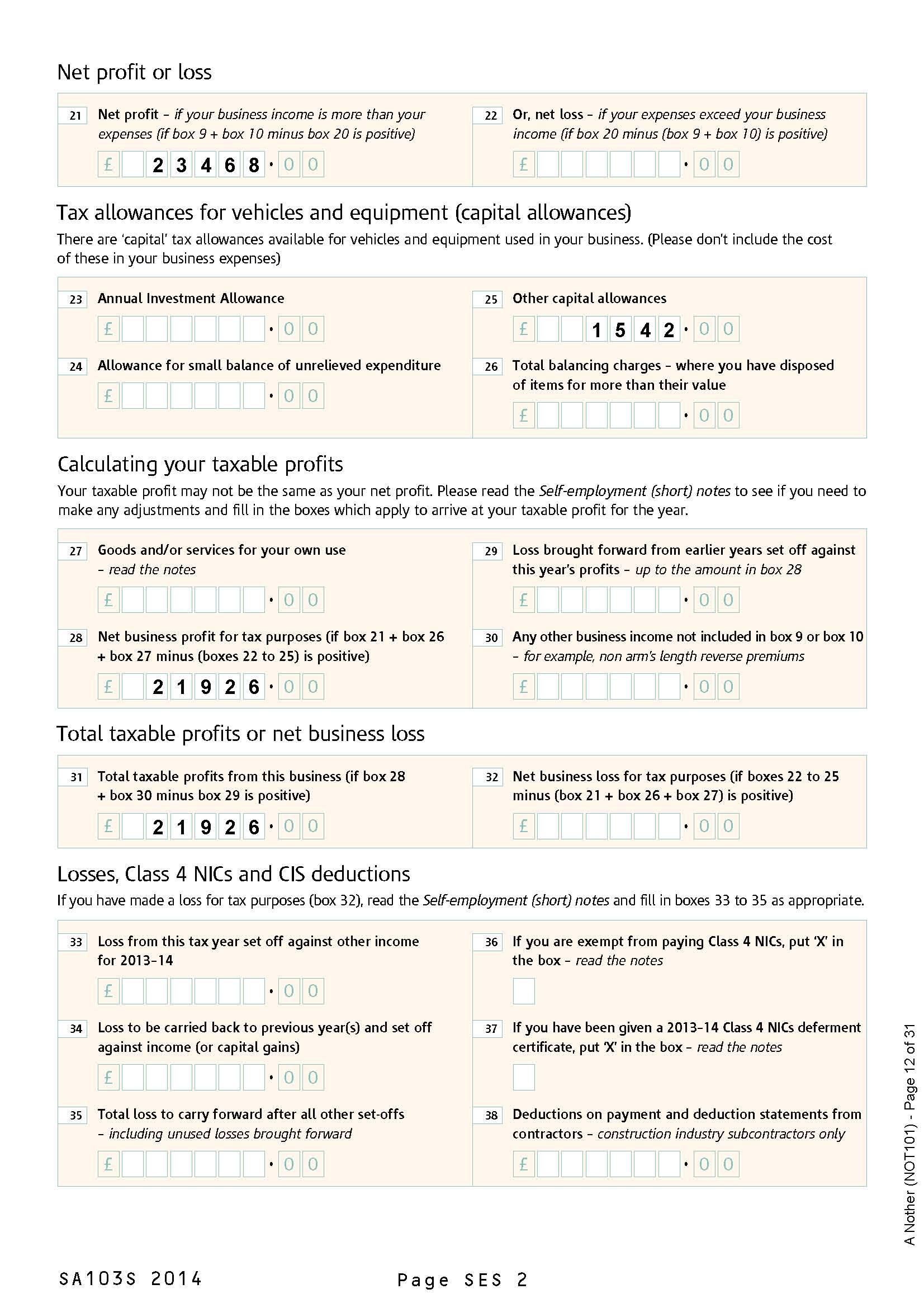

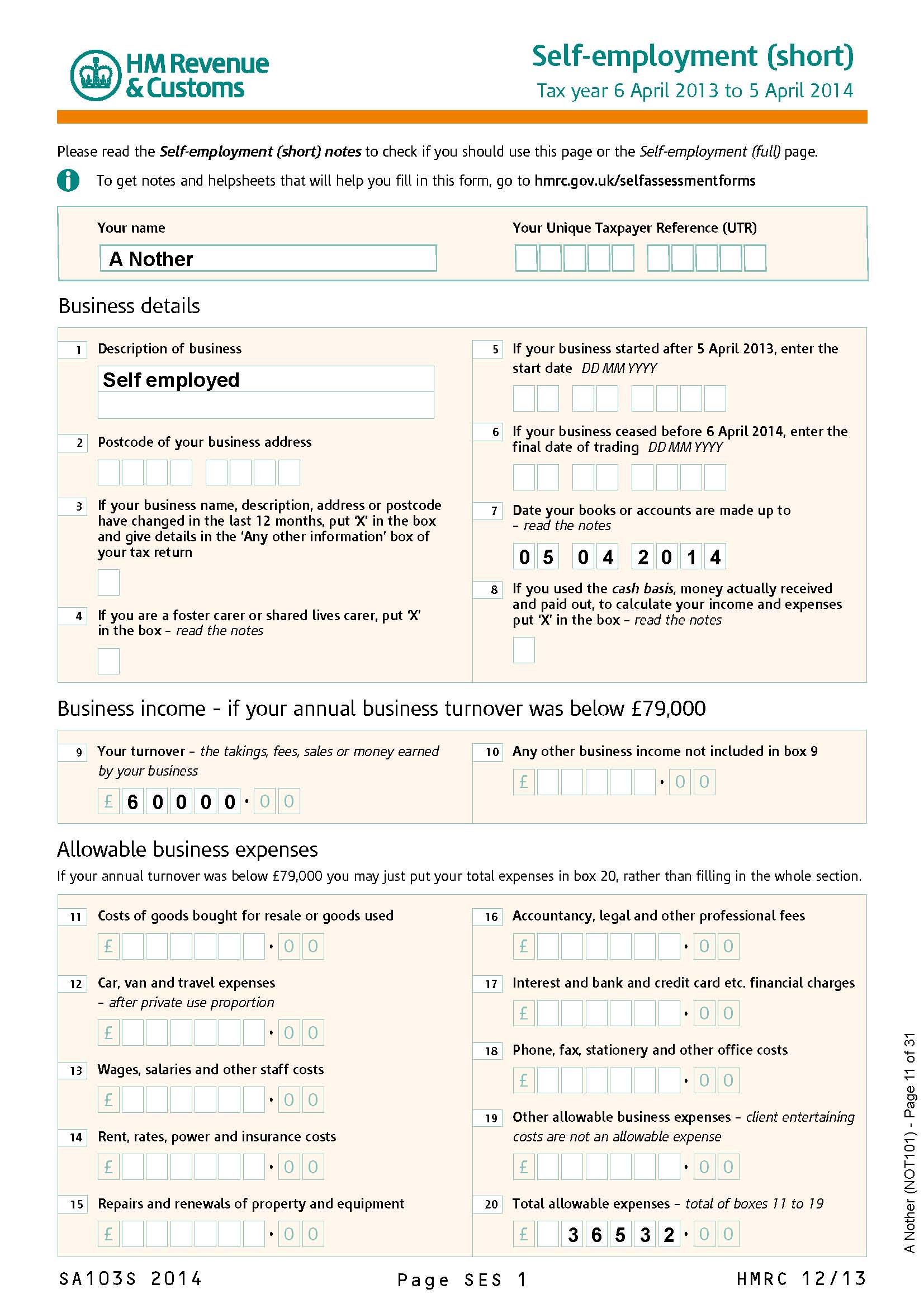

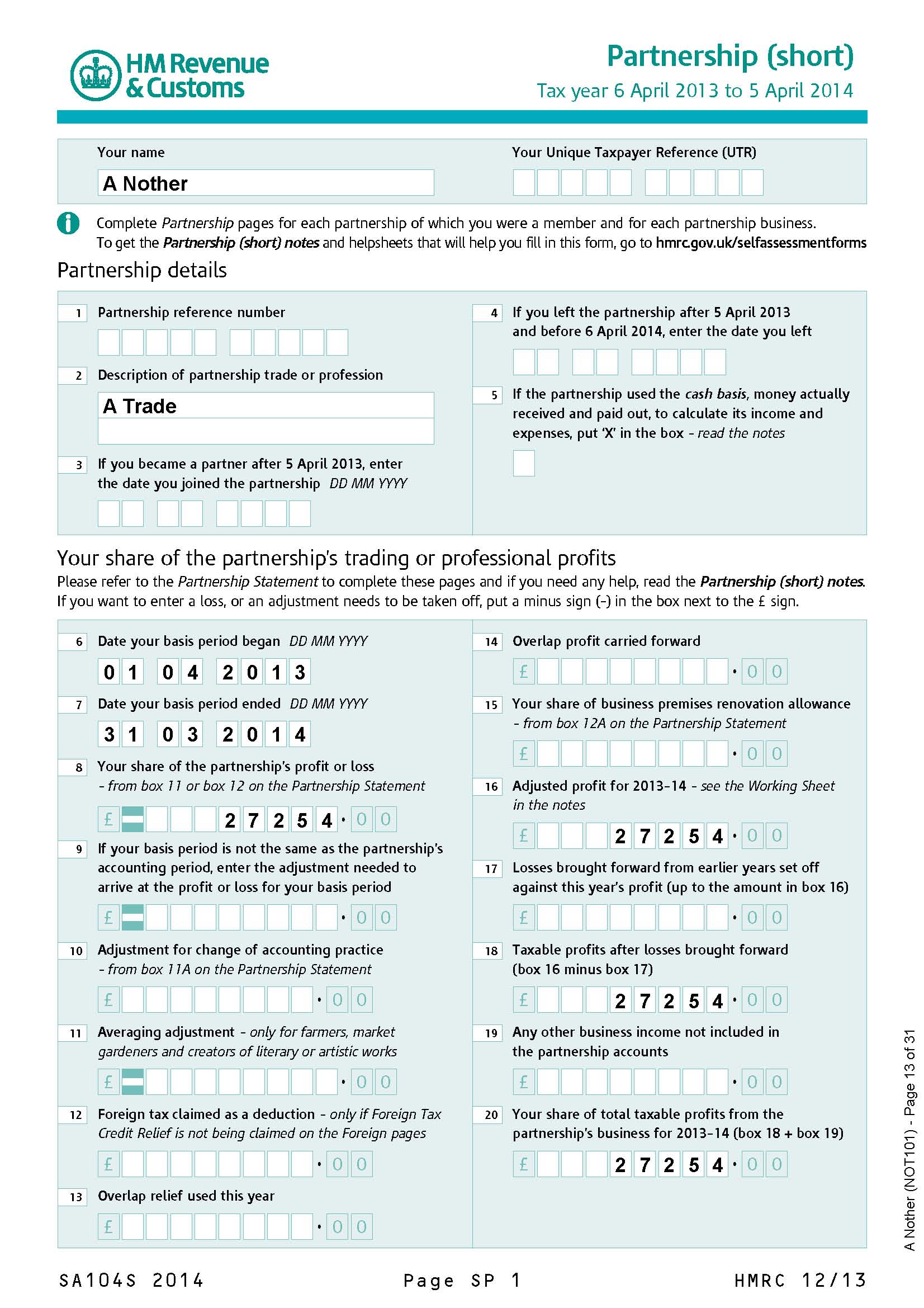

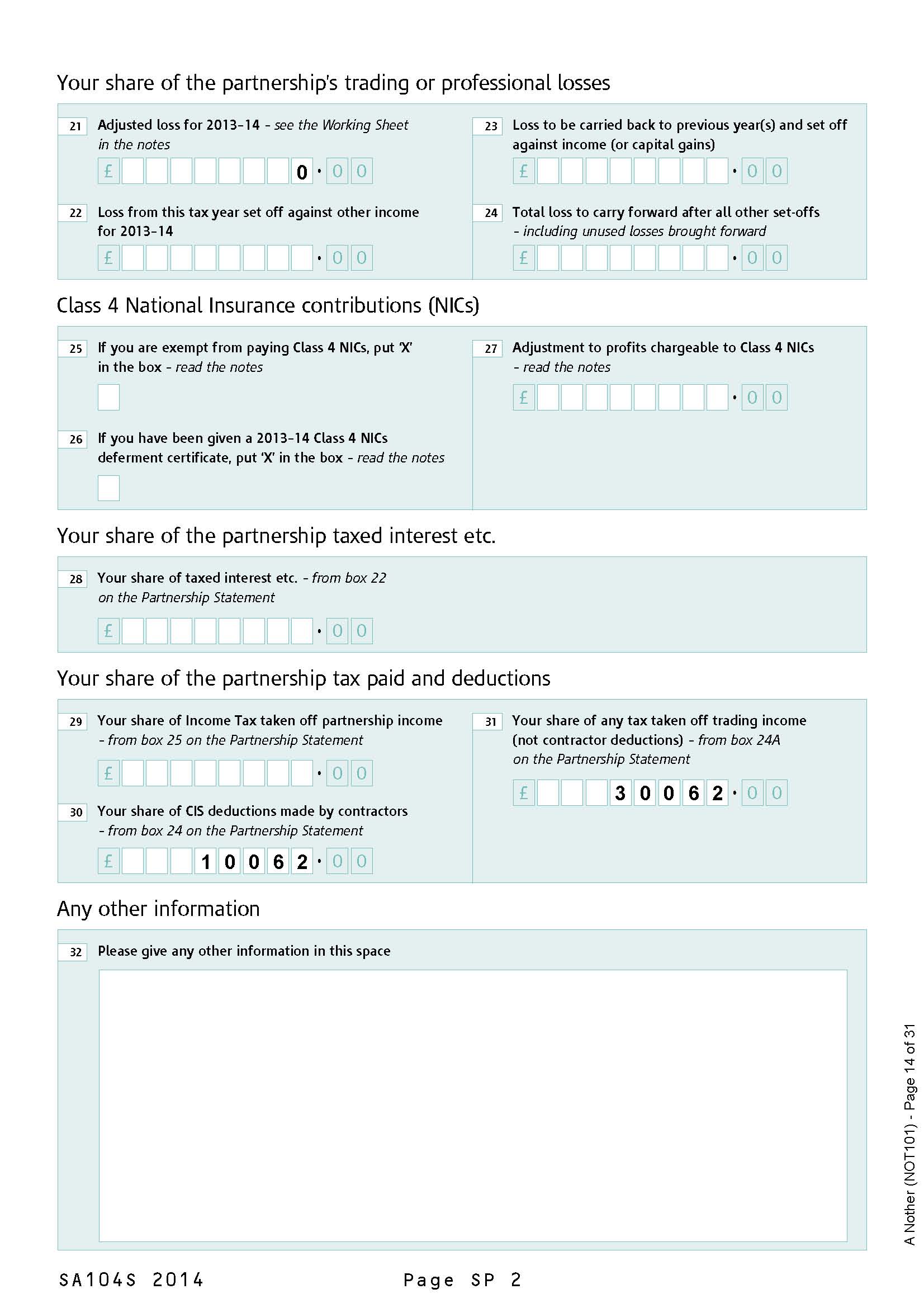

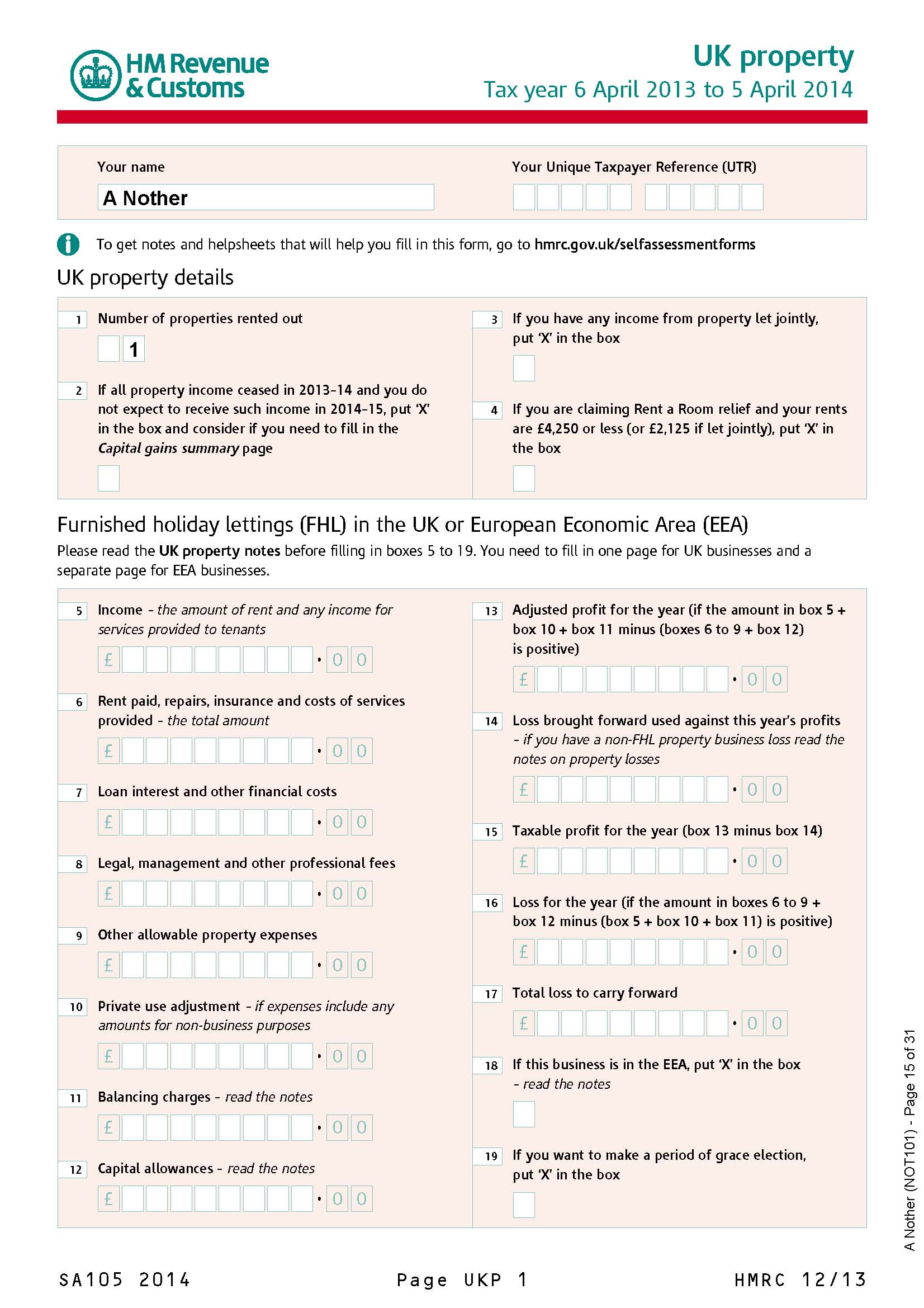

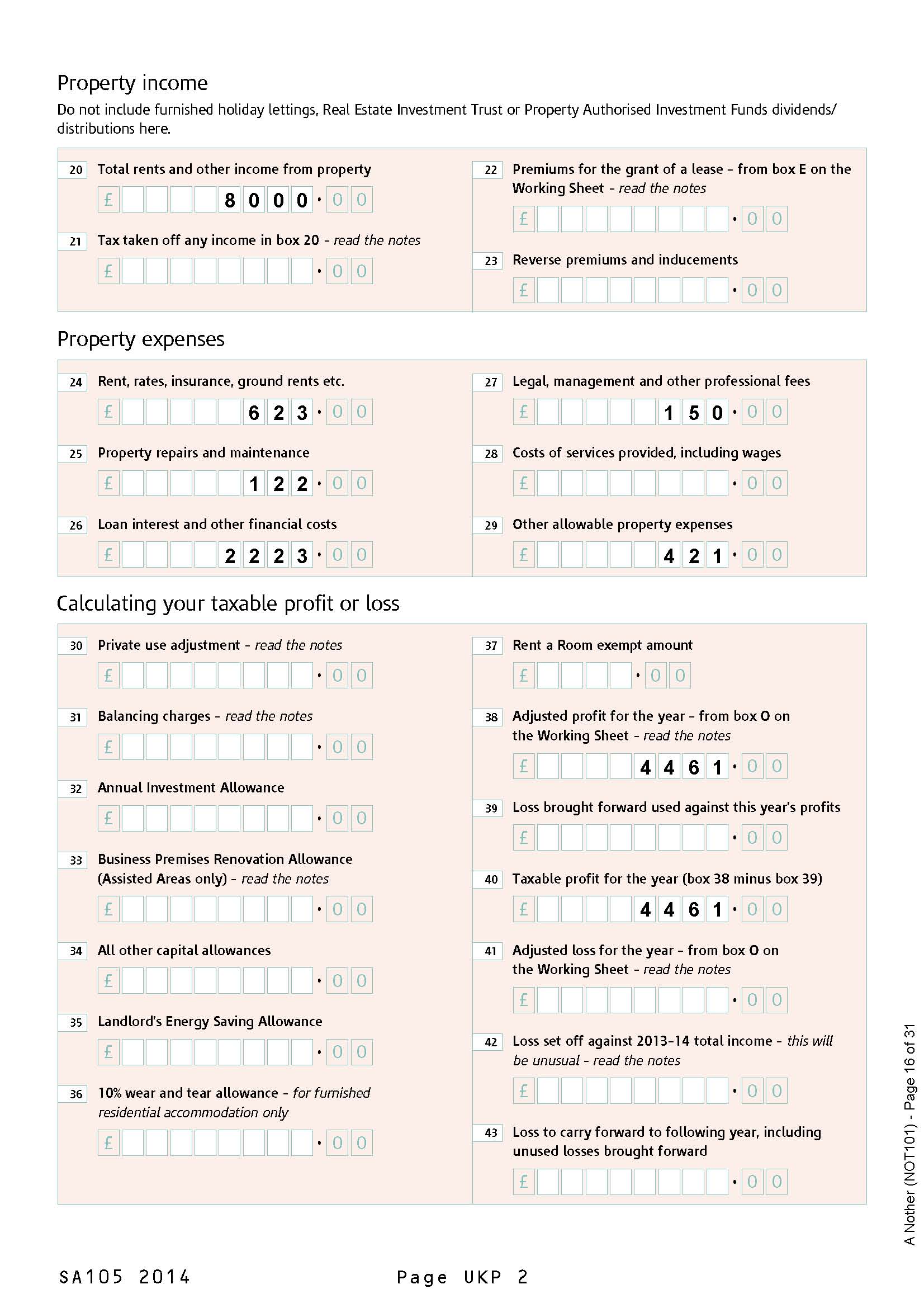

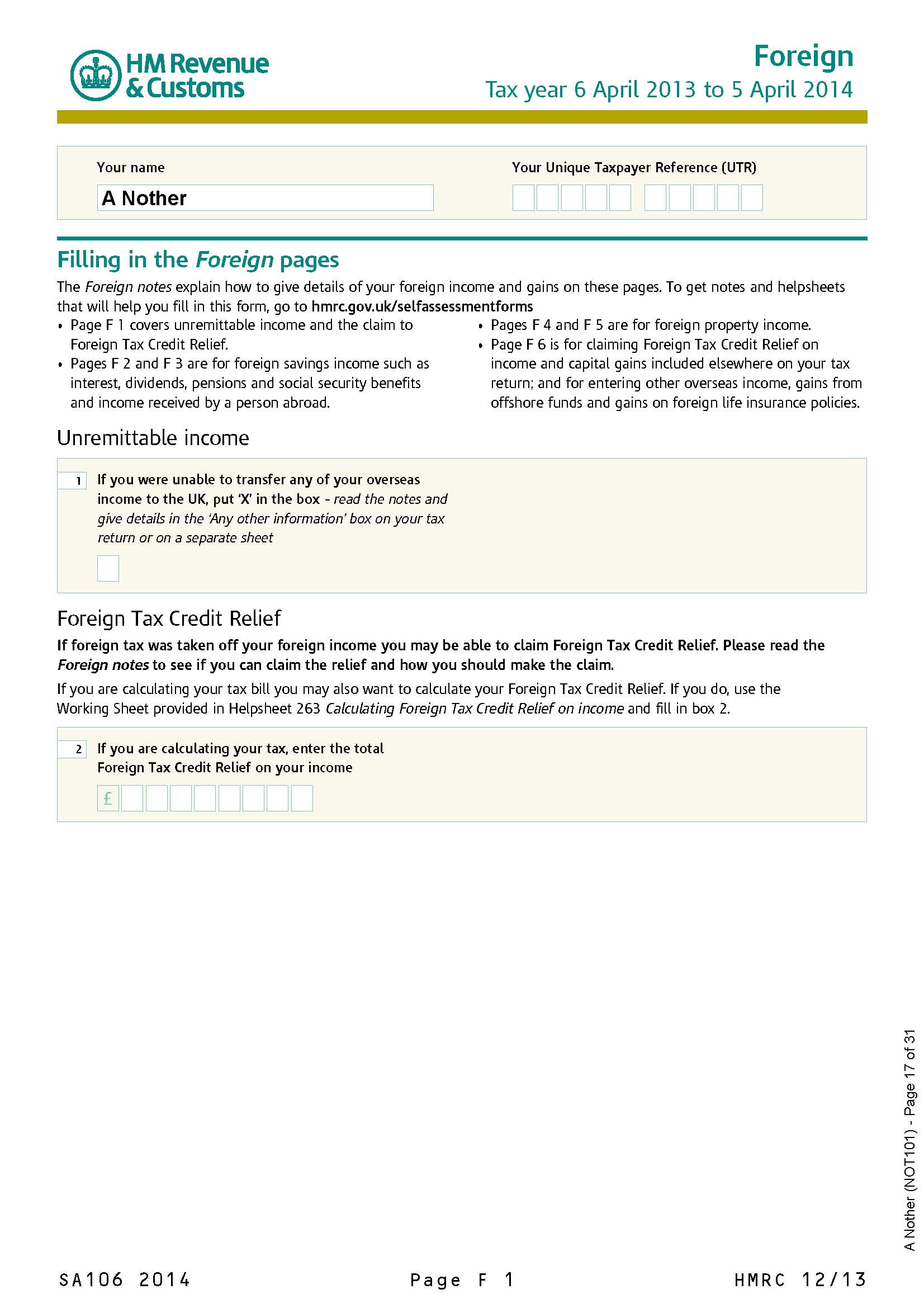

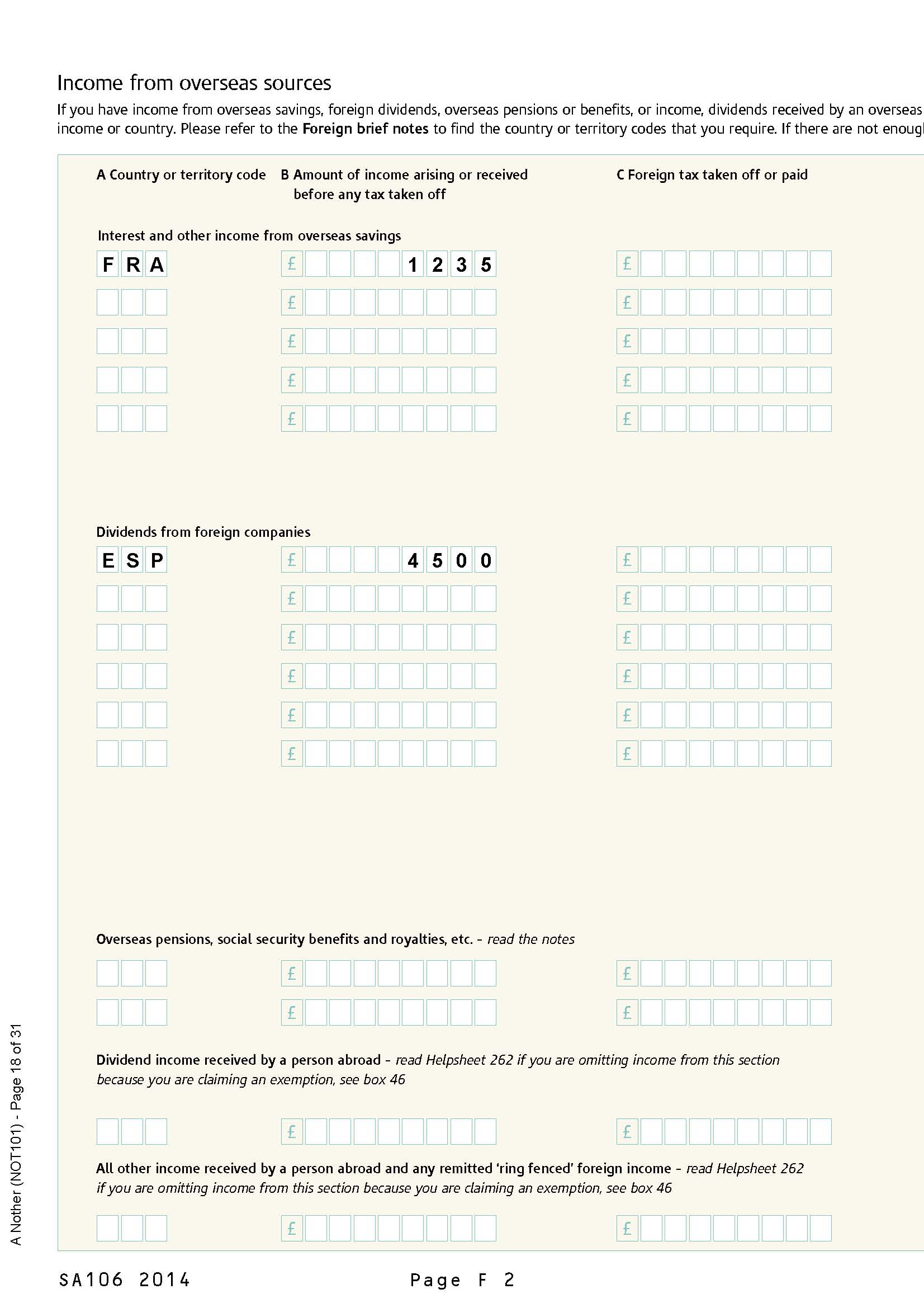

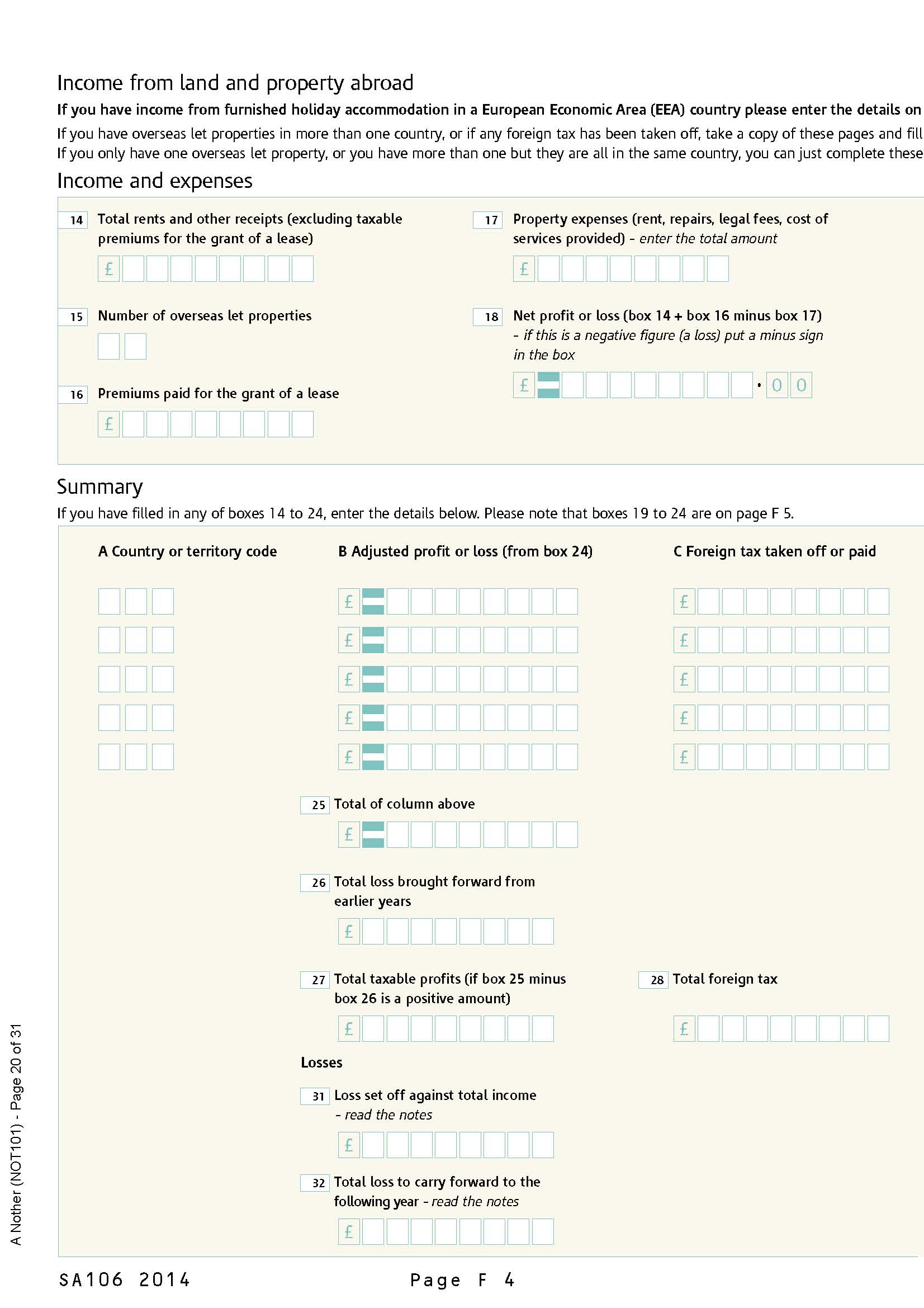

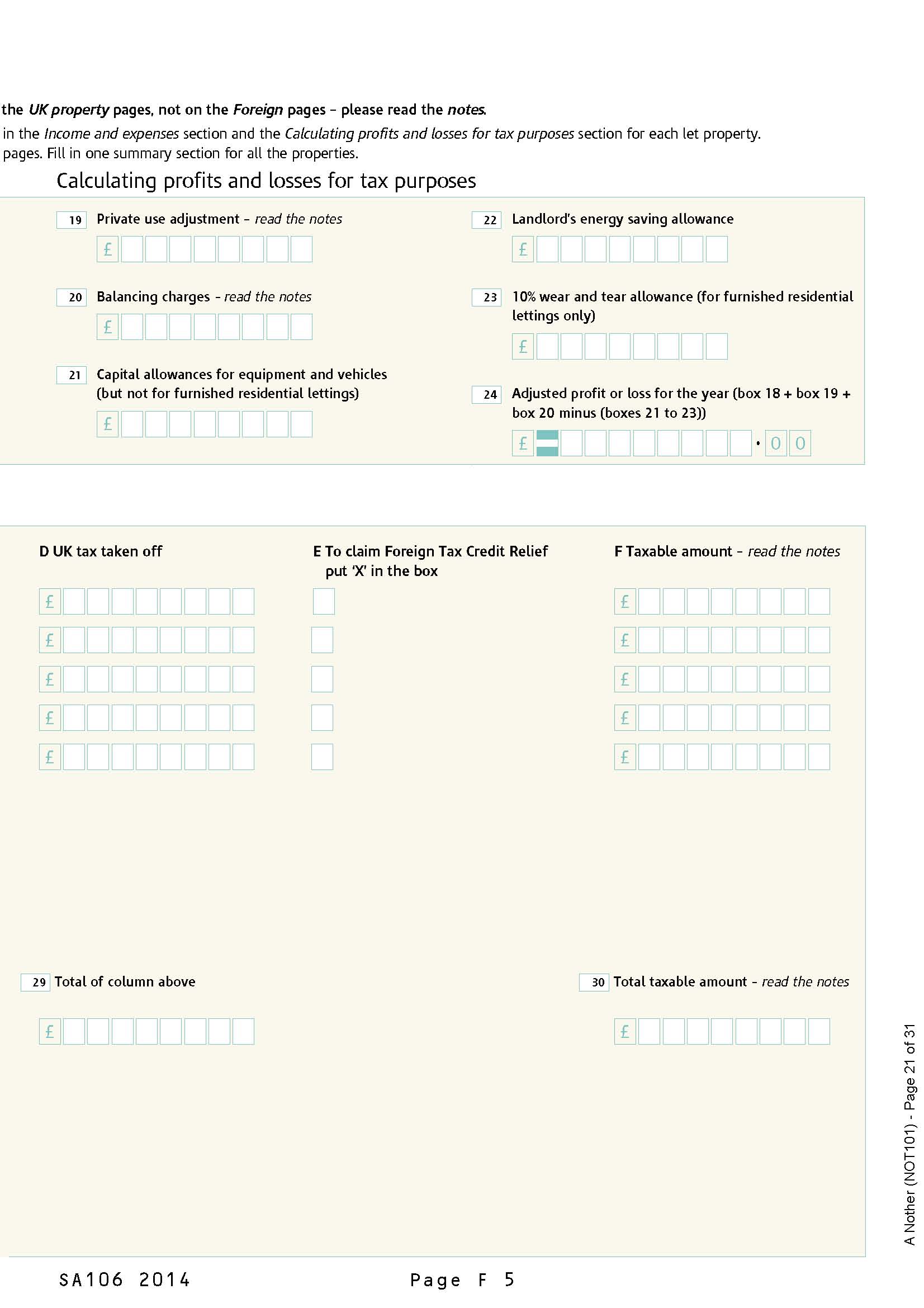

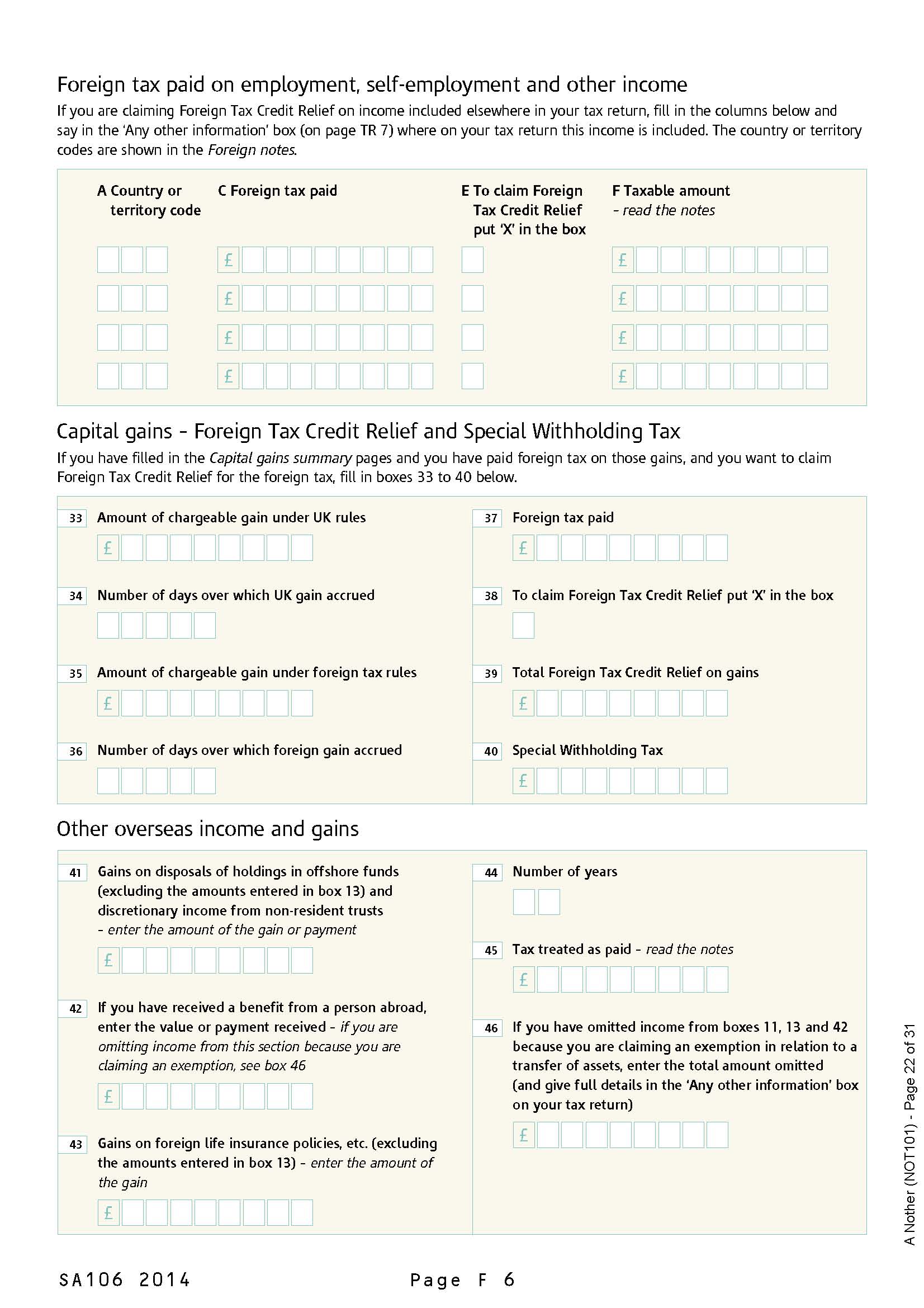

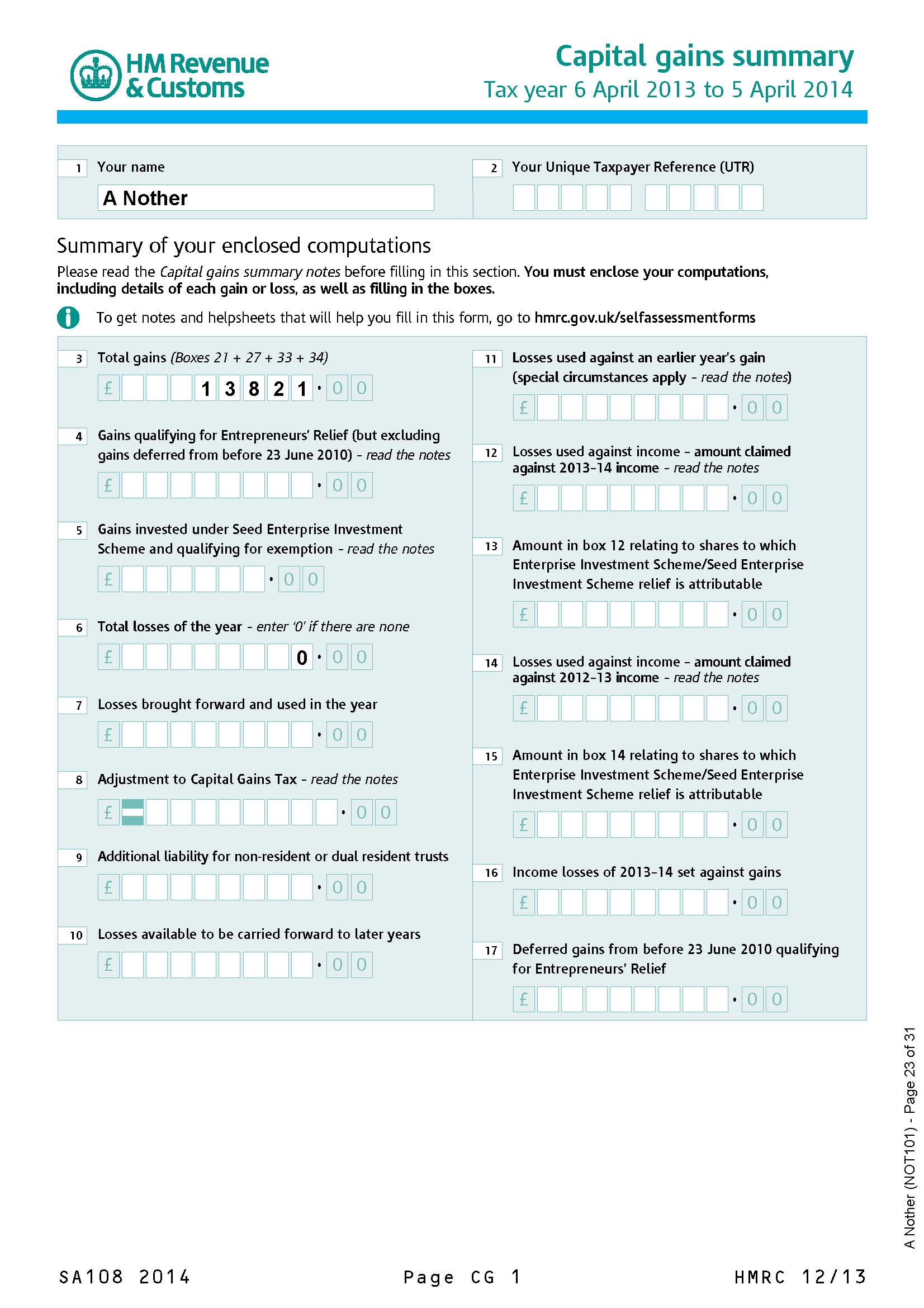

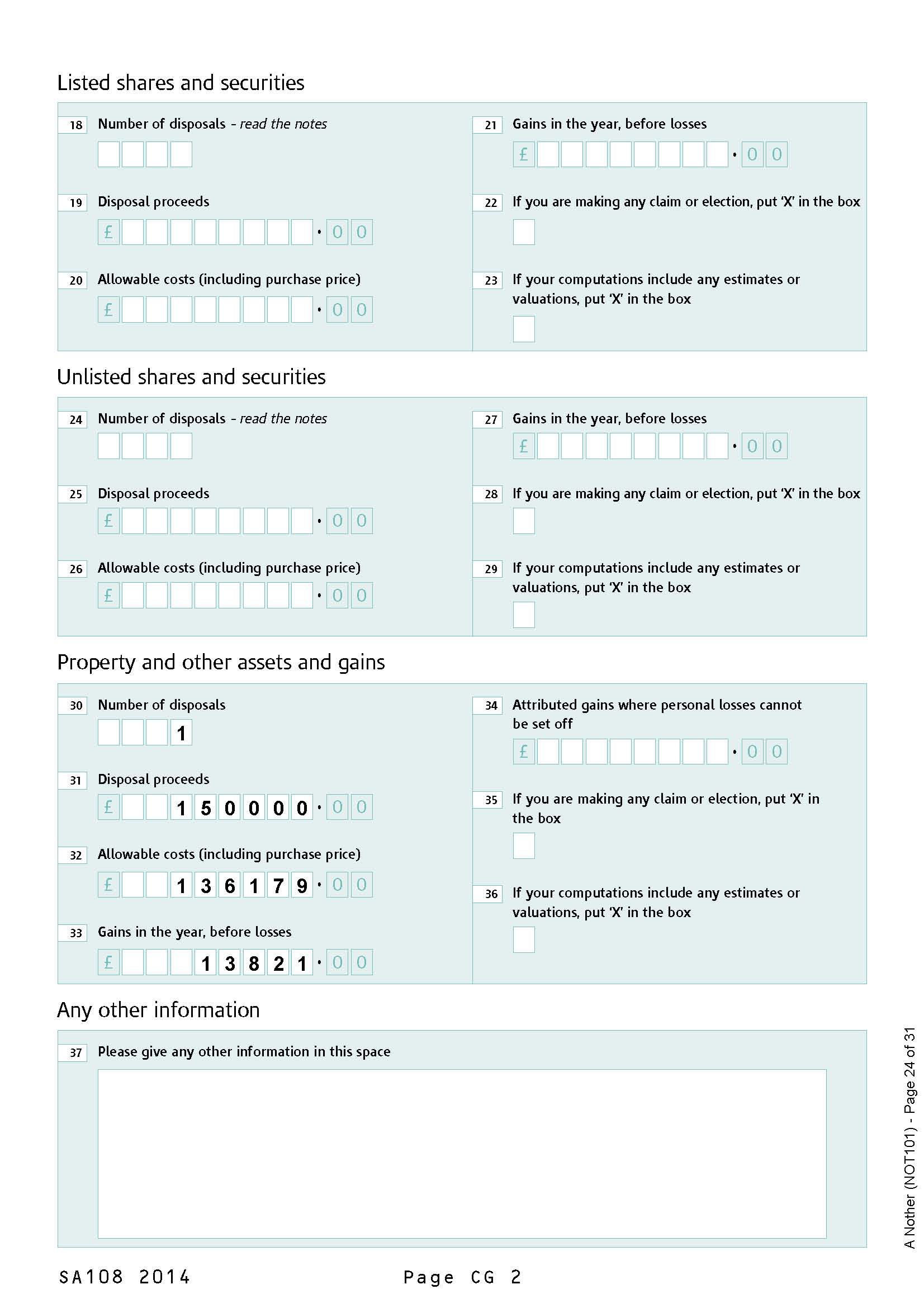

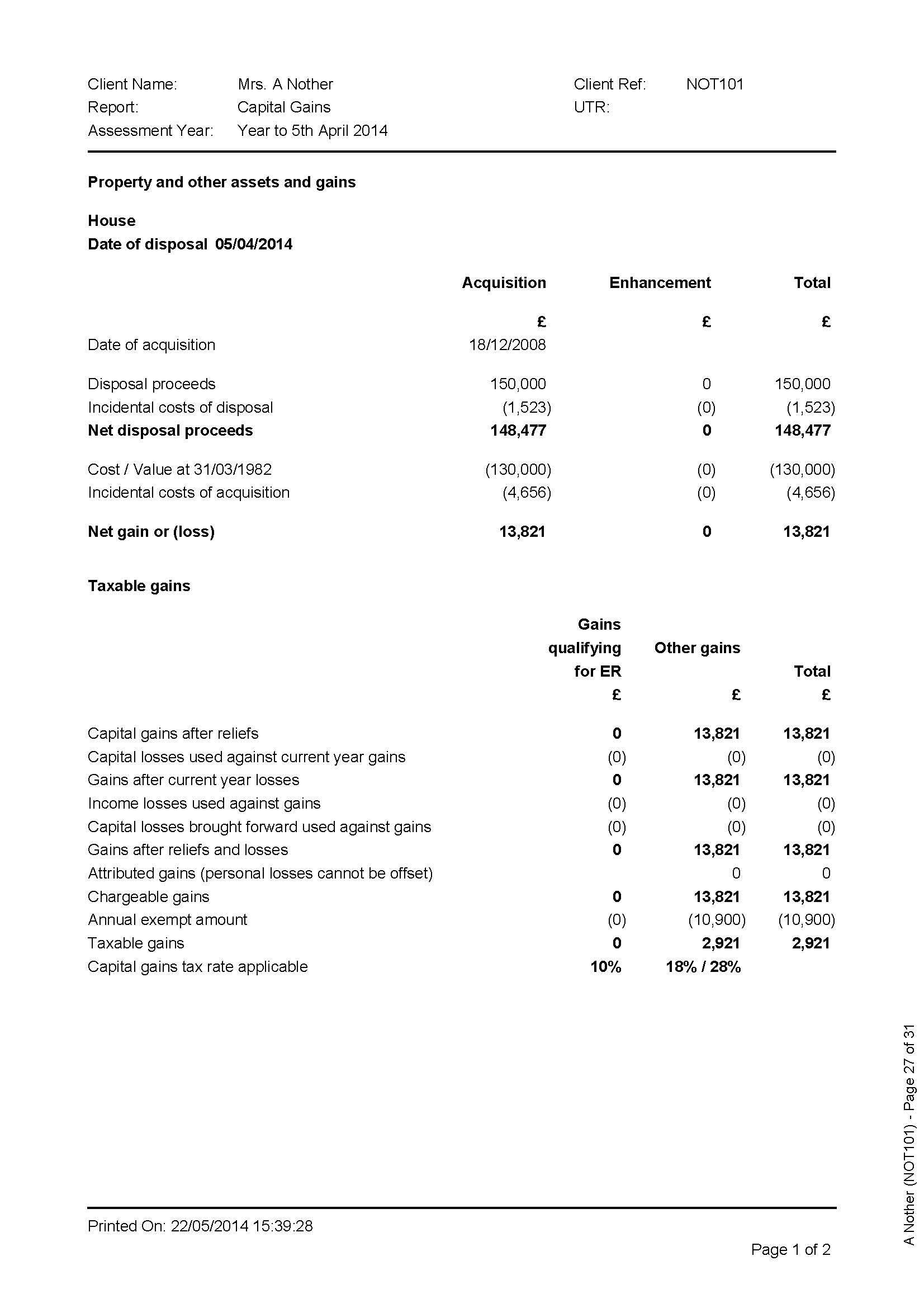

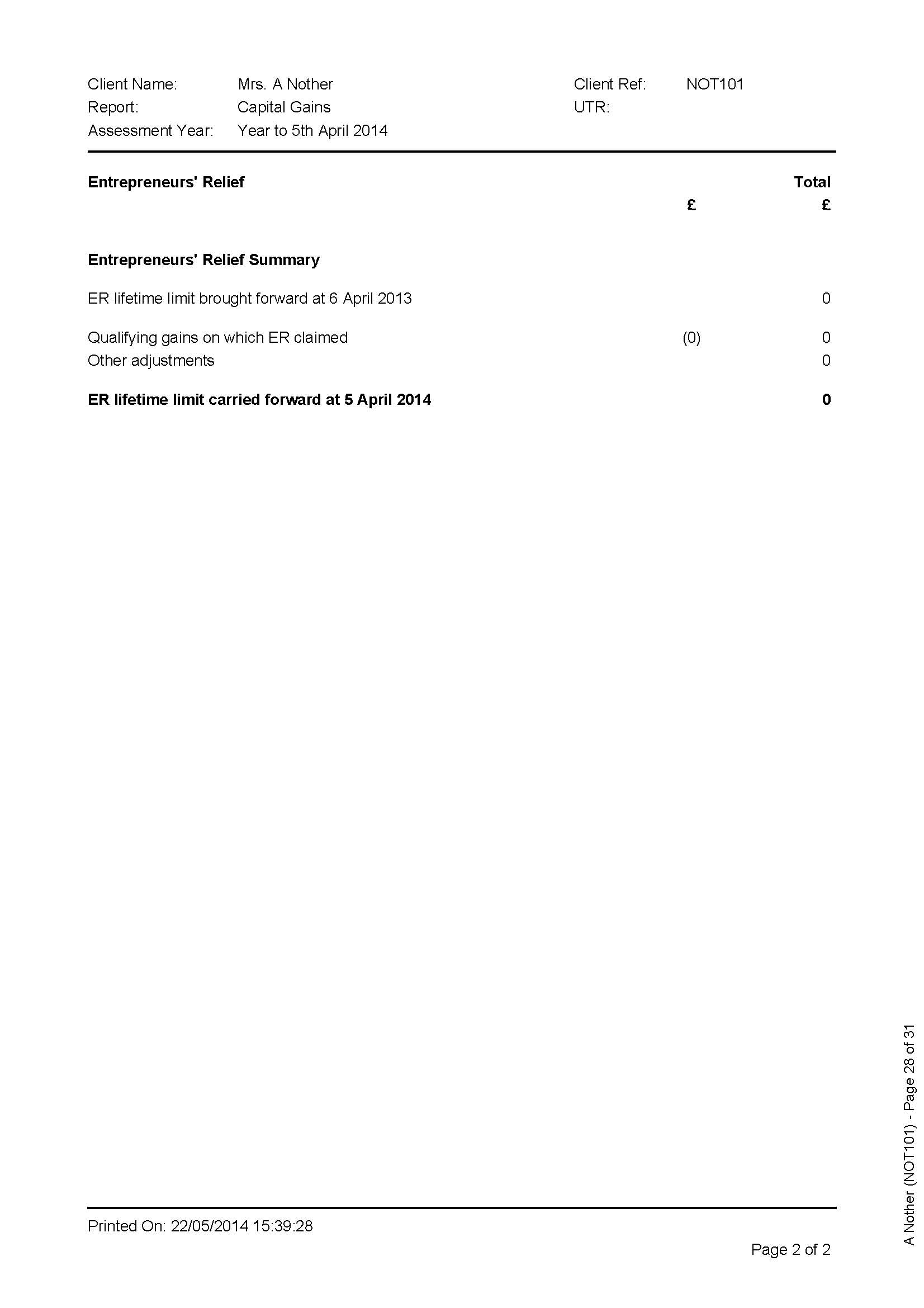

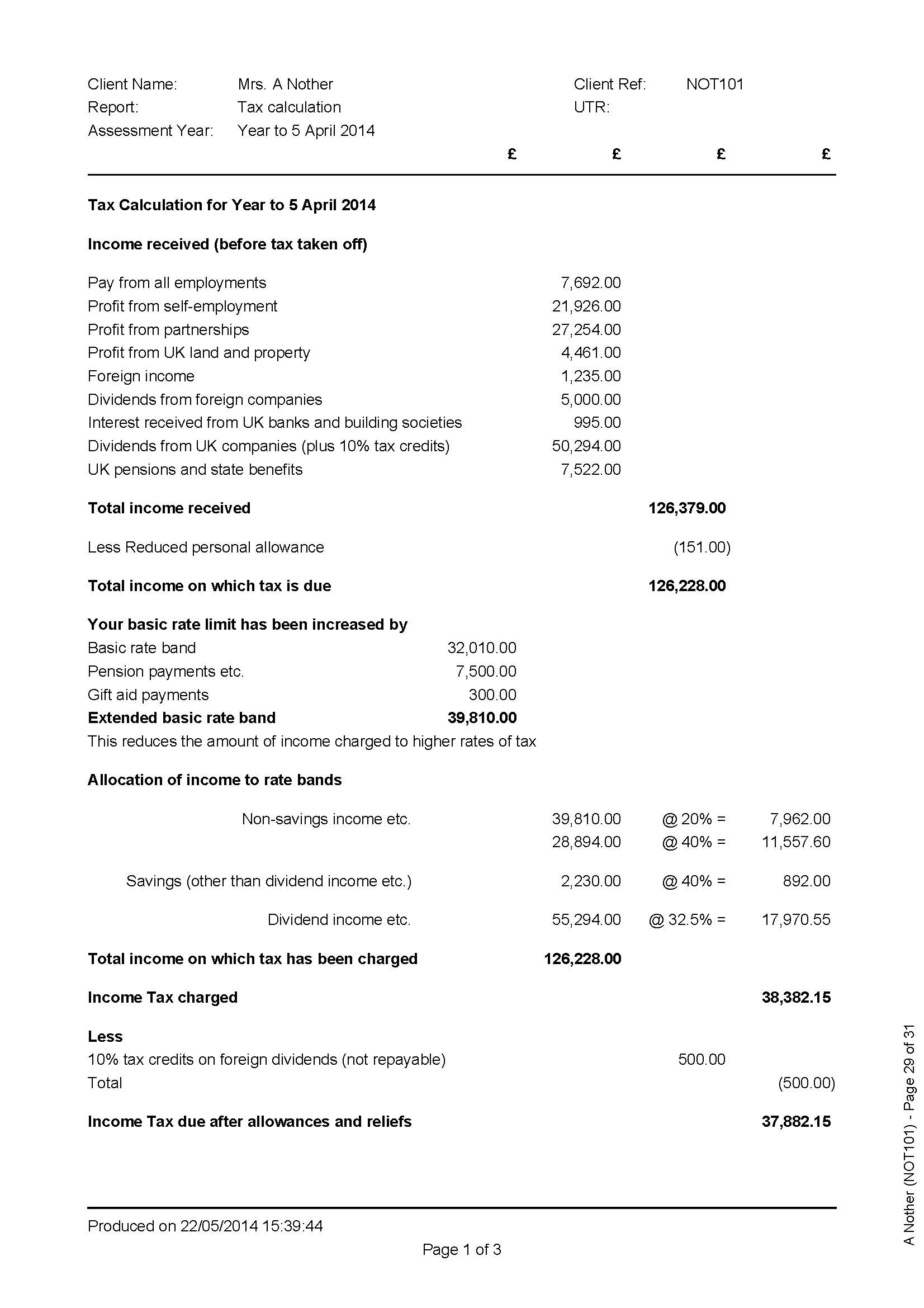

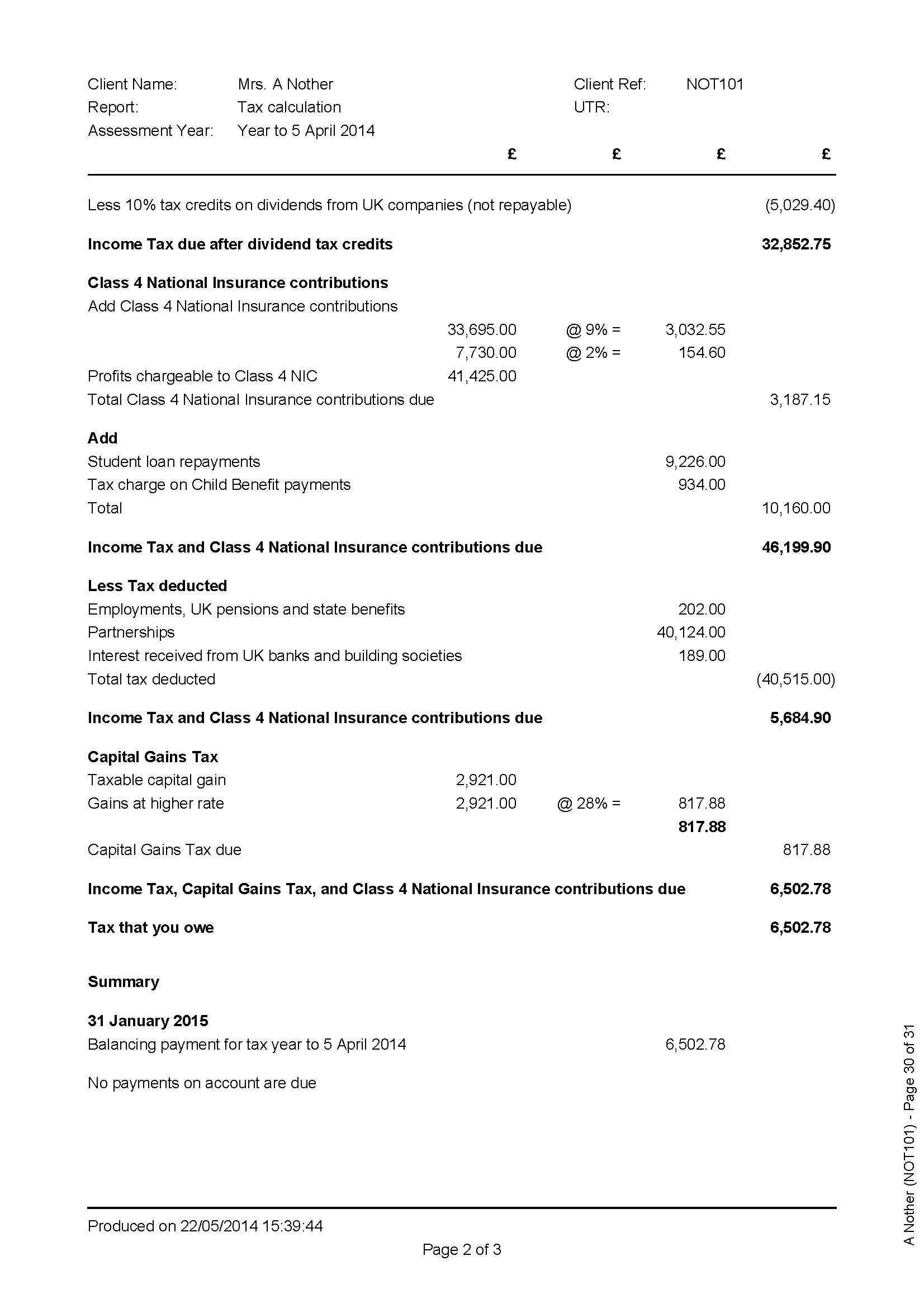

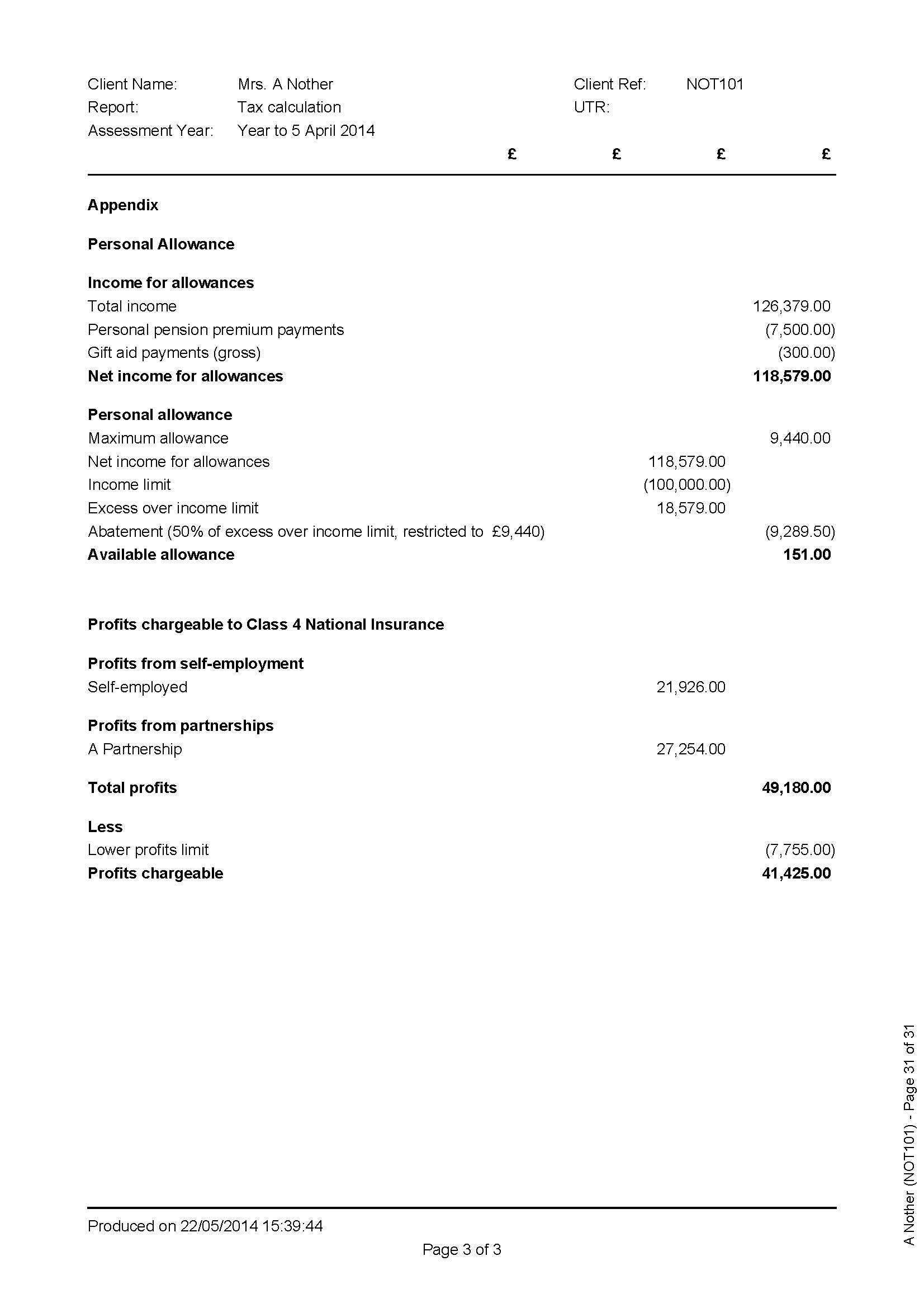

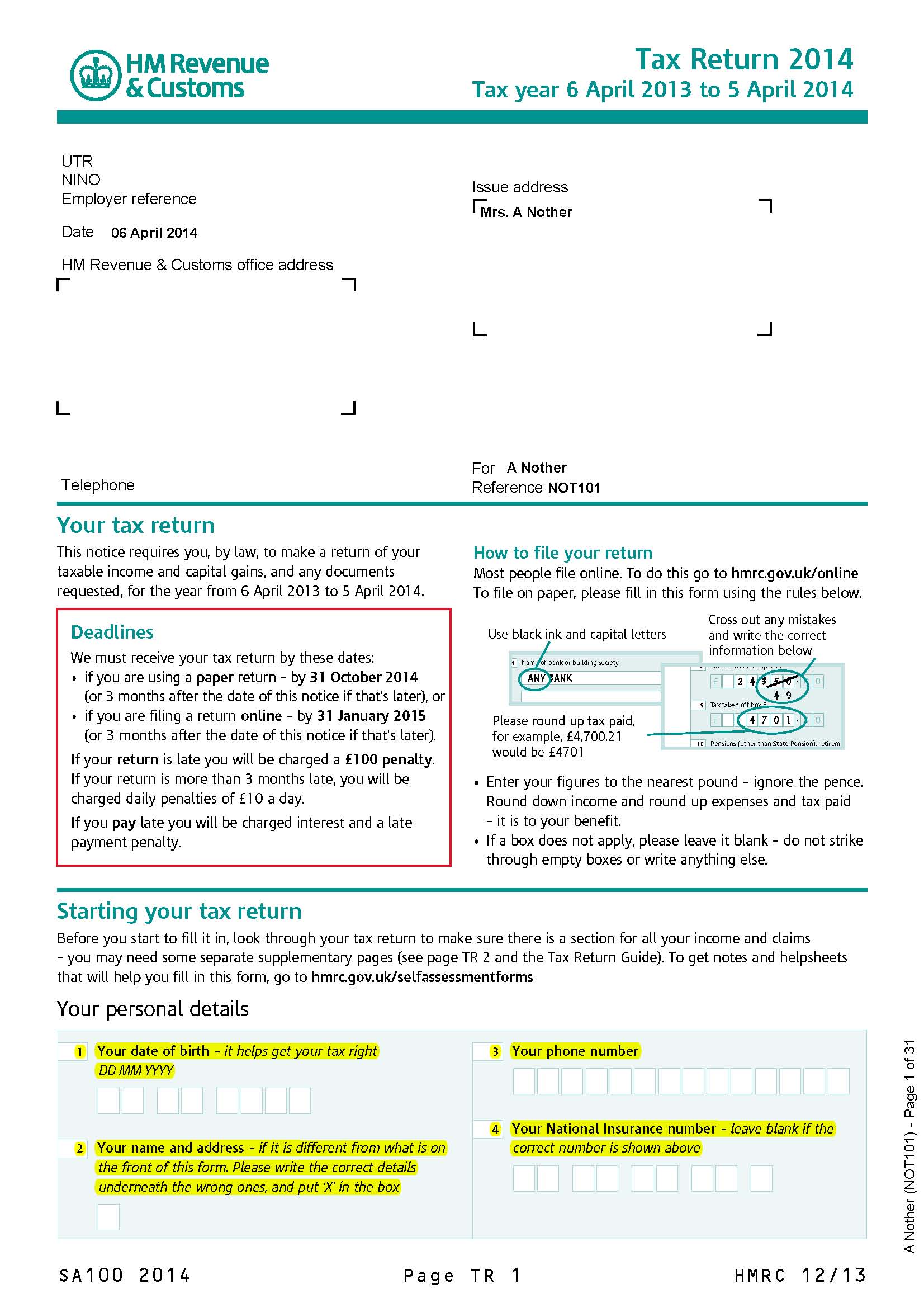

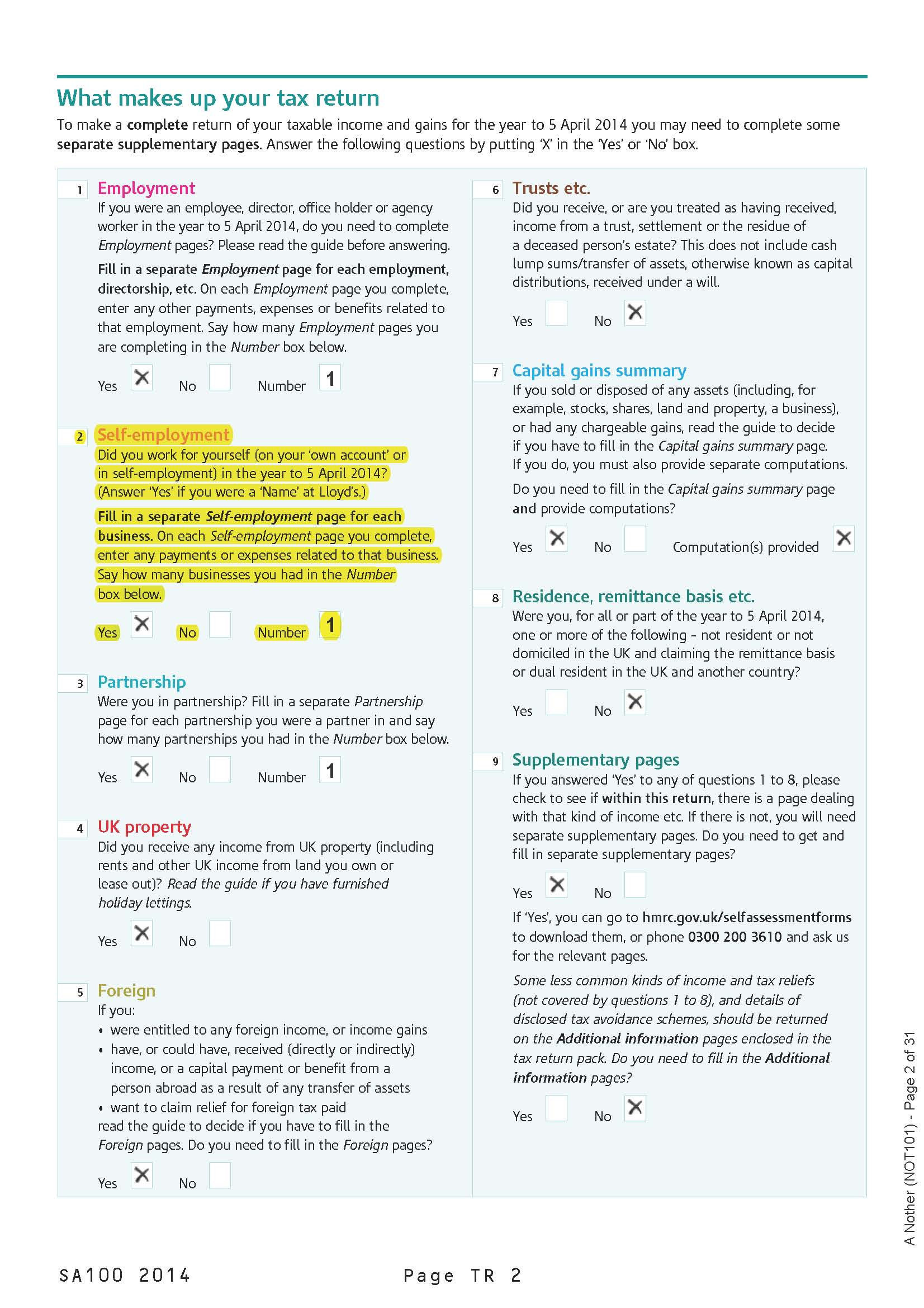

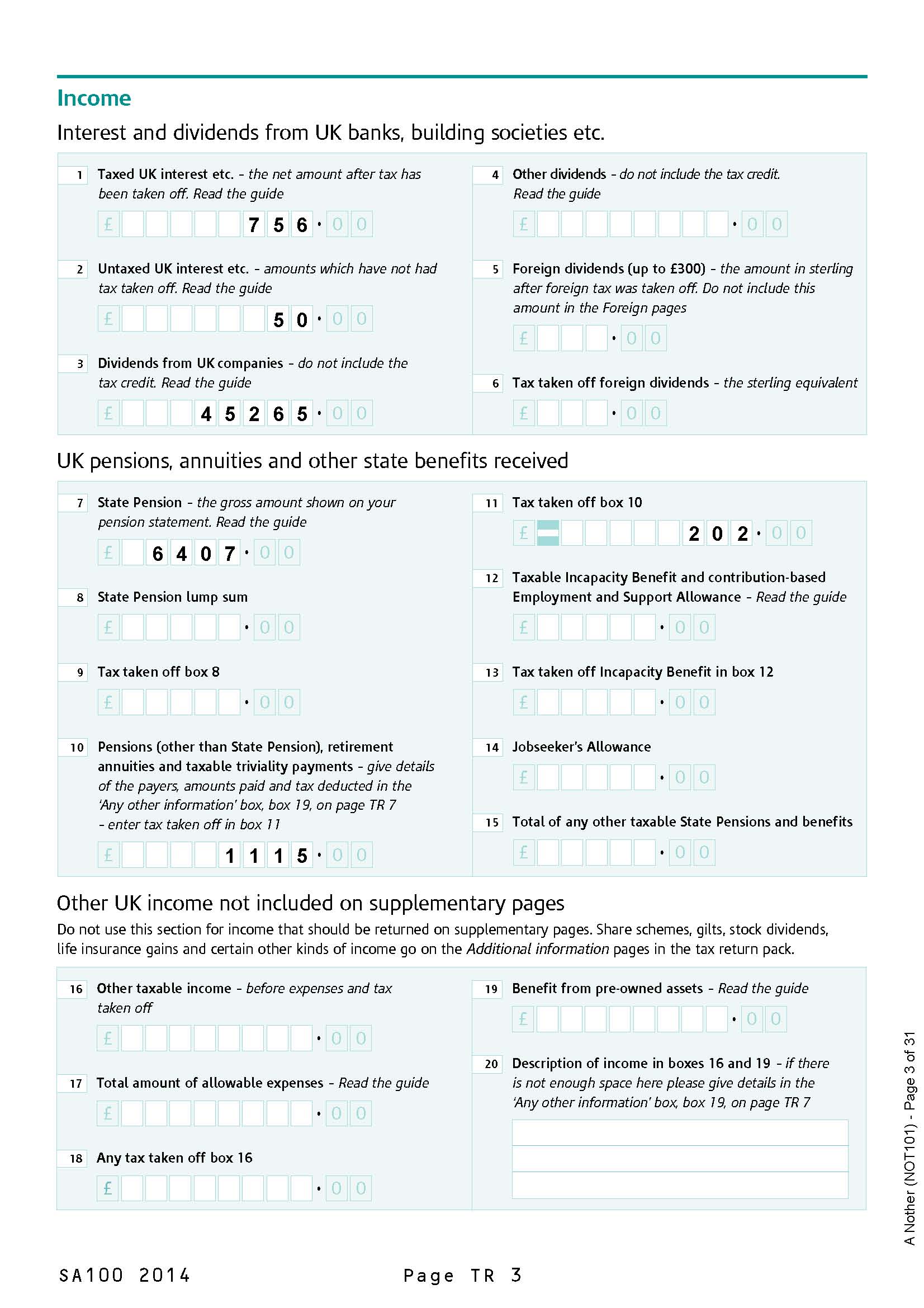

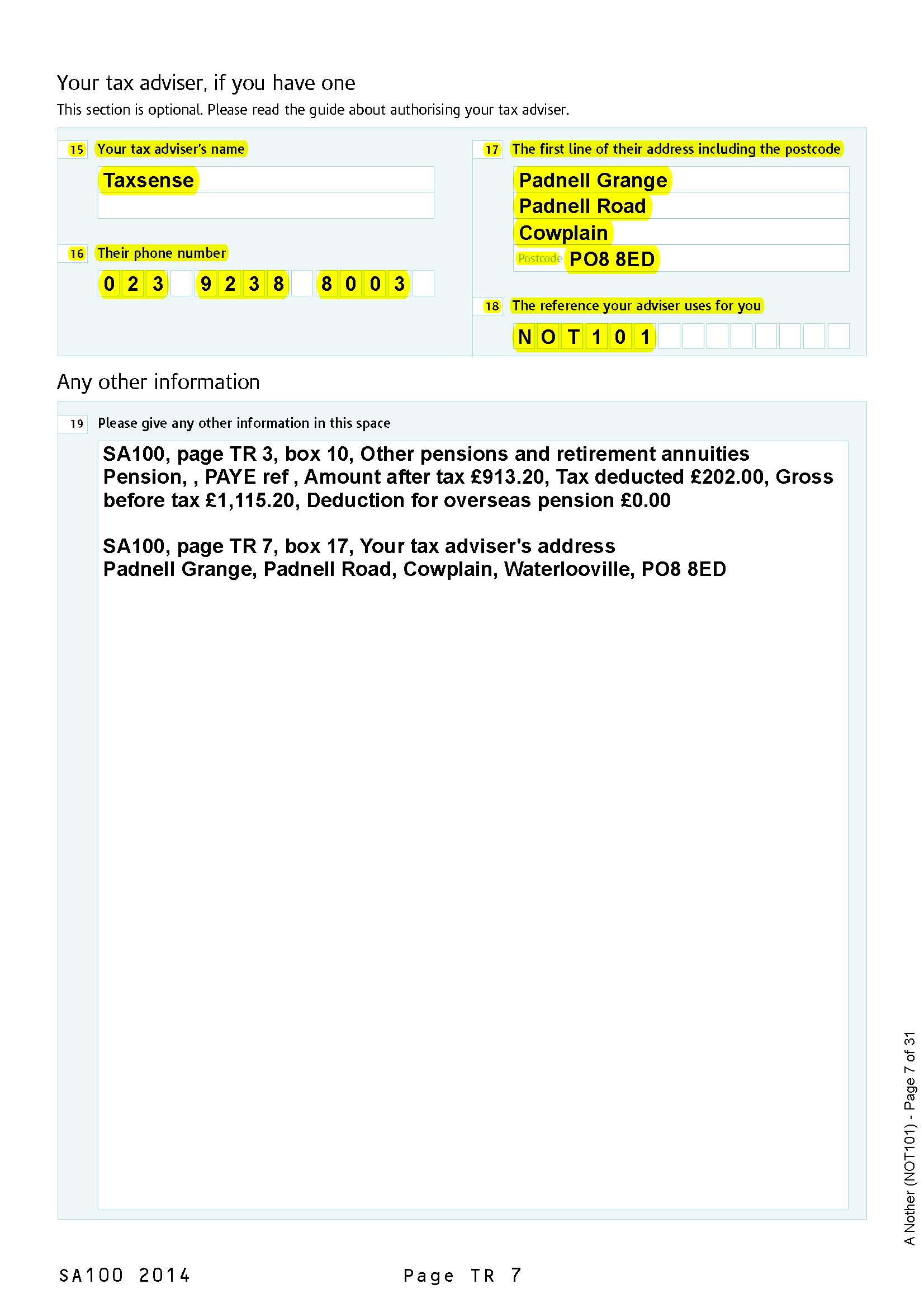

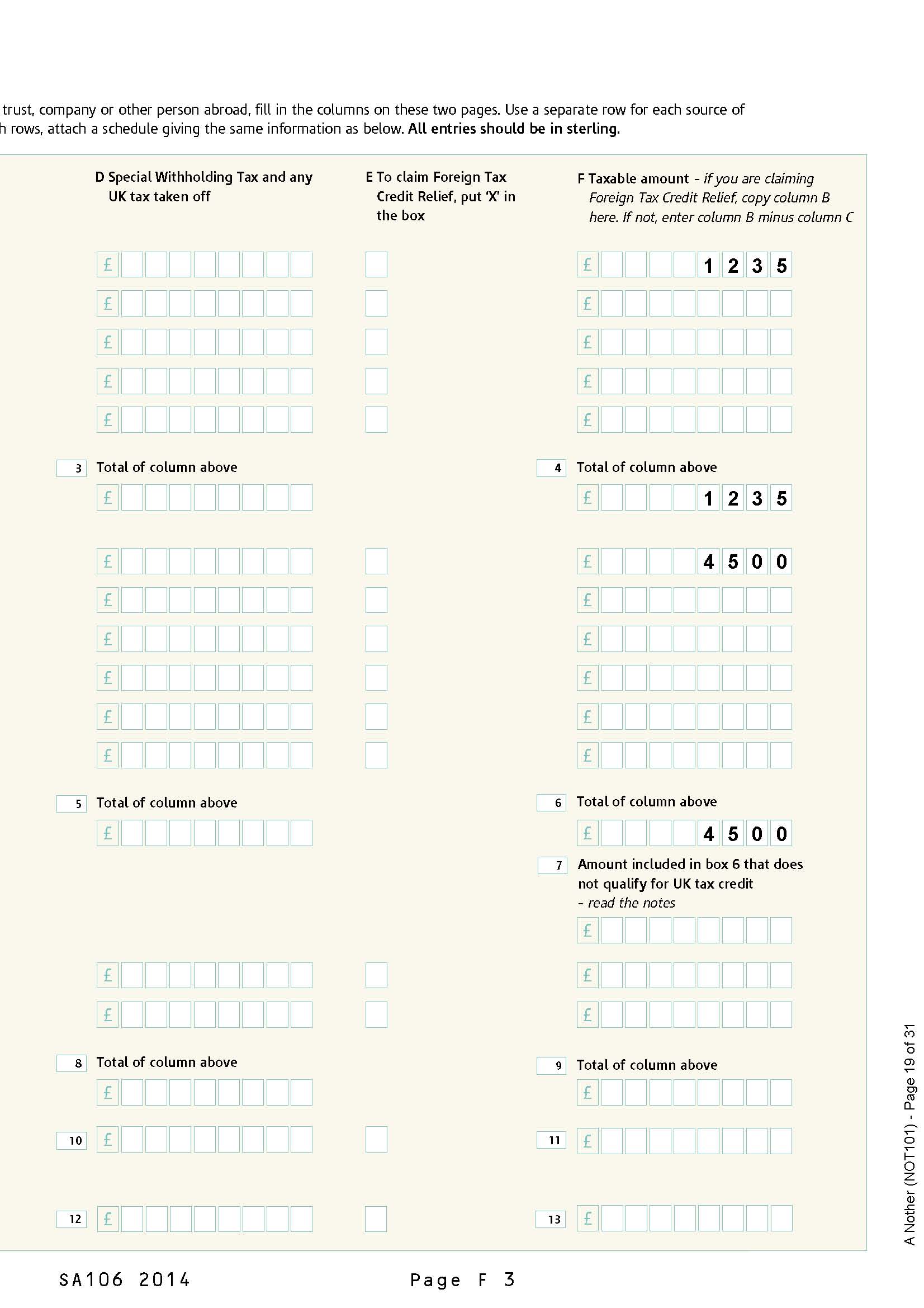

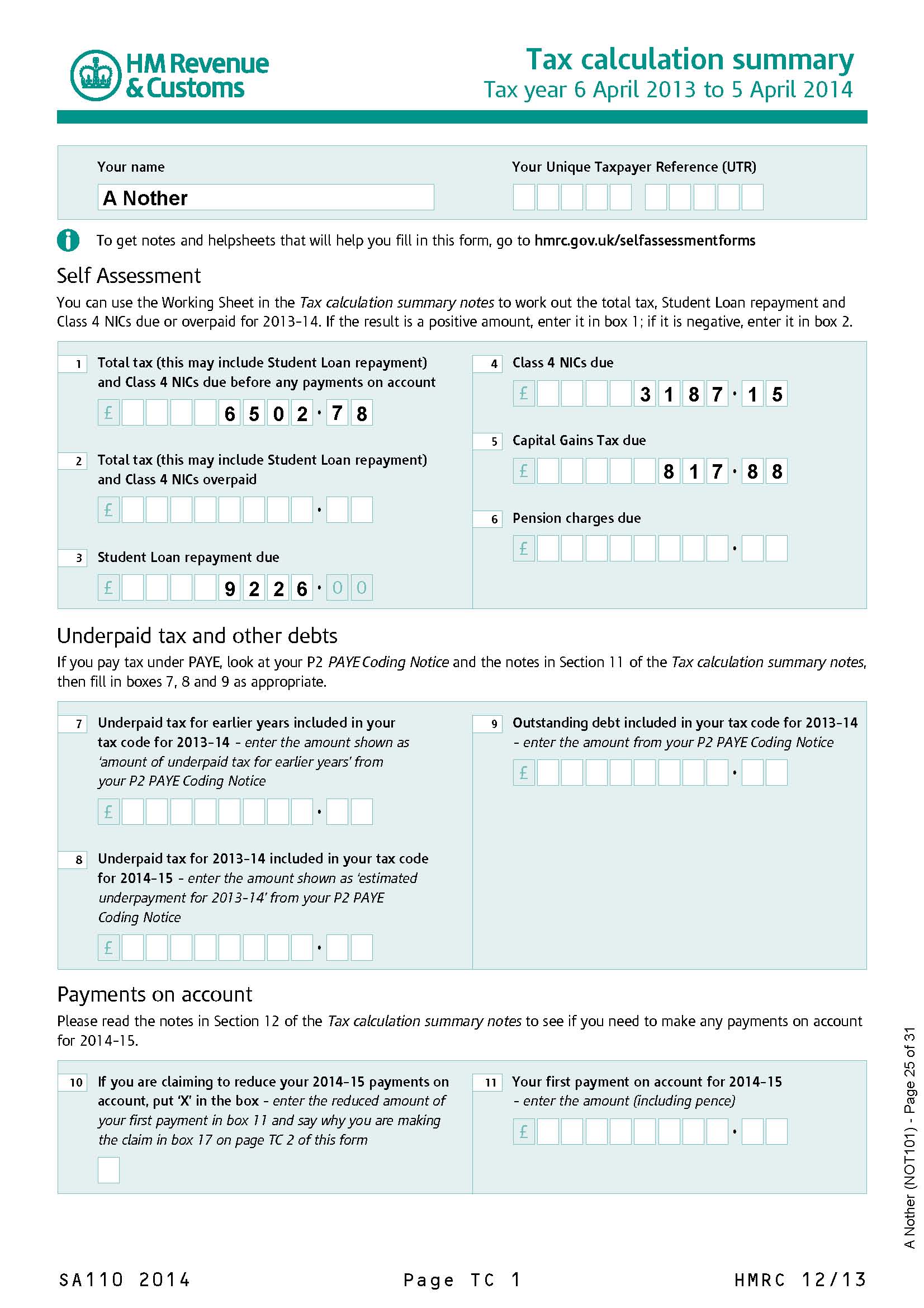

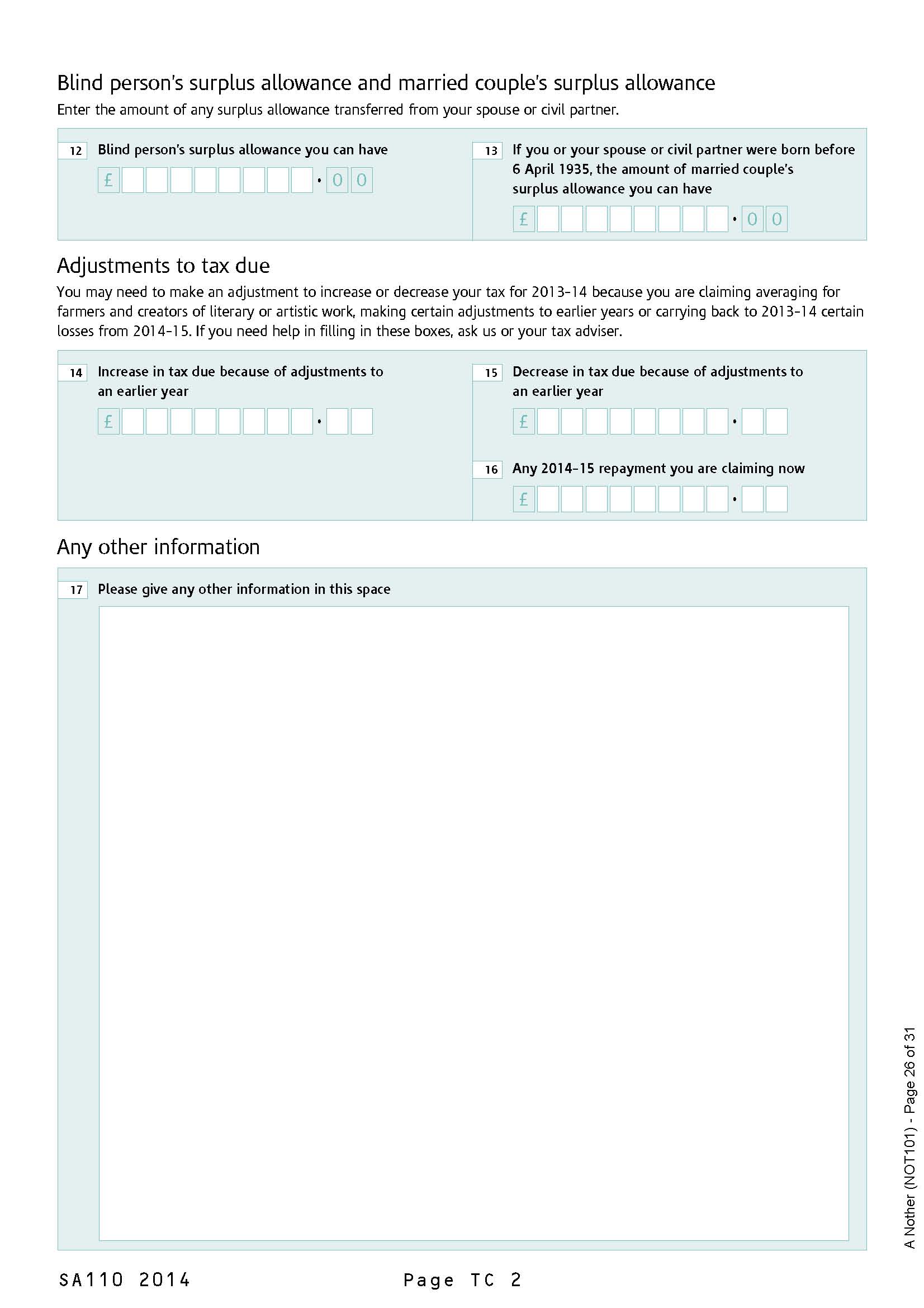

The product images show exactly which sections of a tax return are included with this product.

6) An evaluation which identifies any issues in your records which may affect your tax return and advice how to correct this.

7) Preparation of a basic SA100 Partner’s tax return to draft copy including;

e) SA100 TR1 questions 1 – 4 Your personal details

f) SA104 TR2 section 3* Partnership income pages

g) SA100 TR7 questions 15 – 18 your tax advisor

h) SA100 TR8 questions 20 – 21 declaration

8) Your questions answered.

9) Amendments to your tax return

10) Final SA100 Self Assessment tax return ready for filing.

If you have more complicated tax affairs for example, if you have another employment, stocks and shares income, or are a landlord then you should bolt on to this purchase one of our additional products which will ensure that your tax affairs are properly stated. Any questions where to?

*If you have more than one partnership you will need to select the partnership bolt on product.

Simply provide us with the information we request and we will produce your SA100 tax return for you ready to file. You will be able to ask your Helpbox chartered accountant questions.

The following are additional products and not included in the purchase above. Please check the list below and if any of the sections applies then add it to your purchase. Our after sales team will in any event contact you by email in order to establish that you have purchased the correct product.

If you are unsure as to which additional sections apply to you then purchase the basic Tax return for a partner and we will contact you with a questionnaire to help qualify this for you.

Supplementary ref Pages/Section on Tax Return When you would need this Product

SA101 Additional Information TR2 section 9 If you have anything else which is not covered by a supplementary already mentioned you will need this completing.

SA102 Employment TR2 section 1 You will need this if you have salaried employment or wages from any other paid employments.

SA103 Self-Employment TR2 section 2 You will need this if you have a second/additional sole trader business, as well as the business partnership already included.

SA104 Partnership TR2 section 3 You will need this if you are a member of a partnership in addition to the one on the basic partnership tax return you are purchasing.

SA105 UK Property Income TR2 section 4 You will need this if you are an individual or rental business and have any income from land and property rental, rent a room, or have furnished holiday lettings in the UK, or a reverse premium.

Fixed Assets & Depreciation TR2 section 2a You will need this if you do not already have a fixed asset list or schedule detailing the separate types of asset and their depreciation for the accounts

Capital Allowances, TR2 section 2b You will need this if you do not already have a fixed asset list or schedule detailing the separate types of asset and their capital allowances or Annual investment Allowance being claimed and offset against tax

Current & Capital Accounts TR2 section 2c You will need this if you do not already prepare yourself to show your capital introduced, drawn down and changes in the capital account.

SA106 Foreign TR2 section 5 You will need this if you received any income from other countries even if you paid tax on that income, to be able to claim tax credit relief.

SA107 Trusts TR2 section 6 you will need this if you received income from any trust or settlement, income chargeable on settlors, or income from the estate of a deceased person.

SA108 Capital Gains TR2 section 7 you will need this if you sold or disposed of any assets, (e.g. stocks, shares, land, property, business)

SA109 Residence, remittance basis etc. TR2 section 8 you will need this section if for any part of the year you were not resident, ordinarily resident or not domiciled in UK etc.

Interest and dividends from banks and building societies etc TR3 Q1-Q6 You will need this section if you have any interest received on bank, building society and other savings accounts, and on loans, unless it is specifically non-taxable.

UK Pensions annuities and other state benefits received TR3 Q7 – 15 You will need this section if you have received income from pensions or benefits

Other UK income not on supplementary pages TR3 Q16– 20 You need this section if you have any other UK income not covered already either on the return or supplementary SA101 such as casual earnings, commissions etc.

Tax Reliefs TR4 Q1 – 4 This section covers the most commonly claimed types of relief – for payments to registered pension schemes and charities – and for Blind Person’s Allowance.

Charitable giving TR4 Q5 – 12 Charitable donations etc made by you

Blind person allowance TR4 Q13 – 16 if you are in receipt of blind persons allowance

Student loan TR5 Q1 – 3 student loan repayments due or made

High income child benefit charge TR5 Q1 – 2 high income child benefit charge if applicable e.g. your income was over £50,000 and you/your partner received child benefit after 07/01/2013

Service companies TR5 Q1 if you provided your services through a service company

Tax Refunded or underpaid TR5/6 – Q1-3 Tax refunded or set off by either HMRC or Jobcentre e.g. CIS, PAYE,

Tax overpaid TR6 Q4 – 14 if you have paid too much tax

What this product includes:

The product images show exactly which sections of a tax return are included with this product.

Every partner gets the basic tax return issued to them by HMRC. There are other, ‘supplementary’, pages covering the less common types of income, and disposals of chargeable assets.

If you need or think you may need any other sections, or other supplementary sections, please see ‘other sections of the tax return which may apply’ and add those to your basket. However we will contact you with a detailed questionnaire after you purchase the product to check if you have included everything you will need.

The basic Tax return (SA100) for Partners includes the following*;

1) An evaluation which identifies any issues in your records which may affect your tax return and advice how to correct this.

2) Preparation of a basic SA100 Partner’s tax return to draft copy including;

a) SA100 TR1 questions 1 – 4 Your personal details

b) SA104 TR2 section 3* Partnership income pages

c) SA100 TR7 questions 15 – 18 your tax advisor

d) SA100 TR8 questions 20 – 21 declaration

3) Your questions answered.

4) Amendments to your tax return

5) Final SA100 Self Assessment tax return ready for filing.

If you have more complicated tax affairs for example, if you have another employment, stocks and shares income, or are a landlord then you should bolt on to this purchase one of our additional products which will ensure that your tax affairs are properly stated. Any questions where to?

*If you have more than one partnership you will need to select the partnership bolt on product – SA104.

Simply provide us with the information we request and we will produce your SA100 tax return for you ready to file. You will be able to ask your Helpbox chartered accountant questions.

Sage accountancy

software

Provide us a back up of your sage (inc. Sage Instant

Accounts, Sage 50 Accounts) software using the Helpbox upload bay. We will then

prepare your annual accounts from your sage software. Preparing annual accounts

from sage via Helpbox is probably the most affordable way to prepare your

annual accounts.

Who are HMRC?

Her Majesties Revenue and Customs (HMRC) are responsible for

collection of all taxes in the UK, commonly known as the ‘Taxman’.

How to Register

as an employer with HMRC

An employer has a need to register the business with Her

Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’.

Dealing with HMRC and

paying tax

External functions include providing information

to Government agencies most commonly Her Majesties Revenue and Customs

What

is a self employed person?

The UK Government is keen for more people to set up in business a

self-employed. One of the key attractions for becoming self employed is that

you no longer have to work for someone else. You are your own boss. Being your

own boss requires new start up business owner to be responsible for their own

sick pay, and paying your own taxes and pension provision.

What

is a self employed business entity?

Once you have decided to take the plunge and you start up your own new

business then you need to consider what kind of entity will operate your

business. Sole trader, partnership, or a limited liability company.

Registering as self employed with HMRC

start-up businesses choose simple self employment and trade their new business

as a sole trader. Whatever entity you choose you must register that you are

self employed with Her majesties Revenue & Customs HMRC. As well as

registering online with HMRC for self assessment tax returns. You should also

consider how you will pay your National Insurance contributions NIC’s

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

Partners in a business Partnership are self employed and

must register with HMRC and file a SA100 self assessment tax return each year.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.

Company directors should be aware of their obligation to

register their directorship with HMRC so that they can have their income

assessed for possible taxation.

Everyone who as a full time or part time income has to tell

Her Majesties Revenue and customs HMRC, commonly known as the ‘Taxman’, what

tax is due to the UK Governments exchequer.

Self employed people do this by filing an HMRC tax form

called a Self Assessment Tax return and is given the file name SA100. Its not

just self employed people who have to file a HMRC SA100 Tax return. Other

employed people including directors of limited liability companies, higher rate

tax payers, if you have a separate part-time income from self employment, such

as income from renting property, some kinds of pensions and stocks and shares.

The tax return has to be filed each year before 31stJanuary and any income relating to the previous years income between 6th April and the

following 5th April. For example:

On the 31st January 2016 HMRC self assessment tax

return you have to account for income relating to the period 6thApril 2014 until 5th April 2015.

It is important to employ a tax accountant to prepare a set

of year end annual accounts profit and loss schedule for the relevant tax

period. A self employed person such as a sole trader or a partner in a business

partnership is allowed to offset their business expenses against their income.

Including purchase receipts which are verified by bank statements helps reduce

the profit and as a consequence reduce the amount of tax payable to HMRC.

It is very important to understand the UK HMRC

tax rules because if the HMRC tax rules say you should register for self

assessment tax assessment, and file an HMRC SA100. If you do not file a tax

return then you are liable to sever, fines and penalties, which will be imposed

on you by HMRC. In more serious cases where the taxpayers is considered to have

ignored their duty to register with HMRC for the purposes of declaring their income,

can face criminal charges which carry penalties of fines and imprisonment.