A set of Annual Accounts for a basic self employed sole trader prepared from your Kashflow bookkeeping records. Prepared by an ACCA qualified chartered accountant.

An off the shelf boxed product. No more unexpected unexplained accountant’s bills. Fixed (fee) price RRP.

What it includes:

1. An Annual Accounts evaluation report. Which helps identify any missing information?

2. A tax specialist report to help identifies ways to reduce your tax payable.

3. A Draft set of accounts.

4. A detailed explanation of the accounts.

5. Your questions answered.

6. Amendments to your draft annual accounts.

7. A final set of Annual Accounts.

Simply provide us with your completed Kashflow bookkeeping records and we will produce a set of annual accounts. You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation explanation of the accounts.

What do I get when I buy this product?

A set of Annual Accounts for a basic self employed sole trader prepared from your Kashflow bookkeeping records. Prepared by an ACCA registered chartered accountant.

Who should buy this product?

If you are a Sole trader (self employed) who keeps their bookkeeping data on Kashflow accounting software you can easily purchase this product. Applies only to UK registered tax payers.

It’s easy: complete an online form and we will do the rest.

At your convenience

The most convenient way to prepare your Annual Accounts.

After you have purchased this product simply provide us with your completed Kashflow bookkeeping records or online log in details and your closing bank statement (which covers the last days either side of your financial year end). We will also forward you a form to complete.

Based upon those replies one of our ACCA registered chartered accountants will produce a set of annual accounts.

No need to attend offices, this purchase is completed online from the convenience of your office or the comfort of your home. You will be able to ask your Helpbox chartered accountant questions and you will receive a full explanation of the accounts.

Price promise

Fixed (fee) price. No more unexpected, unexplained accountant’s bills.

We will prepare your annual accounts ready for you to complete your tax return yourself or we will complete it for you. If you want us to complete your tax return simply add SA100 tax return for each partner to your shopping trolley when requested.

Guaranteed - NO MORE MISSED DEADLINES

If you provide us with the information in the exact format which we request it and within our specifically stated timeframes we guarantee that we will prepare your return within HMRC’s filing deadlines.

What are a Sole trader’s statutory obligations?

All Sole Traders have a legal duty to:

1. Register with HMRC within 3 months of beginning to trade.

2. Each tax year prepare and complete a set of accounts the figures from which are used to:

Prepare and file an individual self assessment tax return (SA100).

An evaluation and deficiency report which identifies any issues in your records which may affect your accounts from items incorrectly entered to unclaimed expenses, and advice how to correct this.

1. Draft set of accounts.

2. A detailed explanation of the accounts.

3. Your questions answered.

4. Amendments to your draft annual accounts

5. A Final set of Annual Accounts.

Simply provide us with your completed Kashflow bookkeeping records and we will produce a set of Annual Accounts. You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation explanation of the accounts.

Annual Accounts

We have transformed traditional accountancy services by developing a range of transparently priced accountancy products; whilst maintaining the integrity of

the professional relationship with a clearly defined description of what you

get for your money at a fixed retail price.

Now for the first time you are able to compare accountancy

services on both a clear value benchmark, which evaluates quantity and quality

of work done along with price.

Our Chartered Accountants are able to prepare annual

accounts for the following business types:

- Sole trader

- Partnerships

- Limited Companies

What are

year-end annual accounts?

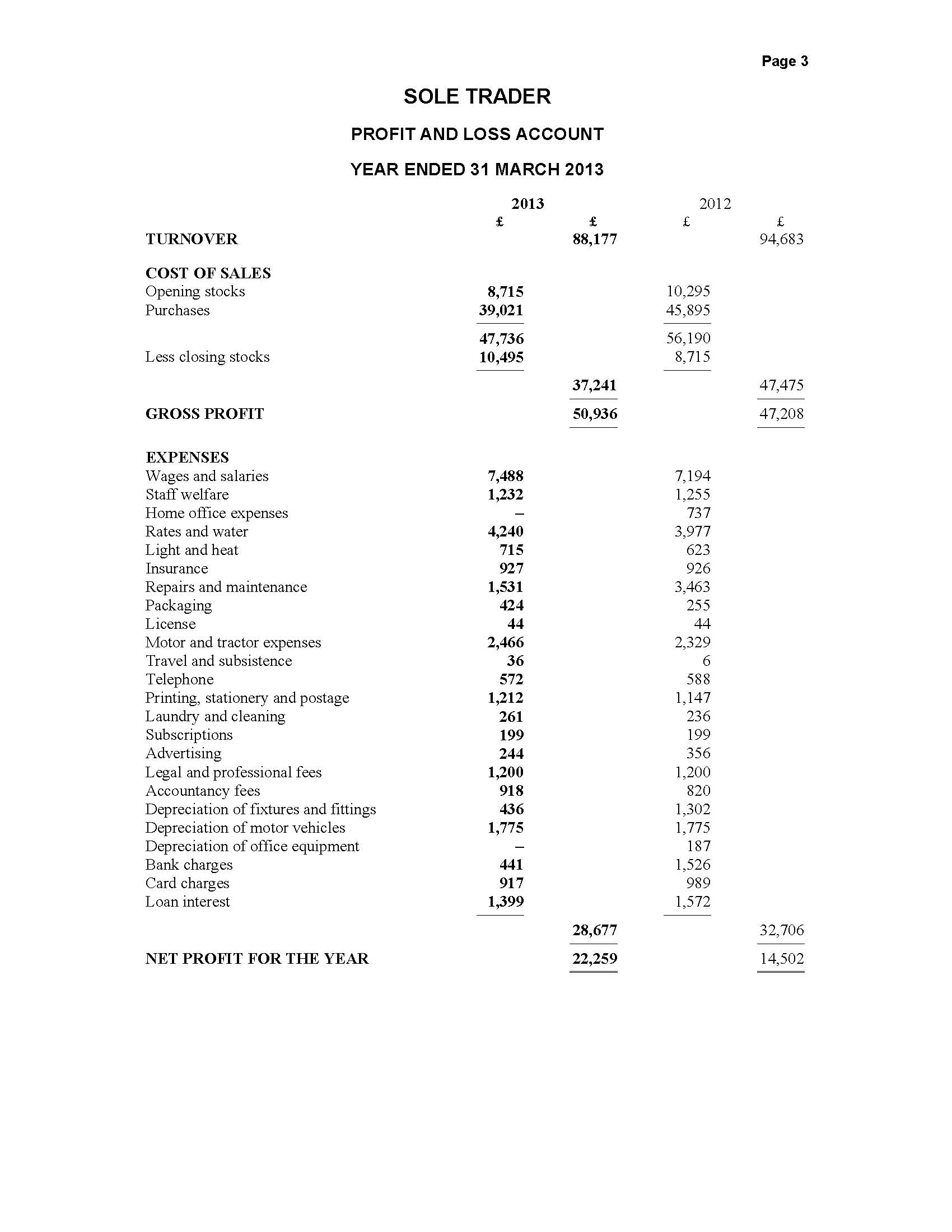

Annual accounts are sometimes referred to as an annual

report, trading accounts or financial statements. The annual or year-end accounts are a summary

of all the entities transactions in a 12 month period which is usually referred

to as the financial trading period.

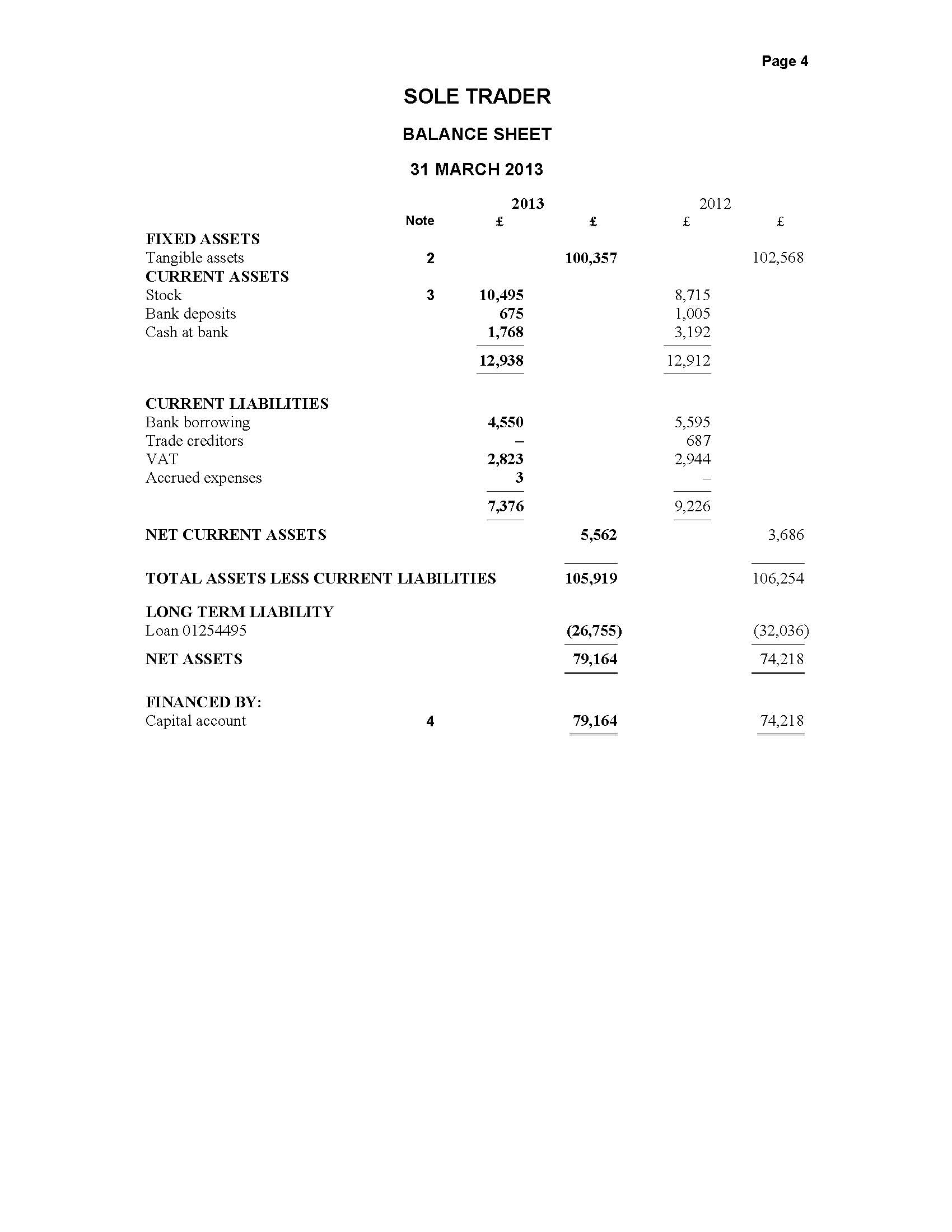

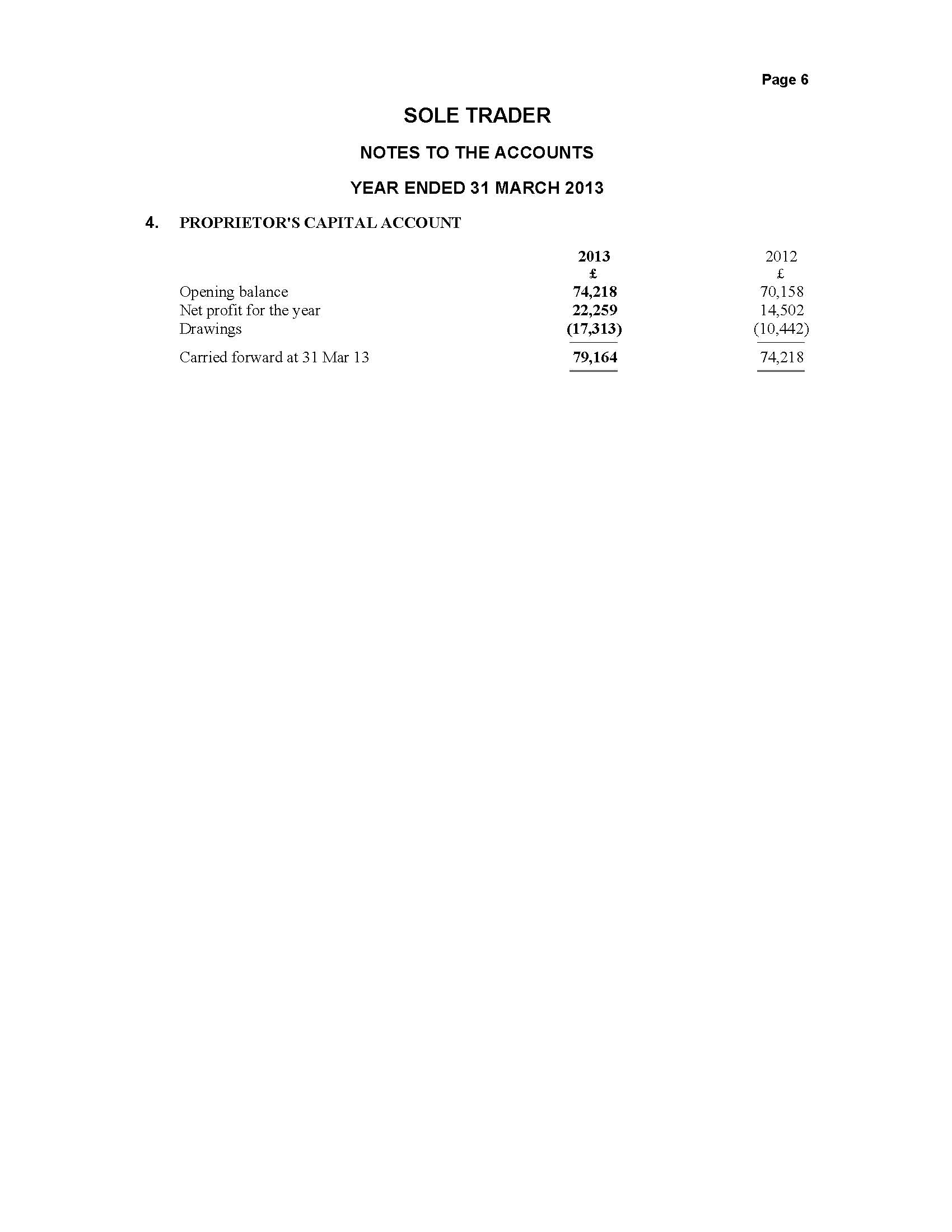

They give a clear picture of both the trading

activity of the business over a 12 month

period through the profit and loss account, whilst the balance sheet gives a

clear snapshot of the business finances on the last day of that period.

Annual accounts are

probably the most common accountancy service which a business asks an

accountant to perform

Annual accounts are probably the most common accountancy service which

a business asks an accountant to perform.

Who has to

prepare annual accounts?

Be it a sole trader, partnership or limited company, the need for

year-end annual accounts is common to all 3 different entities. Annual accounts

are the product of the businesses bookkeeping records.

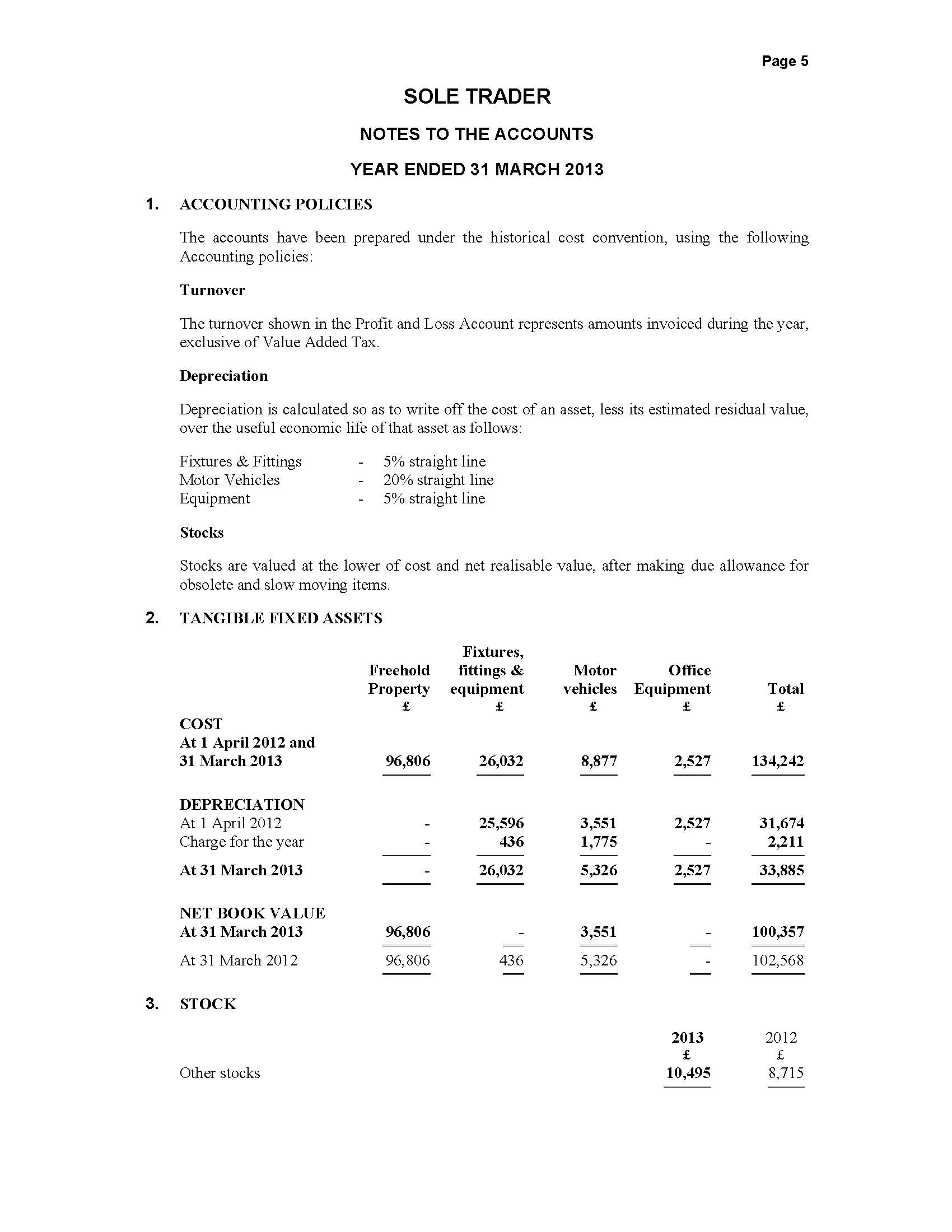

What is a trial

balance?

The bookkeeper brings together all the entries

in the different ledgers which make up the books whether this is kept on paper

books, spreadsheets or accounting software. It includes sales invoices, purchase

receipts, bank payment and cash payments, into an accounting document called a

trial balance. The trial balance is passed from the bookkeeper to the

accountant and this forms the basis for the yearend annual accounts. It is basically a summary of all the totals

in the accounting records and should balance with how the business was funded

whether through sales income or capital invested.

Are year end and

annual accounts different?

Both Annual accounts and year-end accounts are the same

thing, as are annual reports, trading accounts and financial statements.

What information should be in the annual accounts?

Generally speaking but not always, annual

accounts should include;

-

Profit and loss account or

income expenditure statement

- Balance sheet

- Fixed asset and depreciation schedule

-

Accountants report

-

Signature of proprietor/partner/director

- Directors report

- Notes to the accounts

- Officials

and directors information

What is the purpose

of preparing annual accounts?

Annual accounts provide an annual (year-end) summary of the businesses

financial performance. This can provide

essential information on how well or how badly the business is performing.

Additionally, every business has a legal requirement to

report their key financial data to HMRC and for limited companies the additional

requirement to file accounts with the Register of companies at companies house.

Kashflow accountancy

software

using the Helpbox upload bay. We will then prepare your annual accounts from

your Kashflow. Preparing annual accounts from Kashflow via Helpbox is probably

the most affordable way to prepare your annual accounts

A sole trader also known as sole proprietorship,

also more simply a proprietorship, is a type of business

entity that is owned and run by one person (individual). There is in

English Law no legal distinction between the business owner and the traded

business.

For example:

John Smith is an individual.

Let’s assume John is a qualified plumber and he sets up a

new business plumbing business start-up called “local plumbers”. This becomes

the trading style of the business. However, in law John Smith is the legal

entity so the sole trader business is John Smith trading as (sometimes

abbreviated to t/a) “Local Plumbers”. John

is responsible for all liabilities associated with the trading style “local

plumbers”. The full title of this sole trader is John Smith trading as Local

Plumbers.

The trading name is often used separately to the proprietors

individual name, in advertising etc. But all documentation should carry the

sole traders name somewhere on each business document.

The sole trader receives all profits (subject to HMRC

taxation which is declared on HMRC tax form SA100 also known as a personal self

assessment tax return). New start-up businesses should note that sole traders

have unlimited liability (responsibility) for all the businesses losses and

debts. Each of the business assets is owned by the Sole trader (proprietor) and

all debts of the business are the sole traders.

A very large proportion of business conducted in London and

the UK is undertaken by self employed sole traders working on their own.

Normally a sole trader will deal with the day-to-day record keeping and

administration (filings forms and paperwork). For more complicated record

keeping such as accountancy bookkeeping will involve the sole trader handing

over the business sales invoices and purchase receipts to an accountant who

will prepare the final end of year accounts and calculate the tax due.

The sole trader can open a bank account in their own name with their trading

style or without their trading style.

Advantages of becoming a sole

trader

It is the easiest business entity to start up a new

business. Organising your accounting records and complying with business law is

simpler than a partnership or a limited company.

Because the sole trader is responsible for all the business

debts sometimes banks and other lenders can be more willing to loan monies to

the business. The same goes for suppliers (creditors).

Unlike a limited company where the business is owned by the

company shareholders and the directors have legal responsibility under the

Companies Act 2006. Therefore they are restricted by that law on what income

they can receive from the limited company. A sole trader receives all the

profits from the business.

A common problem faced by new start up partnerships and

limited companies is that the more partners and directors the more chance that

you might fall out. Which often leads to business failure. A sole trader is a

simple entity where the proprietor makes all the decisions.

Disadvantages of

being a sole trader is that as the business becomes successful, the associated

business risks increase. To mitigate

those risks sole traders often incorporate. That is they form a limited

liability company

Sole trader Annual

Accounts

Sole traders have no

legal requirement to file accounts. However, HMRC say: If you have to send HMRC a tax

return, the law says that you must keep all the records and documents you need

to complete the return. If you don't have adequate records or if you don't keep

them for long enough, you may have to pay penalties.

Therefore, if an HMRC investigation is to be avoided proper

financial records have to be kept. These includes annual accounts.

Annual accounts are particularly helpful when completing the

self employed self assessment tax return (SA100).

Do sole traders have

to prepare the same annual accounts as limited companies?

year-end sole trader accounts are prepared in a shorter format than limited

company year-end financial statements. Because partnership year-end accounts

include a summary for each partner they are a little more complex than sole

traders. How much more complicated depends upon the number of partners in the

partnership.

Affordable

accountancy solutions for sole traders. This product is ideal for self employed

sole traders who want have the time and ability to book keep all their business

transactions onto an accountancy software programme. These include cloud based

online accountancy software as well as the traditional double entry models

including Sage, Quickbooks, Xero, Kashflow, Excel, Freeagent, Clearbooks and

Mybooks to enter their own bookkeeping records. If you are a self employed sole

trader and want to take advantage of

being your own bookkeeper. Then when you enter details of your business

transactions, purchase receipts, sales invoices and bank statements, and any

payroll wages you have run or HMRC PAYE, you have a better understanding of the

actual performance of your business. A second advantage is that having spent

time bookkeeping your business transactions you have saved the cost of paying a

bookkeeper to account for those transactions. Our online and cloud based

software filing master saves you both time and money, and maximises your

efforts. The gains go into your pocket rather than the pocket of another

accountant or accountancy firm. From

your own bookkeeping software we will prepare a set of year end accounts,

including profit and loss schedule and balance sheet. Whether you are VAT

registered or not, a new start-up or existing business, we will provide a

seamless service which includes preparing HMRC ready annual accounts. Which

means we can also provide a very affordable tax filing service from those year

end annual accounts. Excellent product for the self employed sole trader

business.

What

is a self employed person?

The UK Government is keen for more people to set up in business a

self-employed. One of the key attractions for becoming self employed is that

you no longer have to work for someone else. You are your own boss. Being your

own boss requires new start up business owner to be responsible for their own

sick pay, and paying your own taxes and pension provision.

What

is a self employed business entity?

Once you have decided to take the plunge and you start up your own new

business then you need to consider what kind of entity will operate your

business. Sole trader, partnership, or a limited liability company.

Registering as self employed with HMRC

start-up businesses choose simple self employment and trade their new business

as a sole trader. Whatever entity you choose you must register that you are

self employed with Her majesties Revenue & Customs HMRC. As well as

registering online with HMRC for self assessment tax returns. You should also

consider how you will pay your National Insurance contributions NIC’s