A set of Limited Company Annual Accounts (financial statements) prepared from your Xero bookkeeping software by an ACCA qualified chartered accountant.

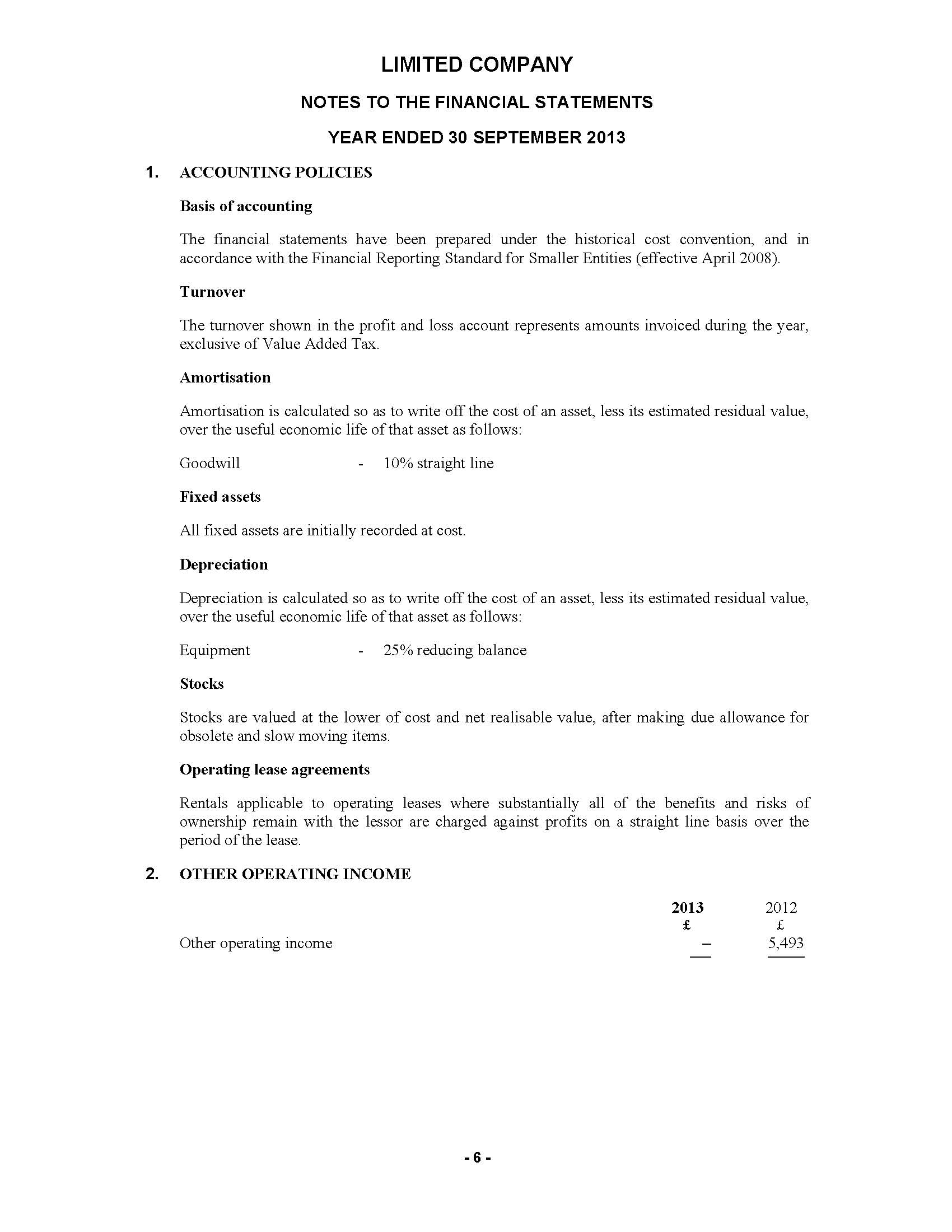

An off the shelf boxed product. No more unexpected unexplained accountant’s bills. Fixed (fee) price RRP.

What it includes:

• Draft set of accounts.

• A detailed explanation of the accounts.

• Your questions answered.

• A Final set of Financial Statements (Annual Accounts).

Simply provide us with your completed Xero bookkeeping records and we will produce a set of Financial Statements (Annual Accounts). You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation and explanation of the accounts.

What do I get when I buy this product?

A set of Limited Company Annual Accounts prepared from your Xero bookkeeping records. Prepared by an ACCA registered chartered accountant.

Who should buy this product?

If you are a Limited Company who keeps their bookkeeping data on Xero accounting software can easily purchase this product. Applies only to Companies registered in England and Wales.

It’s easy: complete an online form and we will do the rest.

At your convenience

The most convenient way to prepare your Company Annual Accounts.

After you have purchased this product simply provide us with your completed Xero bookkeeping records or online log in details and your closing bank statement (which covers the last days either side of your financial year end). We will also forward you a form to complete.

Based upon those replies and your Xero bookkeeping back up, one of our ACCA registered chartered accountants will prepare your annual accounts.

No need to attend an accountant’s office, this purchase is completed online from the convenience of your office or the comfort of your home.

Price promise

Fixed (fee) price. No more unexpected, unexplained accountant’s bills.

We will prepare your annual accounts ready for you to complete your CT600 corporation tax return yourself or we will complete it for you. If you want us to complete your CT600 tax return for you simply add to your shopping trolley when requested.

Guaranteed - NO MORE MISSED DEADLINES

If you provide us with the information in the exact format which we request it and within our specifically stated timeframes we guarantee that we will prepare your accounts ready for filing within HMRC’s filing deadlines.

What are Limited Company statutory obligations?

All Limited Companies have a legal duty to:

1. Register with both HMRC and Companies house

2. Each tax year prepare and complete a set of accounts (Financial Statements) whether they are trading or not (Dormant Accounts if not trading)

3. Prepare and file a corporation tax return (CT600) within 12 months of their financial year end

4. Prepare and file the Accounts at Companies house within 9 months of their financial year end

Pay any corporation tax due within 9 months and a day of their financial year end

1. An evaluation and deficiency report which identifies any issues in your records which may affect your accounts from items incorrectly entered to unclaimed expenses, and advice how to correct this.

2. Draft set of accounts.

3. A detailed explanation of the accounts.

4. Your questions answered.

5. Amendments to your draft annual accounts

6. A Final set of Financial Statements (Annual Accounts).

Simply provide us with your completed Xero bookkeeping records and we will produce a set of Financial Statements (Annual Accounts). You will be able to ask your Helpbox chartered accountant questions and you will receive a full presentation explanation of the accounts.

Annual Accounts

We have transformed traditional accountancy services by developing a range of transparently priced accountancy products; whilst maintaining the integrity of

the professional relationship with a clearly defined description of what you

get for your money at a fixed retail price.

Now for the first time you are able to compare accountancy

services on both a clear value benchmark, which evaluates quantity and quality

of work done along with price.

Our Chartered Accountants are able to prepare annual

accounts for the following business types:

- Sole trader

- Partnerships

- Limited Companies

What are

year-end annual accounts?

Annual accounts are sometimes referred to as an annual

report, trading accounts or financial statements. The annual or year-end accounts are a summary

of all the entities transactions in a 12 month period which is usually referred

to as the financial trading period.

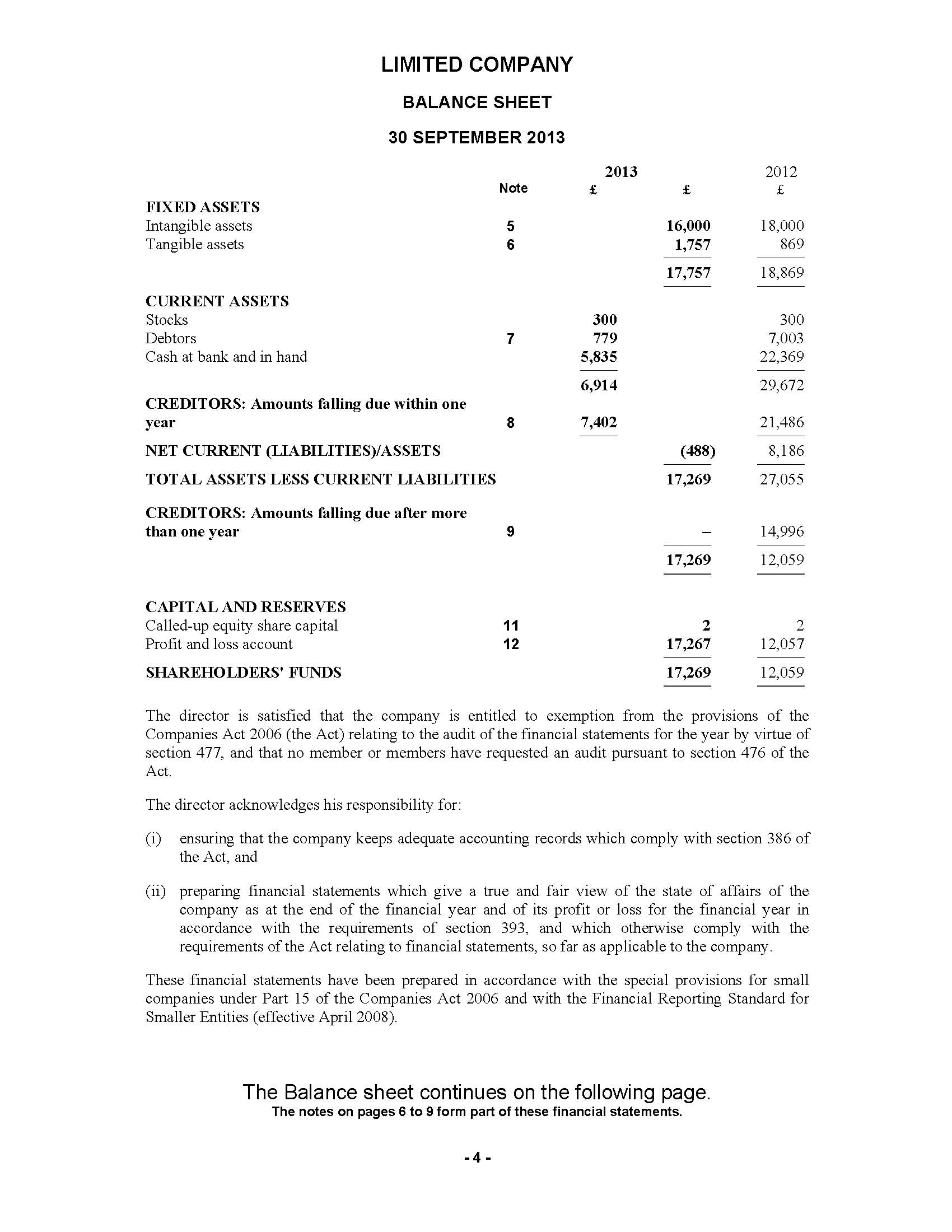

They give a clear picture of both the trading

activity of the business over a 12 month

period through the profit and loss account, whilst the balance sheet gives a

clear snapshot of the business finances on the last day of that period.

Annual accounts are

probably the most common accountancy service which a business asks an

accountant to perform

Annual accounts are probably the most common accountancy service which

a business asks an accountant to perform.

Who has to

prepare annual accounts?

Be it a sole trader, partnership or limited company, the need for

year-end annual accounts is common to all 3 different entities. Annual accounts

are the product of the businesses bookkeeping records.

What is a trial

balance?

The bookkeeper brings together all the entries

in the different ledgers which make up the books whether this is kept on paper

books, spreadsheets or accounting software. It includes sales invoices, purchase

receipts, bank payment and cash payments, into an accounting document called a

trial balance. The trial balance is passed from the bookkeeper to the

accountant and this forms the basis for the yearend annual accounts. It is basically a summary of all the totals

in the accounting records and should balance with how the business was funded

whether through sales income or capital invested.

Are year end and

annual accounts different?

Both Annual accounts and year-end accounts are the same

thing, as are annual reports, trading accounts and financial statements.

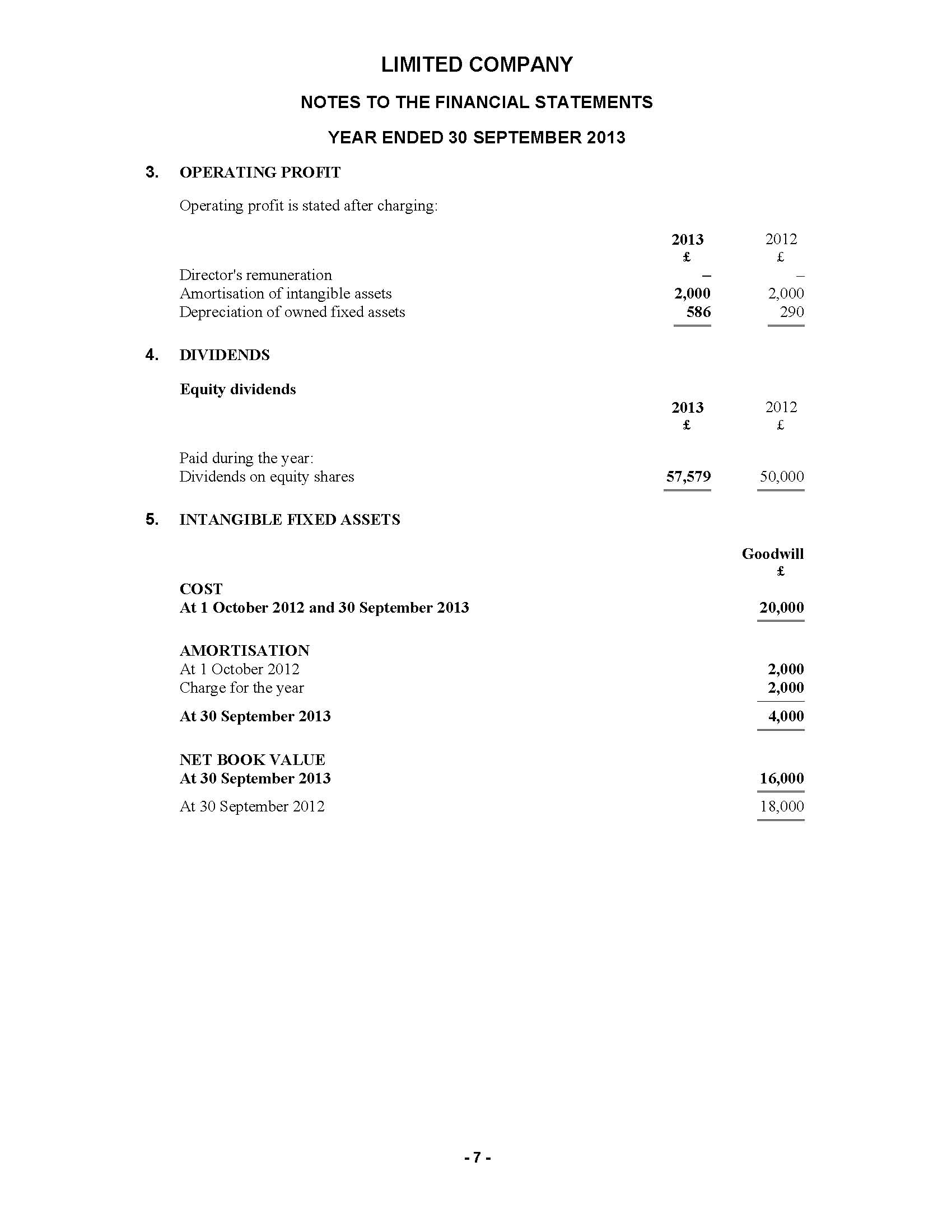

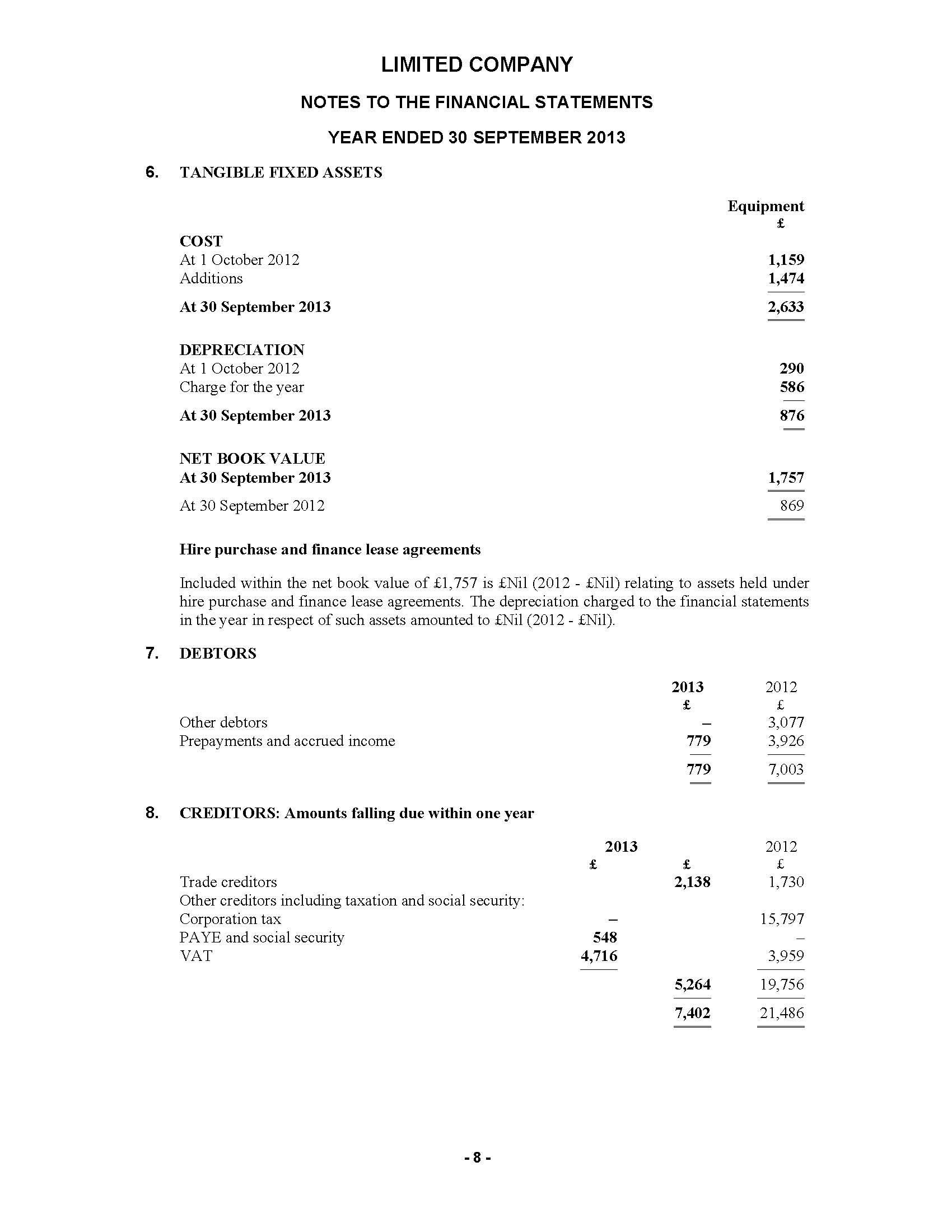

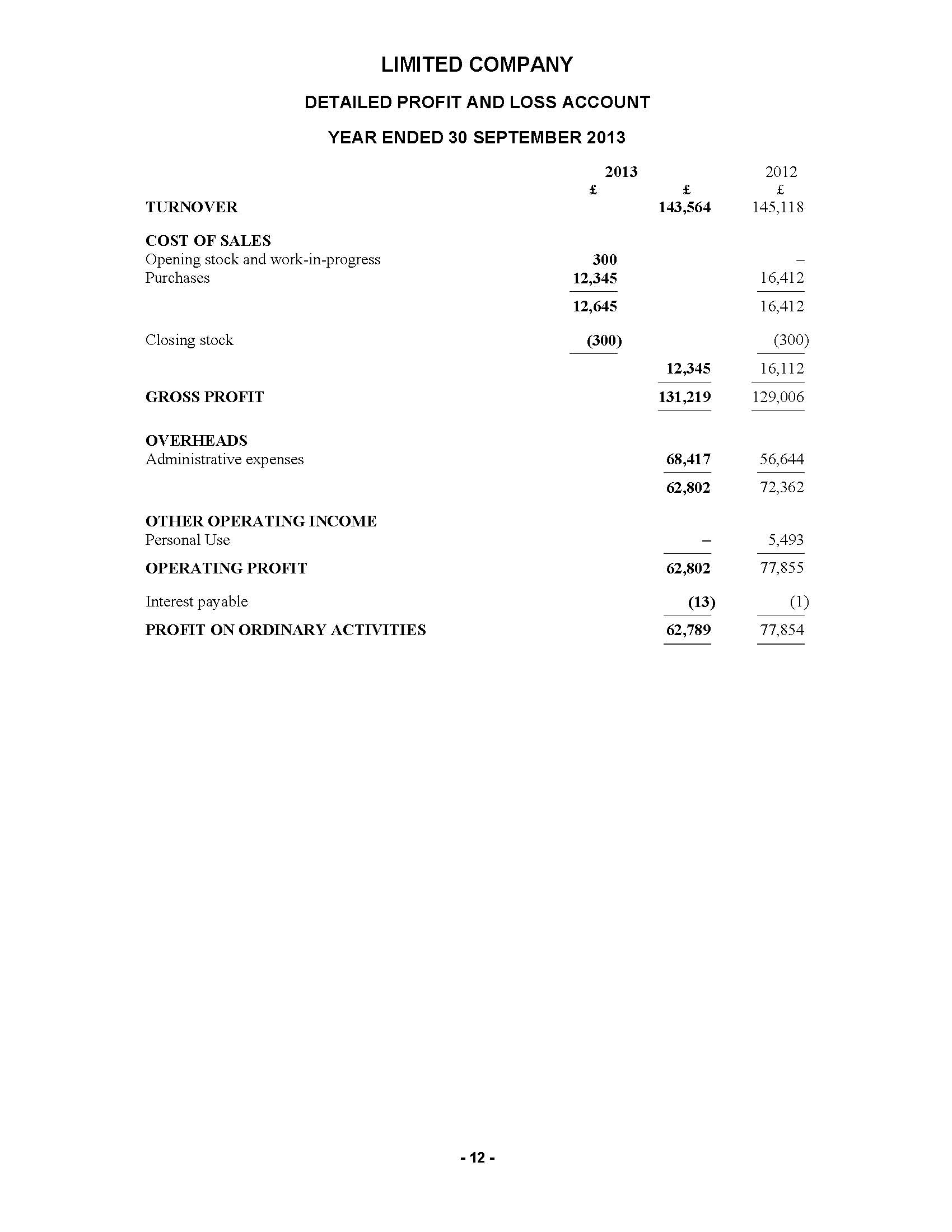

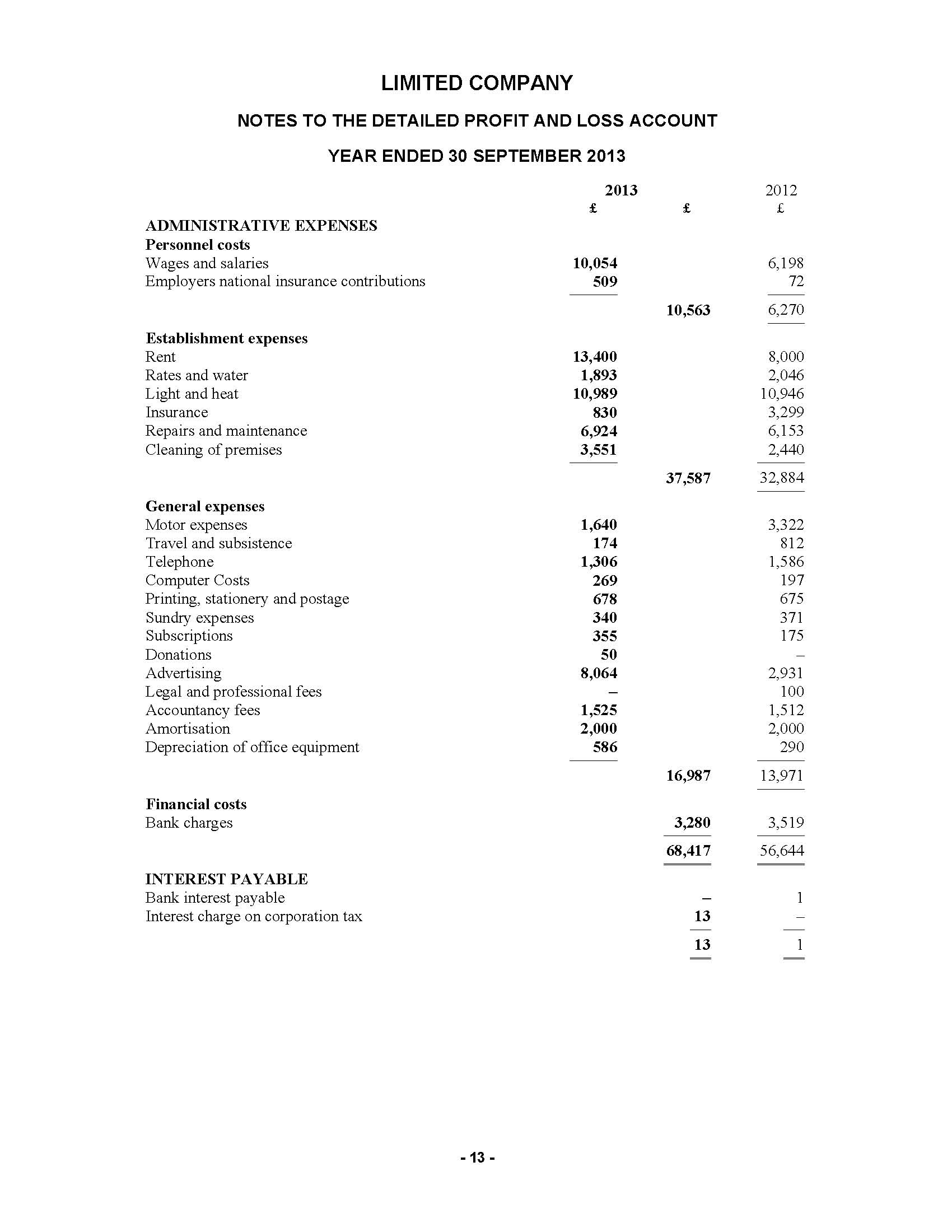

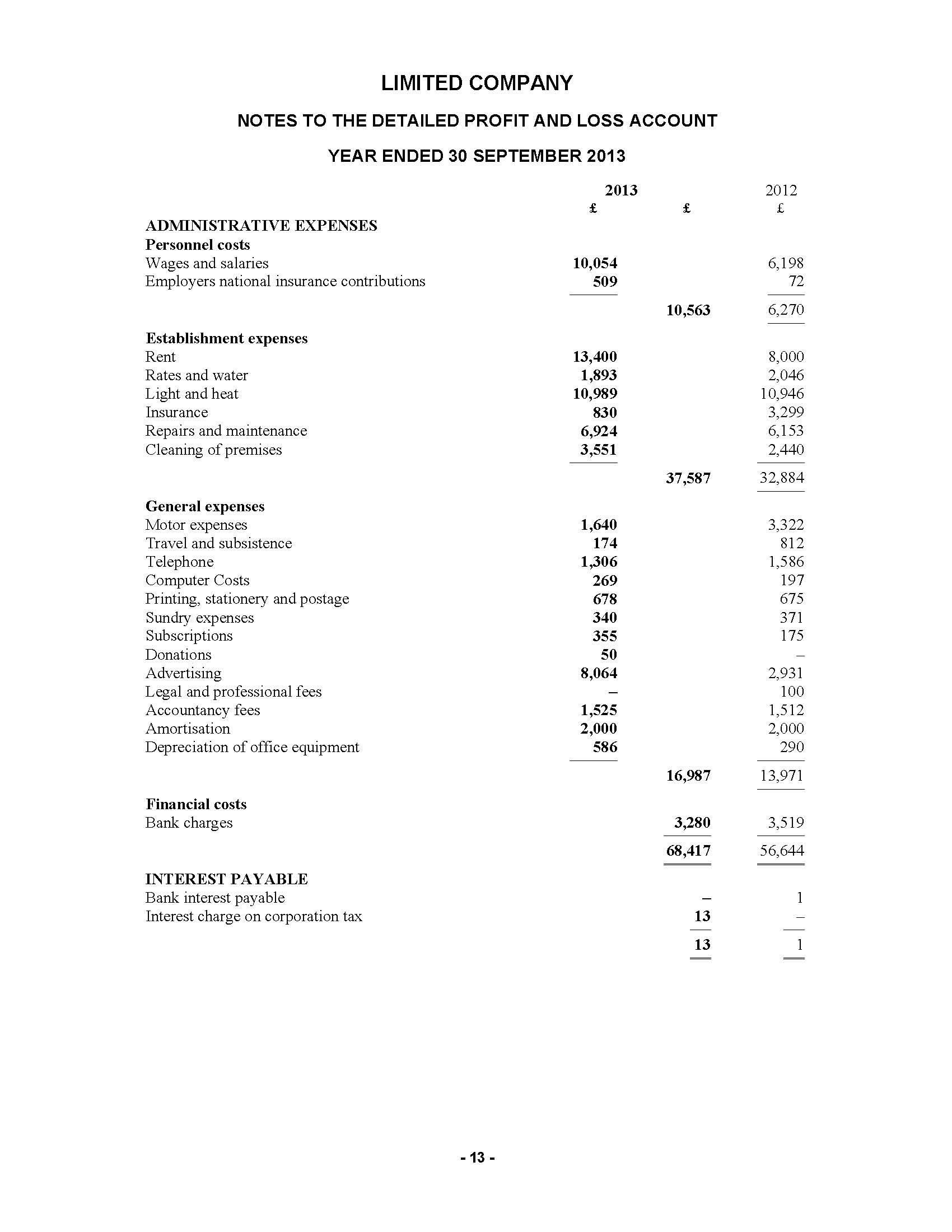

What information should be in the annual accounts?

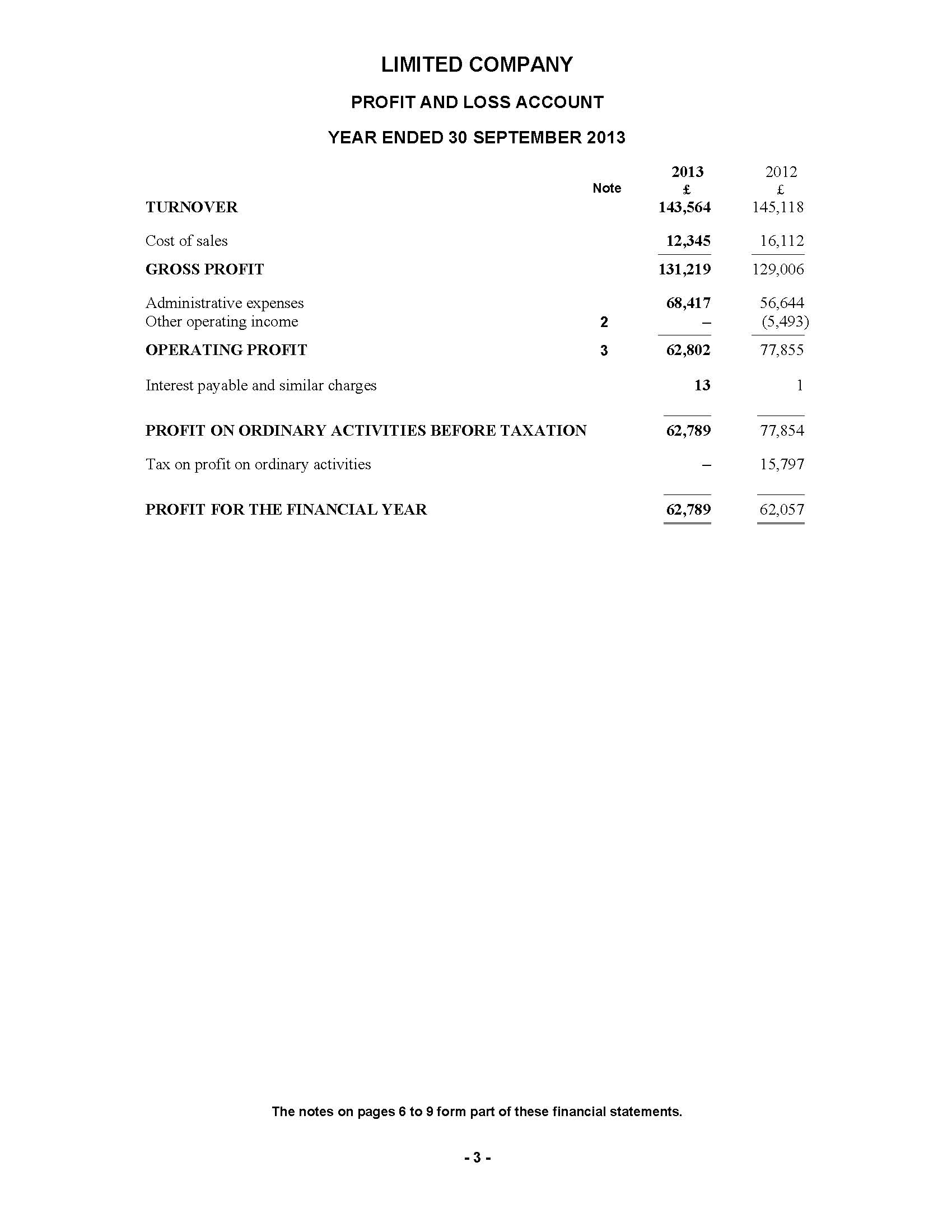

Generally speaking but not always, annual

accounts should include;

-

Profit and loss account or

income expenditure statement

- Balance sheet

- Fixed asset and depreciation schedule

-

Accountants report

-

Signature of proprietor/partner/director

- Directors report

- Notes to the accounts

- Officials

and directors information

What is the purpose

of preparing annual accounts?

Annual accounts provide an annual (year-end) summary of the businesses

financial performance. This can provide

essential information on how well or how badly the business is performing.

Additionally, every business has a legal requirement to

report their key financial data to HMRC and for limited companies the additional

requirement to file accounts with the Register of companies at companies house.

What is a Limited company?

A limited company has to be

brought into creation (formation) and its name approved and registered

by Companies House, in accordance with the primary piece of UK company

law known as the Companies Act 2006.

A Limited company is

actually a separate legal entity in its own right. This means it has its

own Unique Tax Reference (UTR – ten digit number), can own assets, and

must complete its own tax return.

The main reason for setting up as a

limited company instead of as a sole trader or partnership tends to be

liability. In a limited company your liability is generally limited to

the amount you have invested in it, usually the face value of the

shares. This limits the risk to yourself of losing your assets such as

your family home etc. This can be very useful if you are in a trade with

a high risk factor. Obviously you want your business to do well and

will do everything you can to make sure it succeeds but it’s good to

have peace of mind.

There are different types of limited company but a

private limited company is the most common and the one you are most

likely to set up. This means the company cannot offer its shares for

sale to the public unlike a public limited company (plc).

What are Limited Company annual accounts (Financial Statements)

The financial statements are the formal record of the financial activities of a business. The relevant information is presented in a standardized format to make them easy to understand regardless of the industry or trade type of the business itself. Their purpose is to provide the reader with information about the financial position and trading activities of the business across the financial year and enables more informed business decisions to be made based on this information. They have four main purposes and users;

• Employees – to decide on taking up employment, in negotiating pay etc

• Investors – both current and potential in deciding how viable the business is for making an investment in

• Financial Institutions – to make decisions on whether to give credit, loans and mortgages etc

Filing Obligations of a Limited Company

Limited companies have a statutory obligation to file accounts with Companies House within 9 months of each financial year-end. Additionally, each Limited company must file an annual tax return called a corporation tax return (CT600) with HMRC within 12 months of the financial year end including a full set of accounts. This gives anyone who sees these accounts a picture of the trading activities of the company over that period

In addition to these the company must file an annual return every 12 months at companies which is a snapshot of the structure of the company including details of directors, shareholders etc. Small companies have a number of exemptions which allows them to file abbreviated accounts at Companies House.

What is a Limited company?

A limited company has to be brought into creation (formation) and its name approved and registered by Companies House, in accordance with the primary piece of UK company law known as the Companies Act 2006.

A Limited company is actually a separate legal entity in its own right. This means it has its own Unique Tax Reference (UTR – ten digit number), can own assets, and must complete its own tax return.

The main reason for setting up as a limited company instead of as a sole trader or partnership tends to be liability. In a limited company your liability is generally limited to the amount you have invested in it, usually the face value of the shares. This limits the risk to yourself of losing your assets such as your family home etc. This can be very useful if you are in a trade with a high risk factor. Obviously you want your business to do well and will do everything you can to make sure it succeeds but it’s good to have peace of mind.

There are different types of limited company but a private limited company is the most common and the one you are most likely to set up. This means the company cannot offer its shares for sale to the public unlike a public limited company (plc).

If your business is dormant

Companies and associations don’t always have to pay Corporation Tax or file Company Tax Returns if they aren’t active (sometimes called ‘dormant’ or ‘non-trading’).

HMRC may decide that your company or association is dormant if it:

• isn’t doing business or receiving income

• is an unincorporated association that owes less than £100 Corporation Tax

• is a flat management company that qualifies as dormant

There are additional requirements for dormant unincorporated associations. You’ll get a letter from HMRC telling you if you don’t have to pay Corporation Tax or file Company Tax Returns. You must still file a Company Tax Return if HMRC tells you to by letter. Check if your company is also dormant for Companies House annual accounts.

If your dormant business becomes active again

You must tell HMRC if your company becomes active again. You’ll get a letter from HMRC telling you if it must pay Corporation Tax and file Company Tax Returns.

What is a small company?

According to Companies House to be a small company it must have, at least two of the following conditions

must be met:

• Annual turnover must be £6.5 million or less

• The balance sheet total must be £3.26 million or less

• The average number of employees must be 50 or fewer

HMRC consider a small company to be a limited company that employs less than 50 employees and has an annual turnover of less than £5.6 million.

What are limited company shareholders?

Limited companies are owned by its shareholders. Shareholders liability is limited to the amount of money they have paid for the shares.

What are limited company directors?

The people who run the business are referred to as the company officers, and are known as directors. The shareholders appoint the directors. The directors make the day to day decisions about the business

Companies House

All Limited Liability companies whose registered office is located in England and Wales must be incorporated and registered at Companies House, which is the registry of companies for the UK. The law governing a limited company is the Companies Act 2006. That act sets out how a company must operate. Part of the Companies Act 2006 requires Ltd co officers (directors) to file certain information with Companies House. For example any changes to the company’s directorships, appointments and resignations must be reported to Companies House. Each year a company has to file an annual return and a set of trading accounts, usually abbreviated accounts.

What is a Corporation tax return CT600?

The HMRC Tax return is different to the companies’ legal obligation and submission of accounts and annual return with Companies House.

A HMRC corporation tax return is often referred to as a Limited company tax return, Company tax return, Corporation tax, and sometimes a CT600. They are all referring to the same thing. It is a summary of the financial activities of the company over the accounting period and details the corporation tax to be paid to HMRC. This CT600 should be filed with HMRC within 12 months of the accounting period end, however the corporation tax itself must be paid within 9 months and 1 day of the accounting period end

Who are HMRC?

Her Majesties Revenue and Customs (HMRC) are responsible for collection of all taxes in the UK, commonly known as the ‘Taxman’.

Do company directors also complete a CT600?

No. Only information relating to the limited company is submitted on the HMRC corporation Tax return CT600. It is the duty of every company director to both registered with HMRC when they are appointed as a director of a limited company. HMRC will then issue the appropriate Tax form: A self assessment tax return SA100.

What happens if I don’t file a Tax return?

HMRC have very powerful and wide ranging powers including the power of arrest. If you fail to either register and or file a tax return, then HMRC powers allow then to impose financial penalties and charge interest on any due tax.

Xero accountancy

software

the Helpbox upload bay. We will then prepare your annual accounts from your

xero. Preparing annual accounts from xero via Helpbox is probably the most

affordable way to prepare your annual accounts.